When it comes to digital marketing, finding the right agency can feel overwhelming. With so many options available, how do you know which one will truly deliver results? That’s where Voy Media comes into play. In this article, we’ll dive into what Voy Media is all about, explore its offerings, and share insights from various reviews to help you make an informed decision.

About Voy Media

Founded with a mission to help brands grow through effective digital marketing strategies, Voy Media has carved a niche for itself in the competitive landscape of advertising agencies. Based in New York, this agency specializes in social media marketing, particularly on platforms like Facebook and Instagram. But what sets them apart? Their focus on data-driven strategies and personalized service is a significant draw for many businesses.

Have you ever felt like your marketing efforts are falling flat? Voy Media aims to change that narrative by tailoring their approach to meet the unique needs of each client. They understand that no two businesses are alike, and their strategies reflect that understanding.

Voy Media Overview

So, what can you expect when working with Voy Media? Their services encompass a wide range of digital marketing solutions, including:

- Social Media Advertising: They create targeted ad campaigns that resonate with your audience, ensuring that your message reaches the right people.

- Creative Services: From eye-catching graphics to compelling copy, Voy Media emphasizes creativity to capture attention and drive engagement.

- Analytics and Reporting: They provide detailed insights into campaign performance, allowing you to see what’s working and where adjustments are needed.

- Consultation Services: If you’re unsure where to start, their team offers consultations to help you develop a comprehensive marketing strategy.

Many clients have shared their experiences with Voy Media on platforms like Yelp and Trustpilot, highlighting the agency’s commitment to transparency and results. For instance, one client noted how Voy Media helped them increase their ROI significantly within just a few months of launching their campaigns.

Moreover, if you’re curious about how Voy Media stacks up against other agencies, you might want to check out reviews on SiteJabber. Many users appreciate the personalized attention they receive, which is often a game-changer in the world of digital marketing.

In conclusion, if you’re looking for a marketing partner that prioritizes your business goals and leverages data to drive success, Voy Media could be a great fit. Their focus on social media advertising, combined with a commitment to creative excellence and analytical rigor, makes them a noteworthy contender in the digital marketing space. For those interested in exploring more about effective marketing strategies, consider checking out our articles on Instagram advertising or digital marketing podcasts for additional insights.

When it comes to digital marketing, finding the right agency can feel like searching for a needle in a haystack. With so many options available, how do you know which one will truly deliver results? One agency that has been making waves in the industry is Voy Media. In this article, we’ll dive into Voy Media’s clients, services, and pricing to help you determine if they might be the right fit for your marketing needs.

Voy Media’s Clients

Understanding who an agency works with can provide valuable insights into its capabilities and expertise. Voy Media has built a diverse portfolio, serving clients across various industries. From startups to established brands, their clientele includes businesses looking to enhance their online presence and drive sales through effective marketing strategies.

For instance, Voy Media has partnered with e-commerce brands, tech startups, and even local businesses. This variety showcases their adaptability and ability to tailor strategies to meet different client needs. Have you ever wondered how a marketing agency can cater to such a wide range of clients? It often comes down to their understanding of market trends and consumer behavior, which Voy Media seems to excel at.

Many clients have praised Voy Media for their personalized approach and commitment to achieving results. You can find detailed reviews and testimonials on platforms like Voy Media’s official site and Glassdoor, where former and current clients share their experiences.

Voy Media’s Services and Specialties

What exactly does Voy Media offer? Their services are designed to cover a broad spectrum of digital marketing needs, making them a one-stop shop for many businesses. They specialize in areas such as:

- Social Media Advertising: With platforms like Facebook and Instagram dominating the digital landscape, Voy Media helps brands create targeted ad campaigns that resonate with their audience.

- Content Marketing: They understand that content is king. By crafting engaging and relevant content, they help brands tell their stories and connect with customers on a deeper level.

- Search Engine Optimization (SEO): Ensuring that your website ranks well on search engines is crucial. Voy Media employs SEO strategies that enhance visibility and drive organic traffic.

- Email Marketing: They also focus on building relationships through email campaigns that nurture leads and convert them into loyal customers.

Each of these services is tailored to meet the unique needs of their clients, which is a significant factor in their success. Have you ever thought about how a well-executed social media campaign can transform a brand’s image? Voy Media’s expertise in this area is evident in the results they achieve for their clients.

