When it comes to child support, many parents find themselves navigating a complex web of emotions and legalities. If you’re a mother in Texas wondering whether you can cancel child support, you’re not alone. This topic can stir up a lot of questions and concerns, especially when it involves the well-being of your child. Let’s dive into the intricacies of child support in Texas and explore what options you might have.

Understanding Child Support in Texas

Child support is more than just a financial obligation; it’s a commitment to ensuring that a child’s needs are met after parents separate or divorce. In Texas, child support is governed by specific laws designed to protect the interests of the child. But what does that really mean for you as a mother?

What is Child Support?

At its core, child support is a court-ordered payment made by one parent to the other to help cover the costs of raising a child. This can include expenses for food, clothing, education, and healthcare. In Texas, the amount of child support is typically calculated based on the non-custodial parent’s income and the number of children involved. For instance, if a father earns $5,000 a month and has one child, he may be required to pay 20% of his income, which amounts to $1,000 each month.

But child support isn’t just about numbers; it’s about ensuring that children have the resources they need to thrive. According to a study by the U.S. Census Bureau, children who receive consistent child support are more likely to have better educational outcomes and overall well-being. This highlights the importance of these payments in a child’s life.

Now, you might be wondering, “Can I cancel child support if my circumstances change?” The answer isn’t straightforward. While it’s possible to modify or even terminate child support under certain conditions, it typically requires a legal process. For example, if the non-custodial parent loses their job or if the child becomes emancipated, a court may consider these factors when reviewing child support obligations.

It’s essential to approach this topic with care. If you’re considering canceling or modifying child support, consulting with a family law attorney can provide clarity and guidance tailored to your situation. They can help you understand the legal implications and ensure that any changes are in the best interest of your child.

Can a Mother Cancel Child Support in Texas?

When it comes to child support, many parents find themselves navigating a complex web of emotions and legalities. If you’re a mother in Texas wondering whether you can cancel child support, you’re not alone. This question often arises from changing circumstances, such as a shift in financial stability or a change in the child’s living situation. Let’s explore the nuances of this topic together.

How is Child Support Calculated?

Understanding how child support is calculated can provide clarity on whether cancellation is feasible. In Texas, child support is primarily determined by the Income Shares Model, which considers both parents’ incomes and the needs of the child. The Texas Attorney General’s Office provides a guideline that suggests a percentage of the non-custodial parent’s income based on the number of children:

- 1 child: 20% of net resources

- 2 children: 25% of net resources

- 3 children: 30% of net resources

- 4 children: 35% of net resources

- 5 or more children: 40% of net resources

It’s important to note that “net resources” include wages, bonuses, and other income sources, minus certain deductions like taxes and health insurance. This calculation aims to ensure that the child’s needs are met while also considering the financial capabilities of both parents.

When Does Child Support End?

Child support in Texas typically ends when the child turns 18 or graduates from high school, whichever comes later. However, there are exceptions. For instance, if the child becomes emancipated or if the parents agree to terminate support due to specific circumstances, the support obligation may end sooner. Understanding these timelines can help you plan for the future and make informed decisions.

But what if your situation changes and you feel that child support is no longer necessary? Perhaps the child is now living with you full-time, or the other parent has become more involved. In such cases, you might wonder if you can simply cancel the support payments.

In Texas, a mother cannot unilaterally cancel child support. Instead, any changes to child support must go through the court system. This means that if you believe a modification or cancellation is warranted, you will need to file a motion with the court. The court will then review the circumstances and make a determination based on the best interests of the child.

It’s also worth noting that if the non-custodial parent is not fulfilling their support obligations, you may have grounds to seek enforcement rather than cancellation. This can be a frustrating process, but it’s essential to ensure that your child’s needs are met.

In summary, while a mother in Texas cannot simply cancel child support, there are legal avenues to explore if circumstances change. Consulting with a family law attorney can provide you with tailored advice and help you navigate the complexities of the legal system. Remember, the ultimate goal is to ensure the well-being of your child, and understanding your rights and options is a crucial step in that journey.

Reasons for Child Support Termination in Texas

Understanding the reasons for child support termination in Texas can feel like navigating a maze. It’s essential to know that child support is not a one-size-fits-all arrangement; it can change based on various circumstances. So, what are the key reasons that might lead to the termination of child support?

- Emancipation of the Child: When a child turns 18 and graduates from high school, they are considered emancipated. This milestone often marks the end of child support obligations. However, if the child is still in high school, support may continue until graduation.

- Change in Custody: If the custodial parent (the one receiving support) loses custody of the child, the non-custodial parent may petition to terminate or reduce their child support payments. This can happen if the child moves in with the non-custodial parent or another guardian.

- Incarceration: If the non-custodial parent is incarcerated for an extended period, they may seek a modification or termination of child support. However, this is not automatic and often requires legal proceedings.

- Financial Hardship: A significant change in the non-custodial parent’s financial situation, such as job loss or a serious medical condition, can lead to a request for modification or termination of child support.

Each of these reasons reflects the dynamic nature of family situations. It’s crucial to approach these changes thoughtfully, considering the best interests of the child involved.

Can a Mother Voluntarily Cancel Child Support in Texas?

The question of whether a mother can voluntarily cancel child support in Texas is a nuanced one. While it might seem straightforward, the reality is that child support is a legal obligation, and simply deciding to stop payments isn’t enough. So, what does this mean for mothers in Texas?

In Texas, a mother cannot unilaterally cancel child support without going through the proper legal channels. If both parents agree that child support is no longer necessary, they can file a motion with the court to modify or terminate the support order. This process ensures that the child’s needs are still being met and that both parents are on the same page.

For instance, let’s say a mother feels that her ex-partner is now financially stable enough to support the child without her assistance. They can jointly approach the court to discuss the possibility of terminating the support. However, it’s essential to document this agreement legally to avoid any future disputes.

It’s also worth noting that if the mother is the custodial parent and believes that the child no longer needs support due to changes in circumstances, she should still consult with a family law attorney. This ensures that all legal bases are covered and that the child’s welfare remains the priority.

Options When Child Support Needs Adjusting

- Modification Request: If you find yourself in a situation where your income has changed significantly—perhaps due to a job loss or a new job with a lower salary—you can file a request for modification with the court. This process involves providing documentation of your financial situation and may require a hearing.

