Understanding the legal implications of child support can be daunting, especially when it comes to the consequences of failing to pay. In Colorado, the stakes can be high, and knowing how much back child support can lead to felony charges is crucial for anyone navigating this complex system. So, how much is too much, and what does it mean for you?

Failure to Pay Child Support (as a Criminal Offense) in Colorado

In Colorado, failing to pay child support can escalate from a civil issue to a criminal offense under certain circumstances. If you find yourself unable to meet your child support obligations, it’s essential to understand the legal thresholds that can turn your situation into a felony. Generally, if you owe more than $2,000 in back child support, you could face felony charges. This amount is significant because it reflects a pattern of non-payment rather than a temporary financial struggle.

Moreover, the law considers the intent behind the non-payment. If it can be proven that you willfully failed to pay child support, the consequences can be severe. For instance, a court may view your actions as an attempt to evade your responsibilities, which can lead to criminal prosecution. According to Shouse Law, the penalties for felony child support non-payment can include hefty fines and even jail time.

What Happens If Your Child Support Is Not Paid in Colorado?

So, what happens if you miss a child support payment? The repercussions can be immediate and far-reaching. Initially, the custodial parent can file a motion to enforce the child support order, which may lead to wage garnishment or interception of tax refunds. This means that the state can take a portion of your earnings directly from your paycheck to cover the owed support.

Additionally, Colorado has various enforcement mechanisms in place. For example, if you’re behind on payments, the state can suspend your driver’s license or even your professional licenses, making it difficult to maintain employment. This can create a vicious cycle where the inability to work leads to further non-payment, which in turn leads to more severe penalties. Resources like Colorado’s Child Support Services provide guidance on how these enforcement actions work.

It’s also worth noting that if you find yourself in a situation where you cannot pay, it’s crucial to communicate with the court. Seeking a modification of your child support order due to changed financial circumstances can be a proactive step. Ignoring the issue will only exacerbate the situation, leading to more significant legal troubles down the line.

In summary, understanding the implications of back child support in Colorado is vital. If you’re facing challenges in meeting your obligations, consider reaching out to legal professionals who can help navigate these waters. Remember, the law is designed to ensure the well-being of children, and being proactive can help you avoid severe penalties.

Parents Are Financially Responsible for Supporting Their Children

As parents, we often find ourselves navigating the complexities of raising children, from their education to their emotional well-being. One of the most fundamental responsibilities we have is to provide financial support. This obligation is not just a moral one; it is a legal requirement in many jurisdictions, including Colorado. When parents separate or divorce, the financial responsibilities can become a contentious issue, but the law is clear: both parents are expected to contribute to their children’s upbringing.

Child support is designed to ensure that children receive the financial resources they need to thrive. This includes covering basic necessities such as food, clothing, and shelter, as well as educational expenses and healthcare. The amount of child support is typically determined by various factors, including the income of both parents and the needs of the child. Understanding these obligations is crucial for parents to fulfill their roles effectively.

Sometimes Parents Don’t Live Up to Their Responsibilities

Unfortunately, not all parents meet their financial obligations. Whether due to financial hardship, lack of awareness, or willful neglect, some parents fall behind on child support payments. This can lead to significant challenges for the custodial parent and the child, who may suffer from a lack of resources. It’s a heartbreaking situation that many families face.

In Colorado, failing to pay child support can have serious legal consequences. If a parent accumulates a significant amount of unpaid child support, it can lead to criminal charges. In fact, if the amount owed exceeds a certain threshold, it can be classified as a felony. This is a serious matter, as it can result in severe penalties, including jail time. For more information on the implications of failing to pay child support in Colorado, you can check out this resource on failing to pay child support.

Understanding Colorado Child Support

Understanding how child support works in Colorado is essential for both custodial and non-custodial parents. The state uses a formula to calculate the amount of support based on the income of both parents and the number of children involved. This formula aims to ensure fairness and adequacy in support payments. However, many parents are unaware of how these calculations are made, which can lead to disputes and misunderstandings.

In Colorado, if a parent fails to pay child support, the custodial parent can take legal action to enforce the support order. This may include wage garnishment, tax refund interception, or even the suspension of professional licenses. The state takes child support seriously, and there are resources available to help parents navigate these challenges. For instance, you can learn more about the consequences of not paying child support by visiting this article on what happens if you don’t pay child support.

Moreover, if the unpaid child support reaches a certain level, it can escalate to a felony charge. This is a critical point for parents to understand, as the legal ramifications can be life-altering. If you’re curious about the specific thresholds and penalties, you might find this article on what happens when child support is not paid in Colorado particularly enlightening.

In conclusion, being a parent comes with a host of responsibilities, and financial support is one of the most significant. Understanding the laws surrounding child support in Colorado can help you navigate these waters more effectively, ensuring that your children receive the support they need. If you find yourself struggling with child support issues, remember that there are resources and legal avenues available to assist you. After all, our children deserve the best we can provide, both emotionally and financially.

How Child Support Is Calculated

Understanding how child support is calculated can feel overwhelming, but it’s essential for ensuring that children receive the financial support they need. In Colorado, child support calculations are primarily based on the Income Shares Model, which considers the income of both parents and the needs of the child. This model aims to ensure that children receive the same proportion of parental income that they would have if the parents were living together.

To break it down, the process typically involves:

- Determining Gross Income: This includes wages, bonuses, and other sources of income for both parents.

- Adjusting for Deductions: Certain deductions, such as taxes and health insurance premiums, are taken into account.