For those interested in exploring more about their offerings, you can check out their profile on UpCity or read reviews on Capterra.

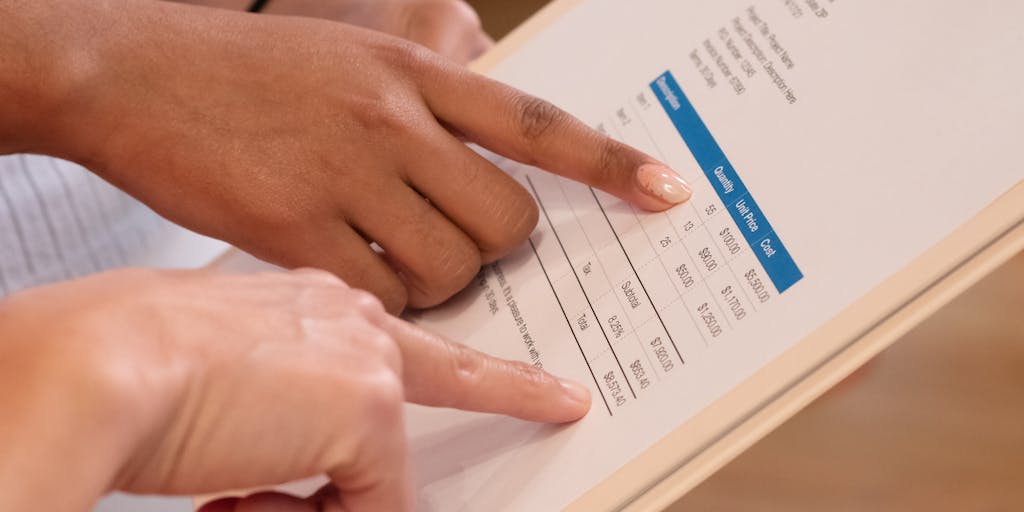

Pricing at Voy Media

When considering a marketing agency, pricing is often a key factor. Voy Media offers various pricing models depending on the services you choose and the scale of your project. While specific figures can vary, they typically provide packages that cater to different budgets and needs.

For example, smaller businesses might opt for basic social media management services, while larger enterprises may require comprehensive marketing strategies that include multiple services. It’s essential to have a conversation with their team to understand what package aligns best with your goals and budget.

Have you ever felt overwhelmed by pricing structures in the marketing world? It’s common to feel that way, but Voy Media aims to provide clarity and transparency in their pricing, ensuring you know exactly what you’re investing in.

In conclusion, Voy Media stands out as a versatile agency with a proven track record of helping clients achieve their marketing goals. Whether you’re a small business or a large corporation, their tailored services and client-focused approach could be just what you need to elevate your brand. If you’re curious to learn more, don’t hesitate to reach out to them for a consultation!

Voy Media Reviews

When it comes to digital marketing, finding the right agency can feel overwhelming. With so many options available, how do you know which one will truly deliver results? That’s where Voy Media comes into play. This agency has garnered attention for its innovative approach to social media marketing, particularly on platforms like Facebook and Instagram. But what do real users think about their services? Let’s dive into some reviews and insights.

Services We Provide

Voy Media offers a range of services designed to help businesses grow their online presence. Their primary focus is on social media advertising, but they also provide:

- Creative Strategy: Tailored marketing strategies that resonate with your target audience.

- Ad Management: Comprehensive management of your ad campaigns to optimize performance.

- Analytics and Reporting: In-depth analysis of campaign performance to inform future strategies.

- Content Creation: Engaging content that captures attention and drives engagement.

- Consultation Services: Expert advice to help you navigate the complexities of digital marketing.

These services are designed to cater to businesses of all sizes, ensuring that whether you’re a startup or an established brand, you can find value in what Voy Media offers.

Pros

One of the standout features of Voy Media is their commitment to transparency and communication. Clients often praise the agency for its:

- Personalized Approach: Many reviews highlight how Voy Media takes the time to understand each client’s unique needs and goals. This tailored approach can lead to more effective campaigns.

- Expert Team: Users frequently mention the expertise of the team members, noting their knowledge of the latest trends and best practices in digital marketing.