- Voluntary Agreement: Sometimes, both parents can come to a mutual agreement about adjusting the child support amount. This agreement should be documented and submitted to the court for approval to ensure it’s legally binding.

- Reviewing the Support Order: It’s wise to periodically review the child support order, especially if there are significant changes in the child’s needs or the parents’ financial situations. This proactive approach can help prevent misunderstandings and ensure that the support remains fair and adequate.

- Consulting a Family Law Attorney: Navigating child support adjustments can be complex. Consulting with a family law attorney can provide clarity and guidance tailored to your specific situation, ensuring that you understand your rights and responsibilities.

Adjusting child support is not just about numbers; it’s about ensuring that the child’s needs are met while also considering the parents’ circumstances. By approaching these changes thoughtfully and legally, you can create a more stable environment for everyone involved.

What to Do if You’re Seeking Child Support Modification or Termination

Have you found yourself in a situation where the child support arrangement no longer fits your family’s needs? Perhaps your financial circumstances have changed, or your child’s needs have evolved. Whatever the reason, seeking a modification or termination of child support can feel daunting. But don’t worry; you’re not alone in this journey.

The first step is to gather all relevant documentation. This includes your current financial situation, any changes in income, and your child’s current needs. For instance, if your child has moved in with you full-time or if you’ve lost your job, these are significant changes that warrant a review of the existing support order.

Next, it’s crucial to consult with a family law attorney who specializes in child support cases. They can provide tailored advice based on your unique situation and help you navigate the legal process. According to a study by the American Academy of Matrimonial Lawyers, having legal representation can significantly increase your chances of a favorable outcome.

Once you have your documentation and legal support, you’ll need to file a motion with the court. This motion should clearly outline the reasons for your request, supported by the evidence you’ve gathered. Remember, the court’s primary concern is the best interest of the child, so be prepared to demonstrate how the modification or termination aligns with that principle.

Finally, be patient. The process can take time, and there may be hearings involved where both parties present their cases. But with the right preparation and support, you can navigate this challenging process successfully.

Top Reasons Mothers Can Stop Child Support in Texas

In Texas, child support is designed to ensure that children receive the financial support they need from both parents. However, there are specific circumstances under which a mother can seek to stop child support payments. Understanding these reasons can empower you to make informed decisions about your situation.

- Change in Custody: If the child has moved in with the mother full-time, she may be eligible to terminate child support payments. This is often the most straightforward reason, as the obligation to support the child shifts with custody changes.

- Emancipation: When a child reaches the age of 18 and is no longer attending high school, they are considered emancipated. At this point, child support obligations typically cease, unless there are special circumstances that require continued support.

- Financial Hardship: If the mother experiences a significant change in her financial situation, such as job loss or a medical emergency, she may petition the court to modify or terminate child support payments. Courts are generally sympathetic to genuine financial hardships.

- Mutual Agreement: Sometimes, both parents can come to a mutual agreement regarding child support. If both parties agree that the support is no longer necessary, they can file a joint motion to terminate the payments.

Each of these reasons requires careful documentation and, often, legal guidance. It’s essential to approach the situation thoughtfully, ensuring that any changes made are in the best interest of the child.

Understanding Child Support Termination in Texas

Understanding the ins and outs of child support termination in Texas can feel like navigating a maze. But let’s break it down together. Child support termination is not just about stopping payments; it’s about ensuring that the child’s needs are met while also considering the financial realities of both parents.

In Texas, child support can be terminated under specific conditions, as we’ve discussed. However, it’s important to recognize that the process involves legal steps that must be followed. For instance, if you’re seeking termination due to emancipation, you’ll need to provide proof that the child has reached the age of majority and is no longer dependent on the parent for support.

Moreover, the Texas Family Code outlines the legal framework for child support, emphasizing that any changes must be approved by the court. This means that even if both parents agree to terminate support, a formal court order is necessary to make it official. This requirement helps protect the rights of both parents and ensures that the child’s best interests remain at the forefront.

It’s also worth noting that if you’re considering termination due to a change in custody or financial hardship, the court will look closely at the circumstances surrounding your request. For example, if you’ve taken on additional responsibilities or if your child’s needs have changed significantly, these factors will weigh heavily in the court’s decision.

In conclusion, while the process of terminating child support in Texas can seem complex, understanding your rights and the legal requirements can empower you to take the necessary steps. Remember, you’re not alone in this journey, and seeking professional guidance can make all the difference in achieving a resolution that works for you and your child.

Conditions Under Which Child Support May Be Canceled

When it comes to child support, many parents find themselves navigating a complex web of legal obligations and emotional considerations. If you’re a mother in Texas wondering whether you can cancel child support, it’s essential to understand the specific conditions that may allow for this. Let’s explore the circumstances under which child support can be canceled, shedding light on the legal framework while also considering the emotional implications for both parents and children.

1. Child Reaches Age 18 or Graduates High School

One of the most straightforward conditions for canceling child support in Texas is when the child reaches the age of 18 or graduates from high school, whichever comes later. This is a significant milestone, not just legally but also emotionally. Think about it: your child is stepping into adulthood, ready to take on new responsibilities and challenges. It’s a moment filled with pride, but it also marks the end of a financial obligation for many parents.

According to Texas Family Code, child support automatically terminates when the child turns 18, unless they are still enrolled in high school. In such cases, support continues until graduation or until the child turns 19, whichever occurs first. This provision is designed to ensure that children have the necessary support during their transition into adulthood, allowing them to focus on their education without the added stress of financial instability.

However, it’s important to note that if you, as a mother, wish to cancel child support, you must formally request this through the court. Simply stopping payments without legal approval can lead to complications, including potential legal repercussions. So, if your child is nearing graduation, it might be a good time to consult with a family law attorney to ensure everything is handled correctly.

2. Legal Emancipation of the Child

Another condition that can lead to the cancellation of child support is the legal emancipation of the child. Emancipation is a legal process that allows a minor to gain independence from their parents or guardians before reaching the age of majority. This can happen for various reasons, such as the child demonstrating the ability to support themselves financially or entering into a marriage.