- Using the Child Support Guidelines: Colorado has specific guidelines that provide a formula to calculate the support amount based on the combined income and the number of children.

For example, if Parent A earns $5,000 a month and Parent B earns $3,000, the combined income is $8,000. The guidelines will then specify how much of that income should be allocated for child support, ensuring that the child’s needs are met.

If you’re curious about the specifics of your situation, you can find more detailed information on the Colorado Child Support website.

What Happens if I don’t pay child support?

Not paying child support can lead to serious consequences, and it’s a situation that many parents dread. If you find yourself unable to make payments, it’s crucial to understand the potential repercussions. Ignoring child support obligations can lead to legal actions that may affect your finances and even your freedom.

In Colorado, if you fail to pay child support, the court can take several actions against you. It’s important to remember that child support is not just a suggestion; it’s a legal obligation. So, what can happen if you don’t pay?

- Wage Garnishment: The court can order that a portion of your wages be automatically deducted to cover child support payments.

- Tax Refund Interception: The state can intercept your tax refunds to apply them toward your child support debt.

- License Suspension: Your driver’s license or professional licenses may be suspended until you comply with the support order.

- Contempt of Court: Failing to pay can lead to being held in contempt of court, which may result in fines or even jail time.

It’s a tough situation, but if you’re struggling, it’s better to communicate with the court or seek legal advice rather than simply ignoring the issue. You can explore options for modifying your child support order if your financial situation has changed.

Consequences of Failing to Pay Child Support

The consequences of failing to pay child support can be severe and long-lasting. Beyond the immediate financial penalties, there are emotional and social implications that can affect your life and your relationship with your children. Have you ever thought about how these consequences ripple through your life?

When child support payments are missed, the child’s well-being is often compromised, which can lead to strained relationships and emotional distress for both the child and the parent. Here are some of the key consequences:

- Legal Penalties: As mentioned earlier, you could face wage garnishment, tax refund interception, and even jail time for contempt of court.

- Increased Debt: The amount owed can accumulate quickly, leading to significant back child support that can be classified as a felony if it exceeds a certain threshold.

- Impact on Credit Score: Unpaid child support can negatively affect your credit score, making it harder to secure loans or housing.

- Emotional Strain: The stress of legal battles and financial instability can take a toll on your mental health and relationships.

It’s essential to take child support obligations seriously. If you’re facing challenges, consider reaching out to a legal professional who can help you navigate your options. For more insights on fighting back child support, check out this article on fighting back child support.

Legal Penalties

When it comes to child support in Colorado, the stakes can be quite high. If you find yourself unable to meet your child support obligations, you might wonder: how much back child support can lead to felony charges? In Colorado, failing to pay child support can escalate from a civil matter to a criminal one, particularly if the amount owed is significant. Generally, if you owe more than $2,000 in back child support, you could face felony charges, which can result in serious legal consequences, including imprisonment.

It’s essential to understand that the law is designed to ensure that children receive the financial support they need. If you’re struggling to make payments, it’s crucial to communicate with the court or your child’s other parent. Seeking modifications to your support order can often prevent the situation from escalating to criminal charges. For more detailed information on the implications of unpaid child support, you can check out this citizen’s guide on child support enforcement.

Wage Garnishment

Have you ever wondered how unpaid child support can affect your paycheck? In Colorado, wage garnishment is a common method used to collect back child support. This means that a portion of your wages can be automatically deducted to pay off your child support debt. Typically, up to 65% of your disposable income can be garnished if you are behind on payments. This can be a significant hit to your finances, making it even more challenging to catch up.

Imagine receiving your paycheck only to find that a large chunk has already been taken out. It’s a tough situation, but it’s important to remember that the system is in place to ensure that children are supported. If you’re facing wage garnishment, consider reaching out to a family law attorney who can help you navigate your options. You might also want to explore resources on retroactive child support in Colorado to understand your rights and responsibilities better.

Can Your License Be Suspended For Not Paying Child Support

Have you ever thought about how child support payments could impact your driving privileges? In Colorado, failing to pay child support can indeed lead to the suspension of your driver’s license. This is a serious consequence that can affect your daily life, from commuting to work to running essential errands. The state has the authority to suspend your license if you are significantly behind on payments, typically if you owe more than $2,500.

Imagine the frustration of being unable to drive because of unpaid child support. It’s a wake-up call for many parents who may not realize the full extent of the repercussions. If you find yourself in this situation, it’s crucial to act quickly. You can often reinstate your license by making arrangements to pay your back support. For more insights on how unpaid child support can affect custody and other rights, consider reading this article on losing custody for not paying child support.

Financial Impact of Unpaid Child Support

When we think about child support, it’s easy to focus on the emotional aspects of parenting and responsibility. However, the financial implications of unpaid child support can be staggering, not just for the custodial parent but for the non-custodial parent as well. In Colorado, failing to pay child support can lead to serious legal consequences, including felony charges if the amount owed exceeds a certain threshold.

Imagine a scenario where a parent is struggling to make ends meet, yet they are also burdened with the weight of unpaid child support. This situation can create a cycle of financial instability that affects not only the parent but also the child. The state of Colorado takes child support seriously, and the repercussions of neglecting these obligations can be severe.

Credit Score Damage

One of the most immediate financial impacts of unpaid child support is the potential damage to your credit score. Did you know that child support payments can be reported to credit bureaus? If you fall behind on payments, it can lead to a significant drop in your credit score, making it harder to secure loans or even rent an apartment. This can create a ripple effect, limiting your financial options and making it more challenging to provide for your family.