- Results-Driven Strategies: Clients report seeing tangible results from their campaigns, including increased engagement and higher conversion rates.

- Supportive Environment: Employees have shared positive experiences on platforms like Glassdoor, indicating a healthy workplace culture that fosters growth and collaboration.

These pros contribute to a positive overall impression of Voy Media, making it a compelling choice for businesses looking to enhance their digital marketing efforts.

For those interested in seeing Voy Media’s work in action, you might want to check out their YouTube playlist, which showcases various campaigns and strategies they’ve implemented.

In conclusion, if you’re considering partnering with a marketing agency, Voy Media’s reviews suggest they could be a strong contender. Their focus on personalized service, expert knowledge, and proven results makes them a noteworthy option in the crowded digital marketing landscape. Whether you’re looking for help with social media or broader marketing strategies, they seem well-equipped to assist you on your journey.

Cons

When considering any marketing agency, it’s essential to weigh the pros and cons. With Voy Media, there are a few drawbacks that potential clients should keep in mind. One common concern is the pricing structure. Some users have reported that the costs can escalate quickly, especially for small businesses or startups with limited budgets. This can lead to a feeling of being overwhelmed, particularly if the return on investment isn’t immediately clear.

Another point of contention is the level of customer service. While many clients have praised the agency for its innovative strategies, others have expressed frustration with communication delays or a lack of personalized attention. It’s crucial to have a responsive team, especially when navigating the fast-paced world of digital marketing.

Lastly, some users have noted that the results can vary significantly based on the industry and target audience. What works for one business may not yield the same success for another, which can be disheartening for those expecting uniform results.

Voy Media Reviews – Paw.com

Paw.com, a pet care service, turned to Voy Media to enhance its online presence and drive customer engagement. The collaboration aimed to leverage social media advertising to reach pet owners effectively. Initial reviews from Paw.com highlighted the agency’s creative approach to ad design and targeting. They appreciated how Voy Media tailored campaigns to resonate with pet lovers, using engaging visuals and relatable messaging.

However, as the campaign progressed, some challenges emerged. While the ads generated significant traffic, the conversion rates did not meet expectations. Paw.com’s team noted that while the engagement was high, translating that into actual sales proved more difficult. This experience underscores the importance of aligning marketing strategies with specific business goals. For those interested in exploring similar marketing strategies, you might find insights in articles about Best YouTube Marketing Agencies or Best Pinterest Marketing Agencies.

Voy Media Reviews – Trinity Hills Co

Trinity Hills Co, a wellness brand, sought Voy Media’s expertise to boost its digital footprint. The initial feedback from their collaboration was largely positive, with many praising the agency’s ability to create compelling content that resonated with their target audience. The campaigns were designed to highlight the brand’s unique offerings, and many customers reported feeling more connected to the brand as a result.

However, as with any partnership, there were areas for improvement. Some reviews indicated that while the creative aspects were strong, the analytical side of the campaigns could have been more robust. Clients expressed a desire for deeper insights into campaign performance, which could help refine future strategies. This highlights a common theme in marketing: the balance between creativity and data-driven decision-making. If you’re curious about how other brands have navigated similar challenges, consider checking out resources on Best Amazon Marketing Agencies or Best Twitter Marketing Agencies.

Voy Media Reviews 2020 – From $2K to $800K in Monthly Profit

Have you ever wondered how some businesses skyrocket their profits seemingly overnight? In 2020, Voy Media emerged as a game-changer for many brands, transforming their advertising strategies and leading them from modest beginnings to impressive monthly profits. Imagine starting with just $2,000 and scaling up to $800,000 in profit—sounds incredible, right?

Voy Media specializes in Facebook advertising, and their approach is both innovative and data-driven. They focus on creating tailored ad campaigns that resonate with target audiences, leveraging advanced analytics to optimize performance. For instance, one client shared their journey of working with Voy Media, highlighting how the team’s expertise in audience segmentation and creative ad design played a pivotal role in their success.

What sets Voy Media apart is their commitment to transparency and education. They don’t just run ads; they empower clients by sharing insights and strategies that can be applied long after the campaign ends. This approach not only builds trust but also fosters a collaborative environment where businesses feel supported in their growth journey.