Imagine a scenario where your teenager has taken on a part-time job, is managing their finances, and has decided to live independently. In such cases, they may seek emancipation, which would legally recognize their ability to make decisions for themselves. If this occurs, the obligation for child support may be terminated, as the child is no longer considered a dependent.

However, the emancipation process is not as simple as it sounds. It requires a court hearing, and the child must prove their ability to support themselves. This can be a challenging journey, both legally and emotionally. As a mother, you might have mixed feelings about your child seeking independence. It’s a testament to their growth, but it can also bring about concerns regarding their well-being. If you find yourself in this situation, it’s crucial to approach the process with open communication and perhaps even seek legal advice to navigate the complexities involved.

3. Significant Changes in Custody Arrangements

Have you ever wondered how a shift in custody arrangements can impact child support obligations? In Texas, the relationship between custody and child support is intricate and deeply intertwined. When a parent experiences a significant change in custody—whether it’s a modification from joint custody to sole custody or a shift in the primary custodial parent—this can lead to a reevaluation of child support payments.

For instance, let’s say you were the non-custodial parent, and your ex-partner has recently moved in with a new partner, leading to a more stable environment for your child. If you can demonstrate that your child would benefit from living with you more often, you might petition the court for a change in custody. According to Texas Family Code, the court will consider the best interests of the child, which can include the stability of their living situation and the emotional bonds they share with each parent.

Expert opinions suggest that when custody arrangements change significantly, it’s essential to document the reasons and circumstances surrounding the change. Family law attorney Sarah Johnson notes, “Courts are often willing to adjust child support if there’s a clear and compelling reason for the change in custody. It’s all about what’s best for the child.” This means that if you can show that your child’s needs are better met in your care, you may have a strong case for modifying child support obligations.

Moreover, it’s important to remember that any changes must be approved by the court. Simply agreeing with your ex-partner to change custody without legal documentation can lead to complications down the line. Always consult with a legal professional to ensure that your rights and your child’s best interests are protected.

4. Significant Financial Changes

Life is unpredictable, isn’t it? One moment you might be comfortably managing your finances, and the next, you could face unexpected challenges. In Texas, significant financial changes can indeed lead to a modification of child support obligations. But what qualifies as a significant financial change? Let’s explore this together.

Imagine you’ve recently lost your job or faced a substantial pay cut. These situations can drastically alter your ability to meet your child support obligations. According to a study by the American Academy of Matrimonial Lawyers, nearly 70% of parents who experience a significant financial change seek to modify their child support payments. This statistic highlights just how common it is for circumstances to shift.

In Texas, the law recognizes that both parents have a responsibility to support their children, but it also acknowledges that financial hardships can occur. If you find yourself in a situation where your income has decreased by 20% or more, you may be eligible to request a modification. It’s crucial to gather documentation, such as pay stubs or termination letters, to present to the court.

On the flip side, if you’ve received a promotion or a significant raise, this could also warrant a review of your child support payments. Family law expert Mark Thompson emphasizes, “Child support is meant to reflect the current financial realities of both parents. If one parent’s financial situation improves, it’s only fair that the child benefits from that change.”

Ultimately, whether you’re facing a financial setback or a windfall, it’s essential to approach the situation with transparency and a focus on your child’s best interests. Open communication with your ex-partner can also help ease the process, as both of you navigate these changes together.

5. Death of the Child

There are few experiences more devastating than the loss of a child. It’s a heart-wrenching reality that no parent should have to face. In Texas, the death of a child has profound implications for child support obligations, and understanding these can be crucial during such a difficult time.

When a child passes away, the legal obligation for child support typically ends. However, the emotional and financial aftermath can be overwhelming. For instance, if you were the non-custodial parent, you might find yourself grappling with not only the grief of losing your child but also the complexities of finalizing any outstanding child support payments. It’s important to communicate with your ex-partner and legal counsel to ensure that all matters are handled appropriately.

According to a report from the Texas Department of Family and Protective Services, many parents are unaware that they can seek to terminate child support obligations following the death of a child. This can lead to unnecessary stress and confusion. Legal experts recommend that parents file a motion with the court to officially terminate child support payments, as this provides a clear legal record and helps prevent any future complications.

Moreover, it’s essential to take care of your emotional well-being during this time. Grieving is a personal journey, and seeking support from friends, family, or professional counselors can be incredibly beneficial. Remember, you’re not alone in this; many have walked this path and found ways to cope and heal.

In conclusion, while the death of a child brings an end to child support obligations, it also opens the door to a myriad of emotional and legal challenges. Navigating these waters requires compassion, understanding, and support from those around you.

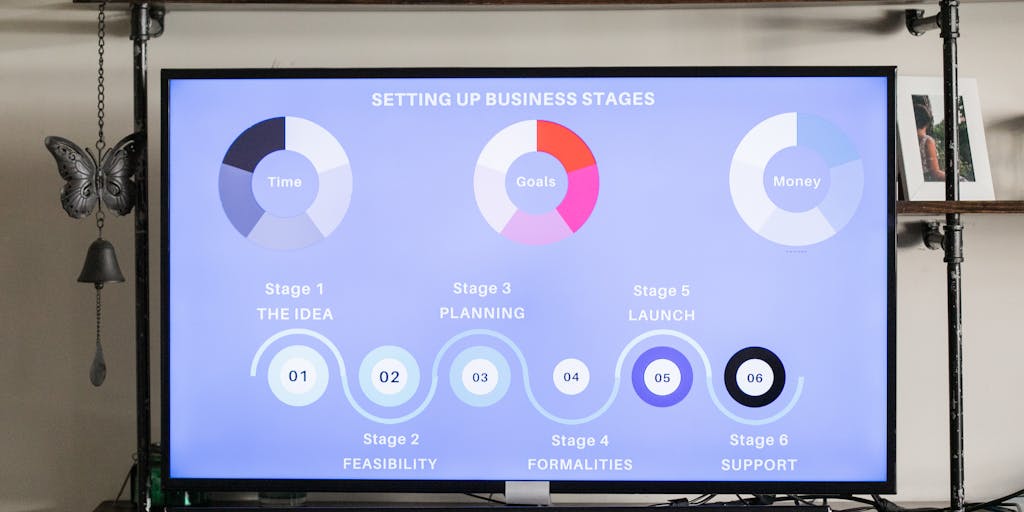

Process of Terminating Child Support in Texas

Have you ever found yourself wondering about the complexities of child support in Texas? It’s a topic that can stir up a whirlwind of emotions and questions. Whether you’re a parent seeking to modify your obligations or simply curious about the legal landscape, understanding the process of terminating child support is crucial. In Texas, child support is not just a financial obligation; it’s a lifeline for many families. However, circumstances change, and sometimes, the need for support can diminish or even cease altogether.