For instance, if you’re trying to buy a home or a car, lenders will look at your credit history. A low score due to unpaid child support can result in higher interest rates or even denial of credit. It’s a harsh reality that many parents face, and it’s crucial to understand how these financial decisions can impact your future.

Interest Accumulation

Another critical aspect to consider is the accumulation of interest on unpaid child support. In Colorado, unpaid child support can accrue interest at a rate of 12% per year. This means that the longer you wait to pay, the more you owe. It’s like a snowball effect; what might start as a manageable amount can quickly escalate into a significant financial burden.

For example, if you owe $5,000 in child support and let it go unpaid for just a year, you could find yourself facing an additional $600 in interest alone. This can create a daunting situation where the total amount owed becomes unmanageable, leading to further legal action and potential felony charges. Understanding this accumulation can motivate parents to prioritize their child support obligations, ensuring they don’t fall into a deeper financial hole.

In conclusion, the financial impact of unpaid child support in Colorado is profound. From damaging your credit score to the relentless accumulation of interest, the consequences can be far-reaching. It’s essential to stay informed and proactive about your child support responsibilities to avoid these pitfalls. If you’re struggling, consider reaching out for support or legal advice to navigate these challenges effectively.

Enforcement Actions by Child Support Service

When it comes to child support in Colorado, the stakes can be high, especially if payments are missed. You might wonder, what happens if someone falls behind on their child support obligations? The Colorado Child Support Services (CSS) has a range of enforcement actions at its disposal to ensure that parents fulfill their financial responsibilities. These actions are not just bureaucratic measures; they can significantly impact a person’s life.

One of the most common enforcement actions is the suspension of a driver’s license. Imagine being unable to drive to work or take your kids to school because of unpaid child support. This can create a cycle of hardship, making it even harder to catch up on payments. CSS can also report delinquent accounts to credit bureaus, which can damage a parent’s credit score and make it difficult to secure loans or housing.

Understanding these enforcement actions is crucial. They serve as a reminder that child support is not just a legal obligation but a commitment to the well-being of children. If you find yourself in a situation where you’re struggling to make payments, it’s essential to communicate with CSS and explore options rather than waiting for enforcement actions to take place.

Tax Refund Interception

Have you ever thought about how tax season can turn into a double-edged sword for parents behind on child support? In Colorado, one of the enforcement tools used by CSS is tax refund interception. This means that if you owe back child support, your federal and state tax refunds can be intercepted to cover those debts. It’s a stark reminder that the government takes child support seriously.

Imagine filing your taxes, expecting a refund that could help with bills or a family vacation, only to find out that it’s been taken to pay off child support arrears. This can be a shocking and frustrating experience. The interception process is automatic, and many parents are caught off guard when they receive a notice from the IRS or the state.

To avoid such situations, it’s wise to stay informed about your child support obligations and seek assistance if you’re struggling to keep up. There are resources available, and sometimes, a simple conversation with CSS can lead to a manageable payment plan.

Property Liens

Have you ever considered how unpaid child support can affect your property? In Colorado, if you fall significantly behind on child support payments, CSS can place a lien on your property. This means that if you try to sell your home or refinance, the lien must be satisfied first. It’s a serious consequence that can complicate your financial future.

Picture this: you’ve worked hard to build equity in your home, only to find that a lien has been placed against it due to unpaid child support. This can limit your options and create stress in your life. The lien serves as a legal claim against your property, ensuring that the state can recover the owed amount when the property is sold.

Understanding the implications of property liens is essential for anyone facing child support issues. It’s not just about the money; it’s about your financial freedom and stability. If you’re in a tough spot, consider reaching out to legal experts who can help navigate these waters. You don’t have to face this alone, and there are ways to address your obligations without losing what you’ve worked so hard for.

Passport Restrictions

Have you ever thought about how unpaid child support can affect your travel plans? In Colorado, if you fall behind on child support payments, you might face passport restrictions. The state can report your delinquency to the federal government, which may lead to the denial of your passport application or even the revocation of your current passport. This can be particularly distressing if you have plans to travel for work or to visit family. Imagine being all set for a vacation, only to find out that your passport is on hold due to unpaid support. It’s a harsh reality that many parents face, and it underscores the importance of staying current with your obligations.

Visitation Rights and Unpaid Child Support

When it comes to child support, many people wonder how it impacts visitation rights. It’s a common misconception that failing to pay child support can automatically result in losing your visitation rights. In Colorado, the law is clear: visitation rights and child support are separate issues. Just because a parent is behind on payments doesn’t mean they can be denied access to their child. However, the custodial parent may express concerns about the non-custodial parent’s ability to provide for the child, which can complicate the situation. If you find yourself in this predicament, it’s crucial to communicate openly and seek legal advice to navigate these waters effectively. Remember, maintaining a relationship with your child is just as important as fulfilling your financial responsibilities.

What Happens If I Lose My Job and Can’t Pay Child Support

Life can throw unexpected challenges our way, and losing a job is one of the most stressful experiences anyone can face. If you find yourself unable to pay child support due to job loss, it’s essential to act quickly. In Colorado, you can request a modification of your child support order based on your change in financial circumstances. This is not just a formality; it’s a necessary step to ensure that you’re not penalized for something beyond your control. You might be worried about the legal implications of missing payments, but remember that the court understands that life happens. It’s better to be proactive and communicate your situation rather than waiting for the court to take action against you. Seeking legal advice can help you navigate this process smoothly and ensure that your rights are protected while you get back on your feet.