For those curious about the tangible results, you can check out a detailed case study on their YouTube channel, showcasing real-life transformations and testimonials from satisfied clients. Watching these success stories unfold can be incredibly motivating, especially if you’re considering a similar path for your business. You can view it here.

In summary, Voy Media’s ability to turn small investments into substantial profits is a testament to their expertise in digital marketing. If you’re looking to elevate your advertising game, they might just be the partner you need.

Voy Media FAQ

As you explore the world of digital marketing, you might have some burning questions about Voy Media. Let’s tackle some of the most frequently asked questions to help you understand what they offer and how they can benefit your business.

What services does Voy Media provide?

Voy Media primarily focuses on Facebook advertising, but they also offer services in Instagram ads, creative design, and analytics. Their holistic approach ensures that every aspect of your campaign is optimized for success.

How does Voy Media measure success?

Success is measured through various metrics, including return on ad spend (ROAS), engagement rates, and conversion rates. They provide detailed reports that help clients understand the effectiveness of their campaigns.

Is Voy Media suitable for small businesses?

Absolutely! Voy Media has a track record of helping small businesses grow. Their strategies are designed to be scalable, meaning they can adapt to your budget and goals.

What makes Voy Media different from other agencies?

Their focus on education and transparency sets them apart. They believe in empowering clients with knowledge, ensuring that you understand the strategies being implemented and the results they yield.

Work at Voy Media? Share your experiences

If you’ve had the opportunity to work at Voy Media, your insights could be invaluable to others considering a career there. What was your experience like? Did you find the work environment collaborative and supportive? Sharing your story can help potential employees gauge whether Voy Media aligns with their career aspirations.

Many former employees have praised the company culture, highlighting the emphasis on creativity and innovation. The team often collaborates on projects, fostering a sense of community and shared purpose. If you enjoyed working on diverse campaigns and appreciated the chance to learn from industry experts, your perspective could inspire others to join the team.

Moreover, discussing the challenges you faced and how you overcame them can provide a realistic view of what it’s like to work in a fast-paced digital marketing environment. Whether it’s the thrill of launching a successful ad campaign or the learning curve of mastering new tools, your experiences can resonate with those looking to make a similar leap.

In conclusion, whether you’re a business owner looking to scale or a professional considering a career at Voy Media, the stories and insights shared by others can be incredibly enlightening. Let’s keep the conversation going and learn from each other’s journeys in the dynamic world of digital marketing!

Similar businesses you may also like

If you’re exploring options for marketing and advertising services, you might be curious about alternatives to Voy Media. There are several businesses that offer similar services, each with its unique strengths and specialties. For instance, Best Facebook Advertising Agencies can help you tap into the vast audience on Facebook, leveraging targeted ads to reach potential customers effectively. Similarly, if you’re looking to engage a younger demographic, the Best Snapchat Marketing Agencies can provide innovative strategies tailored for that platform.

Another option to consider is the Best Mobile Advertising Agencies, which focus on reaching users through mobile devices, an increasingly important channel in today’s digital landscape. If your business requires real-time customer interaction, exploring the Best Live Chat for Lawyer Websites could enhance your customer service and engagement efforts. Each of these businesses brings something different to the table, so it’s worth taking the time to evaluate which aligns best with your goals.

Sitejabber for Business

Have you ever wondered how customer reviews can impact your business? Sitejabber for Business is a platform that allows companies to manage their online reputation effectively. By collecting and showcasing customer feedback, businesses can build trust and credibility with potential clients. This is particularly important in the digital age, where consumers often rely on reviews before making purchasing decisions.

Using Sitejabber, businesses can respond to reviews, gain insights into customer satisfaction, and even resolve issues proactively. This not only helps in improving service but also enhances customer loyalty. Imagine a potential client reading glowing reviews about your business on Sitejabber; it could be the deciding factor that leads them to choose your services over a competitor’s. In a world where word-of-mouth is amplified through online platforms, leveraging tools like Sitejabber can be a game-changer for your brand.

Ratings by Category

When evaluating marketing agencies like Voy Media, it’s essential to consider ratings by category. Different agencies may excel in various aspects such as customer service, pricing, or effectiveness of campaigns. For instance, some agencies might receive high marks for their innovative strategies, while others may be praised for their customer support.