In Texas, the process of terminating child support is governed by specific legal guidelines. It’s essential to know that child support can only be terminated under certain conditions, such as the child reaching adulthood, getting married, or becoming self-sufficient. Additionally, if the custodial parent has passed away, the obligation may also end. But how do you navigate this process? Let’s break it down.

Legal Process for Canceling or Modifying Child Support

When it comes to canceling or modifying child support, the legal process can feel daunting. However, it’s designed to ensure that the best interests of the child remain at the forefront. The first step in this journey is understanding that you cannot simply stop making payments without legal approval. Doing so could lead to serious legal repercussions.

To initiate the process, you’ll need to demonstrate a significant change in circumstances. This could include a change in income, employment status, or even changes in the child’s needs. For instance, if you’ve lost your job and can no longer afford the current support amount, this could be grounds for modification. According to a study by the American Academy of Matrimonial Lawyers, nearly 70% of child support modifications are due to changes in the paying parent’s financial situation.

It’s also worth noting that Texas law requires a review of child support orders every three years, which can be a good opportunity to reassess your obligations. If you believe that your situation warrants a change, it’s advisable to consult with a family law attorney who can guide you through the nuances of the law and help you prepare your case.

Filing a Petition

So, how do you actually file a petition to terminate or modify child support? The process begins with drafting a petition that outlines your request and the reasons behind it. This document is crucial, as it serves as the foundation for your case. You’ll need to include specific details, such as your current financial situation and any relevant changes that have occurred since the original support order was established.

Once your petition is prepared, you’ll file it with the court that issued the original child support order. This is where things can get a bit tricky. You’ll need to ensure that you follow all local court rules and procedures, which can vary by county. After filing, a hearing will be scheduled where both parents can present their cases. It’s important to come prepared with documentation that supports your claims, such as pay stubs, tax returns, or any other financial records.

During the hearing, the judge will consider the evidence presented and make a determination based on the best interests of the child. This is a critical moment, as the judge’s decision will impact not only your financial obligations but also the well-being of your child. Remember, the goal is to reach a resolution that serves the child’s needs while also considering the parents’ circumstances.

In conclusion, while the process of terminating child support in Texas may seem overwhelming, understanding the legal framework and preparing adequately can make a significant difference. It’s a journey that requires patience, diligence, and often, the support of legal professionals who can help you navigate the complexities of family law. So, if you find yourself in this situation, take a deep breath, gather your documents, and remember that you’re not alone in this process.

Providing Documentation

When it comes to child support in Texas, the phrase “documentation is key” could not be more accurate. Imagine you’re sitting at your kitchen table, papers strewn about, trying to gather everything you need to make your case. It can feel overwhelming, but understanding what documents are necessary can simplify the process significantly.

To initiate a request for cancellation or modification of child support, you’ll need to provide specific documentation that supports your claim. This might include:

- Proof of Income Changes: If you’ve lost your job or experienced a significant decrease in income, you’ll want to gather pay stubs, termination letters, or any other relevant financial documents.

- Evidence of Changed Circumstances: This could be anything from a change in the child’s living situation to a new job opportunity that requires relocation. Documentation might include school records, medical records, or even a new lease agreement.

- Previous Court Orders: Having copies of existing child support orders is crucial. This helps the court understand the context of your request and the original terms that were set.

According to a study by the Texas Office of the Attorney General, cases with complete documentation are processed more efficiently, leading to quicker resolutions. So, as tedious as it may seem, taking the time to gather and organize your documents can make a significant difference in your case.

Attending a Court Hearing

Picture this: you’re sitting in a courtroom, the air thick with anticipation. You’ve done your homework, gathered your documents, and now it’s time to present your case. Attending a court hearing can be a nerve-wracking experience, but it’s also an opportunity to advocate for yourself and your child.

When you attend a court hearing regarding child support cancellation, there are a few key points to keep in mind:

- Be Prepared: Arrive early, dress appropriately, and bring all necessary documentation. This shows the court that you take the matter seriously.

- Understand the Process: Familiarize yourself with the court procedures. Knowing what to expect can help ease your anxiety. You’ll typically have the chance to present your case, followed by the other party’s response.

- Stay Calm and Respectful: Emotions can run high in these situations, but maintaining composure is crucial. The judge will appreciate your professionalism, and it can positively influence their perception of your case.

Experts suggest that practicing your presentation beforehand can help you articulate your points clearly. You might even consider role-playing with a friend or family member. Remember, the goal is to communicate your situation effectively and demonstrate why a modification or cancellation of child support is warranted.

Role of the Texas Attorney General’s Office and Family Law Attorney

Have you ever wondered who’s really in your corner when it comes to navigating the complexities of child support? In Texas, the Attorney General’s Office plays a pivotal role in enforcing child support orders, but they’re not the only players in this game. Understanding the roles of both the Attorney General’s Office and a family law attorney can empower you as you seek to modify or cancel child support.

The Texas Attorney General’s Office is responsible for ensuring that child support payments are made and can assist in cases where payments are overdue. They can also provide resources and guidance on how to modify existing orders. However, their primary focus is on enforcement rather than advocacy for either parent.

On the other hand, hiring a family law attorney can be a game-changer. Here’s why:

- Personalized Guidance: A family law attorney can offer tailored advice based on your unique situation, helping you understand your rights and options.

- Representation in Court: Having an attorney represent you can significantly increase your chances of a favorable outcome. They know the ins and outs of the legal system and can present your case more effectively.

- Negotiation Skills: Attorneys are trained negotiators. They can help facilitate discussions with the other parent or their attorney, aiming for a resolution that works for everyone involved.