Understanding Child Support Obligations

Child support is a critical aspect of ensuring that children receive the financial support they need from both parents. In Colorado, like in many states, failing to pay child support can lead to serious legal consequences. But how much back child support can actually be considered a felony? This question is essential for anyone navigating the complexities of family law in Colorado.

Court Notification

When a parent falls behind on child support payments, the court typically issues notifications to both parties involved. This process is crucial because it ensures that both parents are aware of the situation and can take appropriate action. If you receive a notification regarding unpaid child support, it’s important to respond promptly. Ignoring these notifications can escalate the situation, potentially leading to legal penalties.

In Colorado, the court may notify you of your arrears, which is the total amount of unpaid child support. If the arrears exceed a certain threshold, the court may classify the failure to pay as a felony. This threshold can vary, but generally, if you owe more than $10,000 in back child support, you could face felony charges. Understanding this threshold is vital, as it can significantly impact your life and your relationship with your children.

Gathering Documentation

One of the first steps in addressing back child support is gathering all relevant documentation. This includes payment records, court orders, and any correspondence related to your child support obligations. Having a clear record can help you understand your situation better and prepare for any legal proceedings.

Consider the following documents to collect:

- Payment history from your employer or the child support enforcement agency.

- Copies of court orders regarding child support.

- Any communication with the other parent regarding payments.

- Proof of income changes, such as pay stubs or tax returns.

By organizing this information, you can present a stronger case if you decide to contest the amount owed or seek modifications based on changes in your financial situation.

Can I Fight Paying Back Child Support?

Many parents wonder if they can contest their child support obligations, especially if they believe the amount is unfair or unmanageable. The answer is yes, you can fight back child support claims, but it requires a solid understanding of the law and the right approach.

In Colorado, you can request a modification of your child support order if you experience a significant change in circumstances, such as job loss or a decrease in income. It’s essential to file this request with the court and provide evidence to support your claim. Remember, simply not paying is not a viable option and can lead to severe consequences, including felony charges if the arrears are substantial.

Additionally, if you believe that the amount you owe is incorrect, you can challenge it in court. This process may involve presenting your documentation and possibly even testifying about your financial situation. Engaging with a legal professional can be beneficial in navigating these waters, ensuring that your rights are protected while also fulfilling your responsibilities as a parent.

Ultimately, the goal is to find a resolution that works for both you and your child. Open communication with the other parent and a willingness to negotiate can often lead to more favorable outcomes.

What are Some Valid Grounds for Not Paying Child Support?

When it comes to child support, many parents find themselves in difficult situations that may prevent them from fulfilling their financial obligations. But what are some valid grounds for not paying child support? Understanding these reasons can help you navigate the complexities of family law.

One common ground is a significant change in financial circumstances. For instance, if you lose your job or face a substantial reduction in income, you may be able to request a modification of your child support order. It’s essential to document these changes thoroughly, as courts will require evidence to support your claims.

Another valid reason could be the inability to pay due to health issues. If a medical condition prevents you from working or incurs high medical expenses, this can be a legitimate reason to seek a reduction in child support payments. Additionally, if the custodial parent is not using the support for the child’s benefit, this could also be a point of contention.

It’s important to remember that simply not wanting to pay or feeling overwhelmed by the amount owed is not a valid excuse. Courts take child support obligations seriously, and failing to pay without a legitimate reason can lead to severe consequences, including legal penalties.

Have you ever found yourself in a situation where you felt overwhelmed by financial obligations? It’s crucial to communicate openly with your co-parent and seek legal advice if you believe you have a valid reason for not paying child support.

The Importance of Evidence to Defend Against Back-Owed Child Support

When facing accusations of back-owed child support, having solid evidence is your best defense. Courts rely heavily on documentation to make informed decisions, so gathering the right information can significantly impact your case.

For example, if you are claiming a change in income, you should provide pay stubs, tax returns, or any relevant financial documents that illustrate your current situation. Similarly, if health issues have affected your ability to work, medical records can serve as crucial evidence.

Moreover, keeping a record of all communications with your co-parent regarding child support can be beneficial. This includes emails, texts, and any formal notices you may have sent or received. Such documentation can demonstrate your willingness to cooperate and your attempts to address the situation responsibly.

Have you ever thought about how much documentation can influence a legal outcome? It’s not just about what you say; it’s about what you can prove. The more organized and thorough your evidence, the stronger your defense will be against claims of back child support.

The Importance of Finding an Experienced Attorney to Fight Orders for Back Child Support

When dealing with back child support issues, having an experienced attorney by your side can make all the difference. Navigating the legal system can be daunting, and an attorney who specializes in family law can provide invaluable guidance and support.

An attorney can help you understand your rights and obligations, as well as the potential consequences of failing to pay child support. They can also assist in gathering the necessary evidence to support your case, ensuring that you present a strong argument in court.

Moreover, an experienced lawyer can negotiate on your behalf, potentially leading to a more favorable outcome. They understand the nuances of family law and can advocate for your interests effectively. If you’re facing a court order for back child support, having someone knowledgeable in your corner can alleviate some of the stress and uncertainty.

Have you ever considered how much easier it is to face challenges with the right support? Finding an attorney who understands your situation can empower you to take control of your circumstances and work towards a resolution that benefits both you and your child.