Understanding these ratings can help you make an informed decision. Are you looking for an agency that specializes in social media marketing? Or perhaps one that has a strong track record in SEO? By examining ratings across categories, you can pinpoint which agency aligns best with your specific needs. This approach not only saves you time but also ensures that you partner with a business that can truly deliver on its promises.

When it comes to digital marketing, finding the right agency can feel overwhelming. With so many options available, how do you know which one will truly deliver results? Voy Media has emerged as a notable player in the field, but what do the reviews say? Let’s dive into the insights and experiences shared by clients and industry experts alike.

Ratings Distribution

Understanding the ratings distribution for Voy Media can provide a clearer picture of their performance and client satisfaction. Generally, ratings are categorized into several tiers, reflecting the diverse experiences of clients. Here’s a breakdown of what you might find:

- 5 Stars: Many clients rave about the personalized service and effective strategies that Voy Media employs. They often highlight the agency’s ability to adapt campaigns based on real-time data, which leads to impressive ROI.

- 4 Stars: While most clients are satisfied, some mention minor issues, such as communication delays or specific campaign adjustments that took longer than expected. However, these clients still appreciate the overall results.

- 3 Stars and Below: A few reviews express dissatisfaction, often citing unmet expectations or a mismatch in service offerings. It’s important to consider these reviews in context, as they may reflect individual circumstances rather than the agency’s overall capabilities.

Overall, the ratings suggest that Voy Media is generally well-regarded, with a strong emphasis on client relationships and results-driven strategies.

Have a question? Ask to get answers from the Voy Media staff and other customers.

If you’re contemplating whether Voy Media is the right fit for your business, you might have questions that need answering. Engaging with the community can be incredibly beneficial. Many potential clients find that asking questions in forums or directly on review platforms can yield valuable insights. You might wonder:

- What specific services does Voy Media excel in?

- How responsive is their customer service?

- Can they provide case studies or examples of successful campaigns?

By reaching out, you not only gain clarity but also connect with others who have navigated similar decisions. This dialogue can help you feel more confident in your choice. If you’re interested in exploring more about Voy Media, you can check out Voy Media Reviews for a comprehensive overview.

5.0 | 26 verified reviews |

When it comes to choosing a marketing agency, the numbers often speak volumes. A perfect score of 5.0 from 26 verified reviews is not just impressive; it’s a testament to the quality and effectiveness of the services provided by Voy Media. But what does this score really mean for you as a potential client?

Imagine walking into a restaurant that boasts a flawless rating. You’d expect exceptional service and delicious food, right? The same principle applies here. Voy Media’s stellar reviews suggest that they consistently deliver results that meet or exceed client expectations. But let’s dig deeper into what these reviews reveal about their approach and effectiveness.

Clients often highlight the agency’s personalized service and attention to detail. For instance, one reviewer might share how Voy Media took the time to understand their unique business needs, crafting tailored strategies that led to significant growth. This level of customization is crucial in today’s competitive landscape, where a one-size-fits-all approach simply doesn’t cut it.

Moreover, many reviews emphasize the agency’s expertise in digital marketing, particularly in areas like social media advertising and Google Ads. If you’re curious about how they stack up against other agencies, you might find it helpful to check out articles like Best Google Adwords Advertising Agencies for a broader perspective.

Another common theme in the reviews is the agency’s commitment to transparency and communication. Clients appreciate being kept in the loop about campaign progress and performance metrics. This open dialogue not only builds trust but also allows for adjustments to be made in real-time, ensuring that marketing efforts remain aligned with business goals.

It’s also worth noting that Voy Media has garnered attention for its innovative strategies. In a world where digital marketing trends evolve rapidly, staying ahead of the curve is essential. Clients often mention how Voy Media’s forward-thinking approach has helped them leverage new platforms and technologies effectively.

In conclusion, a perfect score of 5.0 from 26 verified reviews is more than just a number; it reflects a commitment to excellence and client satisfaction. If you’re considering partnering with a marketing agency, Voy Media’s track record suggests they could be a strong contender. For those interested in exploring similar agencies, you might want to read about Mutesix Reviews to compare experiences and outcomes.