In a recent survey conducted by the Texas Bar Association, individuals who sought legal representation reported feeling more confident and informed throughout the process. It’s a reminder that while you can navigate this journey alone, having a knowledgeable ally can make all the difference.

Reasons for Terminating Child Support Obligations

Have you ever wondered if a parent can simply decide to stop child support payments? In Texas, the answer is nuanced and depends on various factors. Understanding the reasons behind terminating child support obligations can help clarify this complex issue.

One of the most common reasons for terminating child support is a significant change in circumstances. For instance, if the custodial parent experiences a substantial increase in income or if the child reaches the age of majority—typically 18 years old—this can lead to a reevaluation of support obligations. Additionally, if the child becomes financially independent, perhaps by securing a job or receiving scholarships, the need for support may diminish.

Another reason could be a change in custody arrangements. If the non-custodial parent gains primary custody, they may seek to terminate or modify their child support obligations. This shift can be a significant turning point, as it reflects a new family dynamic that the courts will consider seriously.

Moreover, in some cases, the custodial parent may voluntarily agree to terminate child support. This often happens when both parents reach a mutual understanding that the child’s needs are being met without the need for financial support. However, it’s essential to formalize this agreement through the court to avoid future disputes.

Ultimately, the decision to terminate child support is not taken lightly. It involves legal processes and considerations that ensure the child’s best interests remain at the forefront.

Legal Implications of Terminating Child Support

When it comes to terminating child support in Texas, the legal implications can be quite significant. It’s crucial to understand that simply stopping payments without a court order can lead to serious consequences.

In Texas, child support obligations are governed by the Texas Family Code, which outlines the legal framework for support payments. If a parent wishes to terminate child support, they must file a motion with the court. This process ensures that any changes are legally recognized and enforceable. Failing to do so can result in the custodial parent pursuing back payments, which can accumulate quickly and lead to legal troubles.

Additionally, the court will consider various factors before approving a termination request. For example, they will assess the financial stability of both parents, the child’s needs, and any changes in custody arrangements. A study by the Texas Office of the Attorney General highlights that courts prioritize the child’s welfare above all else, which means that any decision made will reflect what is deemed best for the child.

It’s also worth noting that if child support is terminated, it does not absolve the non-custodial parent from any past due payments. This means that if there were any arrears before the termination, those obligations remain intact. Therefore, it’s essential to approach this process with caution and ideally seek legal counsel to navigate the complexities involved.

Custody Arrangements and Child Support

Have you ever thought about how custody arrangements impact child support? The relationship between custody and support is intricate, and understanding it can help clarify your rights and responsibilities as a parent.

In Texas, child support is typically determined based on the custody arrangement in place. If one parent has primary custody, the other parent is usually required to pay child support to help cover the child’s living expenses. However, if custody arrangements change—say, if the non-custodial parent gains primary custody—the dynamics of child support can shift dramatically.

For instance, let’s say a mother has been receiving child support from the father while having primary custody. If the father successfully petitions for a change in custody, he may not only stop paying support but could also receive support from the mother, depending on the circumstances. This change can be a significant adjustment for both parents and requires careful legal consideration.

Moreover, the Texas Family Code provides guidelines for calculating child support based on the non-custodial parent’s income and the number of children involved. This means that as custody arrangements evolve, so too can the financial obligations. A study from the American Academy of Matrimonial Lawyers emphasizes that clear communication and legal documentation are vital in these situations to prevent misunderstandings and ensure that both parents are on the same page.

In conclusion, navigating child support and custody arrangements in Texas requires a thoughtful approach. Whether you’re considering terminating support or adjusting custody, it’s essential to keep the child’s best interests at heart and seek legal guidance to ensure a smooth transition.

Importance of a Family Law Attorney in Child Support Matters

When navigating the often complex waters of child support, having a knowledgeable ally by your side can make all the difference. Have you ever felt overwhelmed by legal jargon or unsure about your rights? This is where a family law attorney steps in, acting as your guide through the intricacies of the legal system. In Texas, child support laws can be particularly nuanced, and an attorney can help clarify your options and responsibilities.

Consider this: a family law attorney not only understands the legal framework but also has experience dealing with similar cases. They can provide insights that you might not have considered. For instance, they can help you understand how child support is calculated, what factors can lead to modifications, and the implications of canceling support altogether. According to a study by the American Academy of Matrimonial Lawyers, cases handled by attorneys are more likely to result in favorable outcomes for clients, highlighting the importance of professional guidance.

Moreover, an attorney can help you prepare for court appearances, ensuring that you present your case effectively. They can also negotiate on your behalf, which can be particularly beneficial if you’re feeling emotional about the situation. Remember, this is not just about numbers; it’s about your child’s well-being and your peace of mind.

Practical Advice for Mothers Seeking to Cancel Child Support

If you’re a mother considering canceling child support, it’s essential to approach this decision thoughtfully. Have you weighed the potential impacts on your child’s financial stability? Here are some practical steps to guide you through the process:

- Assess Your Situation: Before making any decisions, take a moment to evaluate your current circumstances. Are you financially stable enough to support your child without assistance? Understanding your financial landscape is crucial.

- Communicate with the Other Parent: If possible, have an open conversation with the child’s other parent. Discussing your intentions can sometimes lead to amicable agreements without the need for court intervention.

- Document Everything: Keep detailed records of your financial situation, including income, expenses, and any changes that may affect your ability to provide support. This documentation can be invaluable if you need to present your case in court.

- Consult with a Family Law Attorney: As mentioned earlier, seeking legal advice is vital. An attorney can help you understand the legal implications of canceling child support and guide you through the necessary steps.

- File a Motion for Modification: If you decide to proceed, you’ll need to file a motion with the court to modify or cancel the child support order. Your attorney can assist you in preparing this motion and representing you in court.

Remember, the goal is to ensure that your child’s needs are met while also considering your own circumstances. It’s a delicate balance, but with the right approach, you can navigate this process successfully.

Potential Consequences of Canceling Child Support

While the idea of canceling child support may seem appealing, it’s crucial to consider the potential consequences. Have you thought about how this decision could affect your child’s future? Here are some important factors to keep in mind:

- Financial Impact on Your Child: Child support is designed to ensure that your child’s basic needs are met. Canceling support could lead to financial strain, affecting their education, healthcare, and overall quality of life.