Calculating Child Support

Understanding how child support is calculated can feel overwhelming, but it’s essential for ensuring that children receive the financial support they need. In Colorado, child support is determined using a formula that considers both parents’ incomes, the number of children, and the amount of time each parent spends with the children. This formula is designed to ensure fairness and consistency across cases.

For instance, if you’re a parent who has lost your job or experienced a significant change in income, it’s crucial to communicate this to the court. Adjustments can be made to reflect your current financial situation. The state uses a guideline that factors in the basic needs of the child, which includes housing, food, and education. You might wonder, how does this affect you? If you’re struggling to meet your obligations, it’s vital to seek legal advice to explore your options.

Moreover, if you’re curious about how child support obligations can change over time, it’s worth noting that they can be modified based on changes in circumstances. For more insights on related topics, check out Best Digital Marketing Podcasts for resources that can help you navigate these challenges.

Enforcing Child Support Orders

Once a child support order is established, enforcing it becomes a critical step in ensuring that payments are made consistently. In Colorado, if a parent fails to pay child support, they may face serious consequences, including wage garnishment, tax refund interception, and even potential jail time. You might be asking yourself, what happens if the non-custodial parent simply refuses to pay? The state has mechanisms in place to enforce these orders, which can include legal action.

It’s important to understand that back child support can accumulate quickly, leading to significant financial obligations. If you find yourself in a situation where you’re owed back support, it’s advisable to consult with a family law attorney who can guide you through the enforcement process. They can help you understand your rights and the steps you can take to ensure compliance with the support order.

Additionally, if you’re interested in learning more about how to effectively market your legal services, consider exploring resources like Best Instagram Advertising Agencies to enhance your outreach.

Interstate Cases

Child support cases that cross state lines can add another layer of complexity. If a parent moves to another state and fails to pay child support, the custodial parent can still seek enforcement through the Uniform Interstate Family Support Act (UIFSA). This act allows for the enforcement of child support orders across state lines, ensuring that children receive the support they need regardless of where the non-custodial parent resides.

Have you ever wondered how this process works? Essentially, the custodial parent can file a petition in their state, which will then be sent to the state where the non-custodial parent lives. This cooperation between states helps streamline the enforcement process, making it easier for parents to receive the support owed to them.

For those navigating these challenging waters, it’s beneficial to stay informed about your rights and the legal processes involved. You might also find it helpful to explore articles on effective marketing strategies, such as Best Pinterest Marketing Agencies, to help you connect with others who may be facing similar challenges.

How Much Back Child Support Is A Felony In Colorado

Understanding the legal implications of child support in Colorado can be daunting, especially when it comes to back child support. You might be wondering, “What happens if I can’t keep up with my payments?” or “How does the state handle unpaid child support?” Let’s dive into the details, starting with the basics of making and receiving child support payments.

Making Child Support Payments

When it comes to making child support payments, Colorado law is quite clear. Parents are legally obligated to support their children financially, and this obligation continues until the child turns 19 or graduates from high school, whichever comes first. If you find yourself unable to make these payments, it’s crucial to communicate with the court or your child’s other parent. Ignoring the situation can lead to serious consequences.

In Colorado, failing to pay child support can escalate to a felony charge if the amount owed exceeds a certain threshold. Specifically, if you owe more than $10,000 in back child support, you could face felony charges. This is a significant amount, and it’s important to understand that the state takes these obligations seriously. If you’re struggling, consider seeking legal advice to explore options like modifying your support order.

Receiving Child Support Payments

On the flip side, if you are the recipient of child support, it’s essential to know your rights. Child support is designed to ensure that children receive the financial support they need from both parents. If you’re not receiving the payments you’re entitled to, there are steps you can take. Colorado has mechanisms in place to enforce child support orders, including wage garnishment and even license suspensions for non-compliant parents.

Moreover, if you find yourself in a situation where back child support is owed to you, it’s important to document everything. Keep records of missed payments and communicate with the child support enforcement agency. They can assist you in recovering the funds owed, ensuring that your child’s needs are met.

Eligibility for Retroactive Child Support Colorado

Have you ever wondered if you can receive retroactive child support in Colorado? The answer is yes, but there are specific criteria that must be met. Retroactive child support refers to payments that are owed for periods prior to the establishment of a child support order. This can be particularly relevant in cases where paternity is established after the child’s birth or when a support order is modified.

In Colorado, you may be eligible for retroactive child support if you can demonstrate that the other parent had the ability to pay during the time the support was owed. The court will consider various factors, including the financial situation of both parents and the needs of the child. It’s a complex area of law, and having a knowledgeable attorney can make a significant difference in navigating these waters.

Ultimately, whether you are making or receiving child support, understanding your rights and obligations is crucial. If you find yourself facing challenges, don’t hesitate to reach out for help. There are resources available, and you don’t have to navigate this alone.

Criteria for Non-Custodial Parents

Understanding the criteria for non-custodial parents in Colorado is crucial, especially when it comes to child support obligations. A non-custodial parent is typically the one who does not have primary physical custody of the child. This designation can lead to various responsibilities, including financial support. But what exactly qualifies someone as a non-custodial parent?

In Colorado, the court considers several factors when determining non-custodial status:

- Physical Custody: The parent who the child lives with most of the time is usually the custodial parent. The other parent is deemed non-custodial.

- Legal Custody: This refers to the right to make important decisions about the child’s life, such as education and healthcare. A non-custodial parent may still have legal custody rights.