- Legal Repercussions: If you cancel child support without a court order, you may face legal consequences. The other parent could seek enforcement of the original order, leading to potential legal battles that could be costly and time-consuming.

- Emotional Effects: The decision to cancel child support can also have emotional ramifications. It may create tension between you and the other parent, and your child may feel the impact of any financial instability.

- Future Modifications: If you cancel support now, it may be more challenging to reinstate it later if your circumstances change. Courts typically look for substantial changes in circumstances before modifying support orders.

Ultimately, the decision to cancel child support should not be taken lightly. It’s essential to weigh the pros and cons carefully and consider the long-term implications for both you and your child. Engaging with a family law attorney can provide clarity and help you make an informed decision that prioritizes your child’s best interests.

Navigating the Emotional and Financial Implications of Canceling Child Support: Tips for Mothers and Families

Have you ever found yourself in a situation where you’re contemplating the cancellation of child support? It’s a decision that can feel overwhelming, both emotionally and financially. As a mother, you might be wrestling with feelings of guilt, concern for your child’s well-being, and the practicalities of your family’s financial situation. It’s important to remember that you’re not alone in this journey.

When considering canceling child support, it’s crucial to weigh the emotional implications. For many mothers, the thought of altering financial support can stir up fears about their child’s future. According to a study by the U.S. Census Bureau, nearly 30% of custodial parents live in poverty, highlighting the importance of financial support in a child’s life. If you’re thinking about canceling, ask yourself: What will this mean for my child’s quality of life?

Financially, canceling child support can have significant repercussions. It’s essential to assess your current financial situation and future needs. Consider creating a budget that reflects your family’s expenses and income. This can help you visualize the impact of losing that support. Additionally, consulting with a financial advisor or a family law attorney can provide clarity on the legal and financial ramifications of your decision.

Ultimately, the decision to cancel child support should be made with careful consideration and open communication with your co-parent. Discussing your thoughts and feelings can lead to a more amicable resolution that prioritizes your child’s best interests.

Exploring the Role of Mothers in Child Support Cancellation

As a mother, you play a pivotal role in the child support conversation. Your perspective is invaluable, and understanding your rights and responsibilities can empower you in this process. In Texas, child support is typically determined by the non-custodial parent’s income, but there are circumstances where a mother may seek to cancel or modify support.

For instance, if you’ve experienced a significant change in circumstances—such as a job loss or a substantial increase in your ex-partner’s income—you might feel that the current support arrangement is no longer fair. In such cases, it’s essential to document these changes and communicate them effectively. A family law attorney can help you navigate the legal process, ensuring that your voice is heard.

Moreover, it’s important to recognize that your role extends beyond just financial considerations. You are a key advocate for your child’s emotional and psychological well-being. Engaging in open discussions with your co-parent about the implications of canceling support can foster a cooperative environment. This collaboration can lead to solutions that benefit everyone involved, especially your child.

Alternatives to Canceling Child Support: Exploring Co-Parenting Arrangements and Custody Agreements

Before making the decision to cancel child support, it’s worth exploring alternatives that might better serve your family’s needs. Have you considered co-parenting arrangements or revisiting custody agreements? These options can provide flexibility and support without the need to cancel financial assistance entirely.

Co-parenting is about collaboration and communication. It’s an opportunity for both parents to work together in the best interest of their child. For example, if you and your co-parent can agree on shared expenses for extracurricular activities or medical bills, this can alleviate some financial pressure without needing to cancel support. A study published in the Journal of Family Psychology found that effective co-parenting can lead to better outcomes for children, including improved emotional health and academic performance.

Additionally, revisiting custody agreements can also be beneficial. If your child’s needs have changed—perhaps they require more time with one parent due to school or social commitments—adjusting the custody arrangement can lead to a more balanced approach to support. This might involve negotiating a new agreement that reflects the current dynamics of your family.

Ultimately, the goal is to create a nurturing environment for your child. By exploring these alternatives, you can maintain financial support while fostering a cooperative relationship with your co-parent. Remember, it’s about finding what works best for your family and ensuring that your child’s needs are always at the forefront of your decisions.

Types of Child Custody Orders

When navigating the often complex world of child support and custody in Texas, it’s essential to understand the different types of custody orders that can impact your situation. Custody isn’t just about where a child lives; it encompasses a range of responsibilities and rights that can significantly affect both parents and children.

In Texas, custody is generally divided into two main categories: legal custody and physical custody.

- Legal Custody: This refers to the right to make important decisions about a child’s life, including education, healthcare, and religious upbringing. In Texas, legal custody can be awarded to one parent (sole custody) or both parents (joint custody). Joint legal custody is quite common, as it allows both parents to have a say in their child’s upbringing.

- Physical Custody: This pertains to where the child lives. Similar to legal custody, physical custody can also be sole or joint. In joint physical custody arrangements, children may spend significant time with both parents, which can help maintain strong relationships.

Understanding these types of custody orders is crucial, especially if you’re considering modifying or canceling child support. For instance, if a mother has sole physical custody, she may have more leverage in negotiating child support terms. However, if both parents share custody, the financial responsibilities may be more evenly distributed.

It’s also worth noting that custody arrangements can evolve. Life changes, such as a parent’s job relocation or a significant change in circumstances, can lead to modifications in custody orders. This is where the legal system comes into play, and having a clear understanding of your rights and responsibilities can make a world of difference.

Key Takeaways

As we delve into the intricacies of child support in Texas, here are some key takeaways to keep in mind:

- Child Support is Not Optional: In Texas, child support is a legal obligation. Parents are required to provide financial support for their children, regardless of their custody arrangement.

- Modification is Possible: If circumstances change—such as a job loss or a significant increase in income—either parent can petition the court for a modification of the child support order.

- Communication is Key: Open dialogue between parents can often lead to amicable agreements regarding child support and custody, reducing the need for court intervention.

- Legal Guidance is Essential: Navigating child support laws can be daunting. Consulting with a family law attorney can provide clarity and ensure that your rights are protected.

These takeaways serve as a foundation for understanding the broader implications of child support and custody in Texas. They remind us that while the legal system can be complex, being informed and proactive can lead to better outcomes for both parents and children.