- Child Support Orders: Non-custodial parents are often required to pay child support, which is calculated based on their income and the needs of the child.

It’s essential to recognize that being a non-custodial parent doesn’t diminish your role in your child’s life. You still have rights and responsibilities, and understanding these can help you navigate the complexities of child support.

Situations Warranting Retroactive Payments

Have you ever wondered when retroactive child support payments come into play? In Colorado, there are specific situations that can lead to the need for retroactive payments. These payments are typically sought when a non-custodial parent has failed to pay child support for a period of time, often due to various circumstances.

Some common situations that may warrant retroactive payments include:

- Change in Custody: If custody arrangements change and the non-custodial parent has not been paying support, the custodial parent may seek retroactive payments.

- Initial Support Orders: Sometimes, a court may issue a child support order after a significant delay, leading to the need for retroactive payments to cover the period before the order was established.

- Income Changes: If a non-custodial parent experiences a significant change in income, it may affect their ability to pay support, prompting a review of past payments.

Understanding these situations can help you prepare for potential legal actions regarding child support. If you find yourself in a position where retroactive payments are necessary, it’s wise to consult with a legal expert to navigate the process effectively.

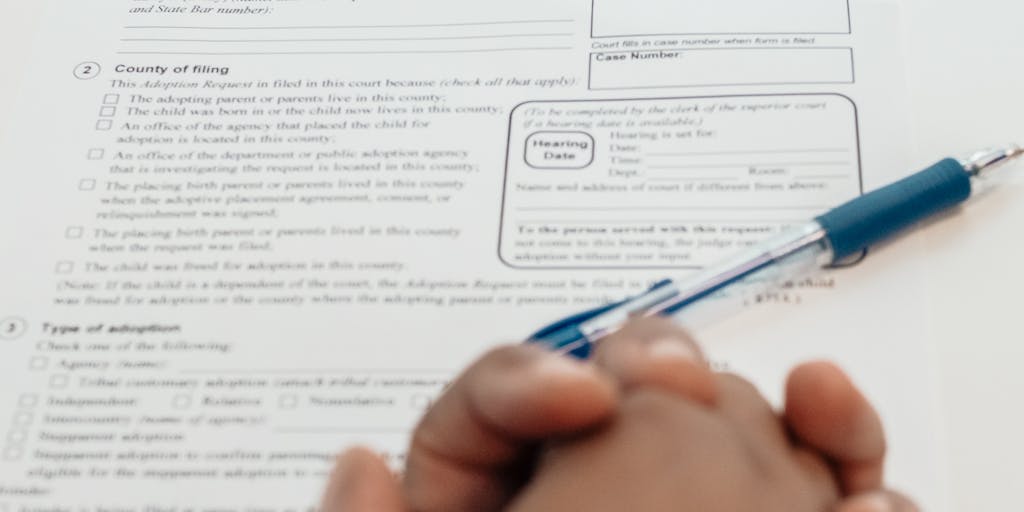

Legal Process for Obtaining Retroactive Child Support Orders

So, how do you go about obtaining retroactive child support orders in Colorado? The legal process can seem daunting, but breaking it down into manageable steps can make it easier to understand. First, it’s important to gather all necessary documentation, including proof of income, previous support agreements, and any communication regarding child support.

The process typically involves the following steps:

- Filing a Motion: The custodial parent must file a motion with the court requesting retroactive child support. This motion should clearly outline the reasons for the request and include supporting evidence.

- Serving the Non-Custodial Parent: Once the motion is filed, it must be served to the non-custodial parent, ensuring they are aware of the proceedings.

- Court Hearing: A court hearing will be scheduled where both parents can present their cases. It’s crucial to be prepared with all relevant documentation and possibly witness testimonies.

- Judgment: After reviewing the evidence, the court will issue a judgment regarding the retroactive support owed. This judgment will specify the amount and the time frame for which support is owed.

Throughout this process, it’s beneficial to have legal representation to ensure your rights are protected and to navigate any complexities that may arise. Remember, the goal is to ensure that the child’s needs are met, and understanding the legal framework can help you achieve that.

Understanding the legal implications of back child support in Colorado can be daunting, especially when it comes to the potential for felony charges. If you’re navigating this complex landscape, you might be wondering: how much back child support can lead to criminal charges? Let’s break it down together.

Implications of Retroactive Child Support

Retroactive child support refers to payments that are owed for periods prior to a court order being established. In Colorado, the law allows for retroactive support to be awarded, which can sometimes lead to significant financial obligations for the non-custodial parent. But what does this mean for you?

If you find yourself in a situation where you owe back child support, it’s crucial to understand that the amount can accumulate quickly. For instance, if a court determines that you owe several months or even years of support, the total can reach thousands of dollars. In Colorado, failure to pay child support can lead to serious consequences, including the possibility of felony charges if the amount owed exceeds a certain threshold.

In Colorado, if you owe more than $10,000 in back child support, you could potentially face felony charges. This is a significant amount, and it’s essential to be proactive in addressing any arrears to avoid legal repercussions. Have you ever thought about how this could impact your life and your relationship with your children?

Necessary Documentation and Filings

When dealing with back child support, proper documentation is key. You’ll need to gather all relevant financial records, including pay stubs, tax returns, and any previous court orders regarding child support. This documentation will not only help you understand your obligations but also assist in any legal proceedings.

Filing for a modification of child support can also be necessary if your financial situation has changed. For example, if you’ve lost your job or experienced a significant decrease in income, you may be eligible to have your support payments adjusted. It’s important to file these modifications with the court promptly to avoid accruing additional back support.