Frequently Asked Questions – Child Support in Texas

When it comes to child support in Texas, many parents have questions that can feel overwhelming. Let’s address some of the most frequently asked questions to help clarify this important topic.

Can a mother cancel child support in Texas?

The short answer is no, a mother cannot unilaterally cancel child support. Child support orders are established by the court, and only the court has the authority to modify or terminate them. If circumstances change—such as a significant change in income or custody arrangements—either parent can petition the court for a modification.

What happens if child support is not paid?

If a parent fails to pay child support, there can be serious consequences. The Texas Attorney General’s Office can take various actions, including wage garnishment, intercepting tax refunds, or even suspending a driver’s license. It’s crucial to address any payment issues promptly to avoid these penalties.

How is child support calculated in Texas?

In Texas, child support is typically calculated based on a percentage of the non-custodial parent’s income. The standard guidelines suggest:

- 20% of net income for one child

- 25% for two children

- 30% for three children

- 35% for four children

- 40% for five or more children

These percentages can vary based on specific circumstances, such as additional children or extraordinary expenses.

Understanding these FAQs can empower you as a parent, helping you navigate the often murky waters of child support with confidence. Remember, you’re not alone in this journey, and seeking support—whether from legal professionals or community resources—can make all the difference.

Can you drop back child support in Texas?

Imagine a situation where life takes unexpected turns—perhaps a job loss, a medical emergency, or a significant change in circumstances. If you’re a parent in Texas facing such challenges, you might wonder, “Can I drop back child support?” The answer isn’t straightforward, but understanding the nuances can help you navigate this complex landscape.

In Texas, child support is typically established through a court order, and any changes to that order must go through the legal system. If you find yourself unable to meet your child support obligations due to unforeseen circumstances, you may be able to request a modification. However, this doesn’t mean you can simply drop the payments without legal approval.

According to the Texas Family Code, you can file for a modification if you can demonstrate a substantial change in circumstances. This could include a significant decrease in income or a change in the needs of the child. For instance, if you lost your job and are actively seeking new employment, the court may consider this a valid reason to adjust your payments.

It’s essential to document your situation thoroughly. Gather evidence such as pay stubs, termination letters, or medical records that support your claim. Consulting with a family law attorney can also provide clarity and ensure you’re following the correct procedures. Remember, the goal is to act in the best interest of your child while also being fair to yourself.

What is the deadbeat dad law in Texas?

The term “deadbeat dad” often evokes strong emotions, and in Texas, the law takes this issue seriously. But what does it really mean? The “deadbeat dad law” refers to legal measures aimed at ensuring that non-custodial parents fulfill their child support obligations. It’s not just a label; it’s a legal framework designed to protect children’s rights to financial support.

In Texas, if a parent fails to pay child support, they can face serious consequences. The state has various enforcement mechanisms, including wage garnishment, tax refund interception, and even the suspension of driver’s licenses. According to the Texas Attorney General’s Office, over $4 billion in child support was collected in 2020 alone, highlighting the state’s commitment to enforcing these laws.

But let’s take a moment to consider the broader implications. While the law aims to hold parents accountable, it’s crucial to recognize that not all non-custodial parents are “deadbeats.” Many face genuine hardships that prevent them from meeting their obligations. This is where understanding and communication become vital. If you’re struggling to make payments, reaching out to the other parent or seeking legal advice can often lead to more constructive solutions than simply falling behind.

How do I file a motion to stop child support in Texas?

If you’ve reached a point where you believe stopping child support is necessary, perhaps due to a change in custody or financial circumstances, you might be asking, “How do I file a motion to stop child support in Texas?” The process can seem daunting, but breaking it down into manageable steps can make it more approachable.

First, it’s important to understand that you cannot simply stop payments without a court order. To initiate the process, you’ll need to file a motion with the court that issued the original child support order. This motion should clearly outline your reasons for requesting the change. For example, if you’ve recently gained full custody of your child, this is a valid reason to seek a modification.

Here’s a simple step-by-step guide to help you through the process:

- Gather Documentation: Collect any relevant documents that support your case, such as custody agreements or proof of income changes.

- Complete the Motion: Fill out the appropriate forms, which can often be found on your local court’s website or obtained from the court clerk’s office.

- File the Motion: Submit your completed motion to the court, along with any required filing fees.

- Serve the Other Parent: Ensure that the other parent is formally notified of your motion, as they have the right to respond.

- Attend the Hearing: Be prepared to present your case in court, providing evidence and answering any questions the judge may have.

Throughout this process, consider seeking legal advice to ensure you’re on the right track. Family law can be intricate, and having an expert by your side can make a significant difference. Remember, the goal is to find a solution that works for both you and your child, fostering a supportive environment for their growth and well-being.

What is the new child support law in Texas?

Have you heard about the recent changes in child support laws in Texas? It’s a topic that affects many families, and understanding these updates can be crucial for both parents and children. In 2021, Texas implemented significant reforms aimed at making child support calculations more equitable and reflective of the current economic landscape. One of the most notable changes is the adjustment of income thresholds used to determine child support obligations.

Previously, the guidelines were based on a fixed percentage of the non-custodial parent’s income, which could sometimes lead to unfair situations, especially if the parent faced unexpected financial hardships. Now, the law considers various factors, including the number of children and the actual needs of the child, which can lead to a more tailored support amount. According to a study by the Texas Office of the Attorney General, these changes have resulted in a more balanced approach, ensuring that children receive the support they need while also considering the financial realities of the parents.

Additionally, the law has introduced provisions for modifying child support orders more easily when there is a significant change in circumstances, such as job loss or a substantial increase in income. This flexibility is essential for parents who may find themselves in fluctuating financial situations. As you navigate these changes, it’s important to stay informed and consider consulting with a family law attorney to understand how these laws may impact your specific situation.

Can parents agree to no child support in Texas?

This is a question that many parents ponder, especially when they are on amicable terms. The short answer is yes, parents can agree to waive child support in Texas, but there are important caveats to consider. The state prioritizes the welfare of the child, so any agreement must be in the child’s best interest. This means that even if both parents agree to forgo child support, a court must still approve this arrangement.