Have you considered reaching out to a legal professional to help navigate these filings? They can provide invaluable assistance in ensuring that all necessary documents are submitted correctly and on time.

Court Considerations for Approval

When a court reviews a case involving back child support, several factors come into play. The judge will consider your financial situation, the needs of the child, and any previous payment history. It’s not just about the numbers; the court will also look at your willingness to comply with support obligations.

For instance, if you’ve made efforts to pay what you can, even if it’s not the full amount, this can positively influence the court’s decision. On the other hand, a history of non-payment or evasion can lead to harsher penalties, including the potential for felony charges.

It’s essential to approach the court with a clear understanding of your situation and a plan for how you intend to address any back support owed. Have you thought about how presenting your case effectively could change the outcome?

Tips For Navigating Child Support and Custody Disputes Legally

When it comes to child support and custody disputes, the emotional stakes can be incredibly high. You might be feeling overwhelmed, unsure of your rights, or even fearful of the potential consequences of not meeting your obligations. So, how can you navigate this complex landscape effectively? Here are some practical tips to help you through the process.

- Understand Your Obligations: Familiarize yourself with Colorado’s child support guidelines. Knowing how support amounts are calculated can empower you to advocate for yourself and your children.

- Document Everything: Keep meticulous records of all communications, payments, and agreements. This documentation can be invaluable if disputes arise.

- Seek Legal Advice: Consulting with a family law attorney can provide clarity on your situation. They can help you understand the legal precedents and limitations in Colorado, ensuring you’re well-informed.

- Communicate Openly: If possible, maintain open lines of communication with the other parent. This can help prevent misunderstandings and foster a cooperative co-parenting relationship.

- Consider Mediation: Mediation can be a less adversarial way to resolve disputes. It allows both parties to discuss their concerns and work towards a mutually beneficial agreement.

- Stay Informed: Laws can change, so staying updated on any modifications to child support laws in Colorado is crucial. Resources like Best YouTube Marketing Agencies can provide insights into how to navigate these changes.

By following these tips, you can approach child support and custody disputes with greater confidence and clarity, ensuring that you’re doing what’s best for your children while also protecting your rights.

Financial Impacts on Both Parents

Child support is not just a legal obligation; it has significant financial implications for both parents involved. Have you ever considered how these payments affect your day-to-day life? For the custodial parent, child support can be a lifeline, providing essential resources for housing, food, and education. However, for the non-custodial parent, the financial burden can feel overwhelming, especially if they are already facing economic challenges.

In Colorado, failing to pay child support can lead to serious consequences, including the possibility of felony charges if the amount owed exceeds a certain threshold. This can create a cycle of financial strain, where the inability to pay leads to legal repercussions, which in turn makes it even harder to meet obligations. It’s a tough situation that many parents find themselves in.

Moreover, the emotional toll of these financial obligations can’t be overlooked. Parents often feel guilt or shame about their financial situations, which can affect their relationships with their children. It’s essential to recognize that seeking help, whether through legal channels or financial counseling, is a proactive step towards breaking this cycle.

Legal Precedents and Limitations in Colorado

Understanding the legal landscape surrounding child support in Colorado is crucial for any parent navigating these waters. Did you know that Colorado has specific laws that dictate how child support is calculated and enforced? These laws are designed to ensure that both parents contribute to the upbringing of their children, but they also come with limitations.

For instance, Colorado law stipulates that if a non-custodial parent fails to pay child support, they can face various penalties, including wage garnishment, tax refund interception, and even jail time for severe cases. In fact, if the back child support owed exceeds $10,000, it can be classified as a felony. This legal precedent serves as a stark reminder of the importance of meeting your obligations.

However, it’s also important to note that there are avenues for modification of child support orders. If your financial situation changes—whether due to job loss, medical emergencies, or other unforeseen circumstances—you can petition the court for a modification. This flexibility is crucial, as it acknowledges that life can be unpredictable.

In conclusion, navigating child support in Colorado requires a solid understanding of both your rights and responsibilities. By staying informed and proactive, you can better manage the financial and emotional impacts of child support obligations.

Conclusion

Understanding the implications of back child support in Colorado is crucial for anyone navigating the complexities of family law. If you find yourself in a situation where you owe back child support, it’s essential to recognize that the consequences can be severe, potentially leading to felony charges if the amount is significant. This reality can feel overwhelming, but it’s important to remember that there are resources and legal avenues available to help you manage your obligations. Seeking guidance from a knowledgeable attorney can provide clarity and support as you work through these challenges.

Ultimately, the goal is to ensure that children receive the support they need while also allowing parents to fulfill their responsibilities without facing undue hardship. By staying informed and proactive, you can navigate this difficult landscape more effectively.

FAQs

Many people have questions about back child support and its legal ramifications. Here are some common inquiries that might resonate with you:

- What constitutes back child support? Back child support refers to payments that a parent has failed to make, accumulating over time. In Colorado, if these payments reach a certain threshold, they can lead to serious legal consequences.

- How is the felony threshold determined? In Colorado, if the amount of back child support owed exceeds $2,000, it can be classified as a felony. This is a significant amount, and it’s crucial to address any arrears before they escalate.

- What are the penalties for felony child support? Penalties can include jail time, fines, and a permanent criminal record, which can affect employment opportunities and other aspects of life.