For instance, let’s say two parents decide that they can manage without formal child support because they share custody and have a mutual understanding of their financial responsibilities. They might draft a written agreement outlining their arrangement. However, when they present this to a judge, the court will evaluate whether this decision truly serves the child’s needs. If the court believes that the child would be better supported with a formal child support order, it may reject the parents’ agreement.

It’s also worth noting that if circumstances change—like one parent losing their job or facing unexpected expenses—the court can still impose child support obligations even if the parents initially agreed to waive them. This is a protective measure to ensure that children’s needs are always prioritized. So, while it’s possible to agree to no child support, it’s essential to approach this decision with caution and a clear understanding of the potential implications.

Can child support take your whole paycheck in Texas?

Imagine waking up one day to find that a significant portion of your paycheck has been garnished for child support. It’s a daunting thought, isn’t it? In Texas, while child support can indeed take a substantial part of your income, there are legal limits designed to protect parents from losing their entire paycheck. The law stipulates that up to 50% of your disposable income can be garnished for child support if you are supporting multiple children. However, if you are supporting only one child, the maximum is typically 20%.

But what does “disposable income” mean? It refers to your income after taxes and other mandatory deductions. So, if you earn $3,000 a month, and after taxes and deductions, your disposable income is $2,000, the maximum amount that could be taken for child support would be $400 if you have one child. This structure is designed to ensure that while children receive the support they need, parents are not left destitute.

Moreover, if you find yourself in a situation where child support is taking a significant portion of your income, it’s crucial to communicate with the court. There are avenues for modification if you can demonstrate a change in your financial circumstances. For example, if you lose your job or face unexpected medical expenses, you can petition the court to lower your child support payments. Remember, the goal is to balance the needs of the child with the financial realities of the parent, and the law provides mechanisms to help achieve that balance.

What is the minimum child support in Texas?

When it comes to child support in Texas, understanding the minimum requirements can feel a bit overwhelming. But let’s break it down together. In Texas, child support is calculated based on a percentage of the non-custodial parent’s income. The state has established guidelines to ensure that children receive adequate financial support, which is crucial for their well-being.

The minimum child support obligation is determined by the number of children needing support. For one child, the non-custodial parent is typically required to pay 20% of their net resources. If there are two children, that percentage increases to 25%, and it continues to rise with additional children. For example:

- 1 child: 20% of net resources

- 2 children: 25% of net resources

- 3 children: 30% of net resources

- 4 children: 35% of net resources

- 5 or more children: 40% of net resources

It’s important to note that “net resources” include not just salary, but also bonuses, commissions, and other forms of income. This means that if you’re a parent navigating this system, it’s essential to have a clear understanding of your financial situation. A study by the Texas Office of the Attorney General found that consistent child support payments significantly improve children’s quality of life, which is a compelling reason to adhere to these guidelines.

Can Both Parents Agree To Stop Child Support In Texas?

Have you ever wondered if both parents can simply agree to stop child support payments? It’s a common question, especially among co-parents who may have developed a cooperative relationship. The short answer is: yes, but it’s not as simple as just shaking hands and calling it a day.

In Texas, while parents can agree to modify or terminate child support, this agreement must be formalized through the court. This means that even if both parents are on the same page, they need to file a motion with the court to officially end the support obligation. This process ensures that the child’s best interests are always prioritized, which is a fundamental principle in family law.

For instance, if both parents agree that the child no longer needs financial support due to a change in circumstances—like the child reaching adulthood or becoming financially independent—they can present this to the court. A family law attorney can help navigate this process, ensuring that everything is documented correctly. Remember, even amicable agreements need to be legally binding to avoid future complications.

Can A Mother Drop Child Support In Texas?

Now, let’s tackle a question that often comes up: can a mother drop child support in Texas? This is a nuanced topic, and it’s essential to approach it with care. The answer largely depends on the circumstances surrounding the child support order.

If a mother is the custodial parent and is receiving child support, she cannot unilaterally decide to drop it. Child support is a legal obligation, and any changes must go through the court system. However, if the mother believes that the child no longer requires support—perhaps due to a significant change in the child’s living situation or financial independence—she can petition the court for a modification or termination of the support order.

It’s also worth noting that if the mother is the one paying child support, she may seek to modify or terminate her payments if her financial situation changes significantly, such as losing a job or experiencing a substantial decrease in income. A study from the American Academy of Matrimonial Lawyers highlights that many parents are unaware of their rights and options regarding child support modifications, which can lead to unnecessary stress and confusion.

Ultimately, whether you’re a mother or father, understanding the legal framework surrounding child support in Texas is crucial. It’s not just about the money; it’s about ensuring that children receive the support they need to thrive. If you find yourself in this situation, consulting with a family law attorney can provide clarity and guidance tailored to your unique circumstances.

Conclusion

As we wrap up our exploration of child support in Texas, it’s essential to reflect on the complexities surrounding this topic. The question of whether a mother can cancel child support is not just a legal matter; it’s deeply intertwined with the emotional and financial well-being of families. Understanding the nuances of child support laws can empower you to make informed decisions that affect your life and your child’s future.

In Texas, the ability to modify or terminate child support hinges on several factors, including changes in circumstances, the child’s age, and the original court order. For instance, if a mother finds herself in a situation where her financial status has significantly improved, or if the child reaches adulthood, she may have grounds to seek a modification or cancellation of support. However, it’s crucial to approach this process with care and legal guidance.

Consider the story of Sarah, a single mother who initially relied on child support to make ends meet. Over the years, she built a successful career and found herself in a position where she felt she no longer needed the financial assistance. After consulting with a family law attorney, she learned that she could petition the court for a modification based on her improved financial situation. This not only relieved her of the obligation but also allowed her to foster a more collaborative co-parenting relationship with her ex-partner.

It’s also important to recognize that child support is designed to ensure that children receive the financial support they need to thrive. As such, any decision to cancel or modify support should be made with the child’s best interests at heart. Engaging in open communication with your co-parent and seeking mediation can often lead to more amicable solutions that benefit everyone involved.

In conclusion, while a mother can seek to cancel child support in Texas under certain conditions, it’s a decision that requires careful consideration and legal advice. By understanding the laws and being proactive in your approach, you can navigate this challenging landscape with confidence. Remember, the ultimate goal is to create a stable and nurturing environment for your child, and that should always guide your decisions.