- Can I modify my child support payments? Yes, if your financial situation changes, you can petition the court for a modification of your child support order. It’s advisable to consult with a legal expert to navigate this process effectively.

- What should I do if I can’t pay my child support? If you’re struggling to make payments, it’s important to communicate with the other parent and seek legal advice. Ignoring the issue can lead to more severe consequences.

Find a County Child Support Office

If you need assistance with child support issues, locating your local county child support office is a great first step. These offices can provide resources, guidance, and support tailored to your specific situation. You can find your county’s office by visiting the Colorado Department of Human Services website or by contacting them directly. They can help you understand your rights and responsibilities, as well as provide information on how to manage any back child support obligations you may have.

Remember, you’re not alone in this journey. Many parents face similar challenges, and there are professionals ready to help you navigate the complexities of child support law. Whether you’re looking for legal representation or just need some advice, reaching out to your local office can be a valuable step forward.

What Should You Do if You Are Behind on Child Support Payments?

Finding yourself behind on child support payments can be a daunting experience, filled with anxiety about potential legal repercussions and the impact on your relationship with your child. The first step is to acknowledge the situation and take proactive measures. Ignoring the problem will only exacerbate it.

One of the most effective actions you can take is to communicate openly with the other parent. Discussing your circumstances can sometimes lead to a mutual understanding or temporary arrangements that can ease the financial burden. Have you considered how a simple conversation might change the dynamics?

Additionally, it’s crucial to understand your legal options. In Colorado, you can request a modification of your child support order if your financial situation has changed significantly. This could be due to job loss, medical emergencies, or other unforeseen circumstances. By formally requesting a modification, you can potentially lower your payments to a more manageable level.

Requesting a Modification of Child Support

When you decide to request a modification, it’s essential to gather all relevant documentation that supports your case. This includes proof of income, expenses, and any changes in your financial situation. The court will consider these factors when determining whether to adjust your child support obligations.

Filing for a modification is not just about presenting your case; it’s also about timing. If you wait too long, you may find yourself facing penalties or even legal action for non-payment. It’s wise to act quickly and consult with a legal professional who can guide you through the process. Have you thought about reaching out to a lawyer who specializes in family law?

Moreover, staying informed about your rights and responsibilities can empower you to make better decisions. Resources like best live chat for lawyer websites can provide immediate assistance and connect you with professionals who can help clarify your situation.

Will You Lose Custody Due to Missed Child Support Payments in Colorado?

One of the most pressing concerns for parents who fall behind on child support is the fear of losing custody of their children. It’s a valid worry, as courts often consider a parent’s financial responsibility when determining custody arrangements. However, it’s important to understand that missing child support payments alone does not automatically result in losing custody.

In Colorado, the courts prioritize the best interests of the child. While consistent child support payments are a factor in custody decisions, they are not the sole determinant. If you can demonstrate that you are actively involved in your child’s life and are making efforts to fulfill your financial obligations, this can positively influence custody outcomes.

It’s also worth noting that if you are facing challenges in making payments, the court may take that into account, especially if you can show that you are taking steps to rectify the situation. Have you considered how your involvement in your child’s life can be a strong argument in your favor?

Ultimately, the key is to remain engaged and proactive. If you find yourself in a difficult financial situation, seek legal advice to understand your options and rights. Resources like best Amazon marketing agencies can also provide insights into financial management that may help you stabilize your situation.

What Happens if You Fail to Pay Child Support in Colorado?

Failing to pay child support in Colorado can lead to serious consequences, both legally and personally. You might wonder, what exactly happens if you find yourself unable to meet your child support obligations? The repercussions can range from financial penalties to potential jail time, depending on the circumstances surrounding your case.

In Colorado, child support is not just a suggestion; it’s a legal obligation. When a court orders child support, it expects compliance. If you fall behind on payments, the state can take various actions to enforce the order. For instance, they may garnish your wages, intercept your tax refunds, or even suspend your driver’s license. These measures can feel overwhelming, but they are designed to ensure that children receive the financial support they need.

Moreover, if you consistently fail to pay child support, you could face contempt of court charges. This is a serious matter that can escalate quickly, leading to further legal troubles. Understanding the implications of non-payment is crucial, especially if you’re navigating financial difficulties. Have you considered how these consequences might affect your relationship with your child or your ability to find employment?

Contempt of Court Charges

Contempt of court charges arise when an individual willfully disobeys a court order, and in the context of child support, this can be particularly severe. If you are found in contempt for failing to pay child support, the court may impose fines or even jail time. This is not just a slap on the wrist; it’s a serious legal issue that can have lasting effects on your life.

Imagine being summoned to court, facing a judge who is reviewing your payment history. The judge may ask probing questions about your financial situation, and if they determine that you have the means to pay but are choosing not to, the consequences can be dire. You might be thinking, “What if I genuinely can’t afford to pay?” In such cases, it’s essential to communicate with the court and seek a modification of your support order rather than simply ignoring it.

Many people find themselves in difficult financial situations, and it’s important to remember that the court can be understanding if you approach the situation proactively. Seeking legal advice can help you navigate these waters more effectively. If you’re interested in learning more about how to manage your financial obligations, you might find resources on best Facebook advertising agencies helpful, as they can provide insights into improving your financial situation through better marketing strategies.

Ultimately, understanding the legal landscape surrounding child support in Colorado is crucial. It’s not just about the money; it’s about ensuring that children receive the support they need to thrive. Have you thought about how your actions today can impact your future and your child’s future? Taking responsibility and seeking help can make a significant difference.