When it comes to the financial responsibilities of parenthood, many veterans wonder how their benefits, particularly VA disability payments, factor into child support obligations. This topic can be complex, but understanding the nuances can help you navigate your responsibilities and rights effectively.

Disabled Veterans and Child Support Obligations

For disabled veterans, the question of child support can be particularly pressing. Many veterans rely on their VA disability benefits as a primary source of income, and the thought of having those benefits garnished for child support can be daunting. It’s essential to recognize that while VA disability benefits are designed to support veterans and their families, they can also be subject to legal obligations like child support.

In many states, child support is calculated based on the income of both parents. This includes various forms of income, and VA disability benefits can be included in this calculation. However, the specifics can vary significantly depending on state laws and individual circumstances. For instance, some states may have provisions that protect a portion of VA benefits from being garnished for child support, while others may not.

If you’re a veteran facing child support obligations, it’s crucial to consult with a legal expert who understands both family law and veterans’ benefits. Resources like Texas Law Help provide valuable insights into how these obligations are handled.

Does VA Disability count as income when calculating child support payments?

The short answer is: it can, but it depends on where you live. In many jurisdictions, VA disability payments are considered income for the purposes of calculating child support. This means that if you are receiving VA benefits, they may be factored into the total income used to determine how much child support you owe.

However, there are exceptions. Some states have laws that specifically exclude VA disability benefits from being counted as income, recognizing the unique nature of these benefits. For example, in Texas, certain protections exist that may prevent the garnishment of VA benefits for child support, as outlined in Texas Law Help.

It’s also worth noting that the courts typically aim to ensure that child support payments are fair and reasonable, taking into account the financial situation of both parents. If you believe that including your VA disability benefits in the child support calculation is unjust, you may have grounds to contest this in court. Seeking advice from a knowledgeable attorney can help you understand your options and rights.

Ultimately, navigating child support as a disabled veteran can be challenging, but you are not alone. Many resources are available to help you understand your obligations and rights, including organizations dedicated to supporting veterans. For more detailed information, you might find it helpful to explore resources like Law for Veterans or Hill and Ponton.

Veterans Benefits and Child Support

When it comes to the intersection of veterans benefits and child support, many veterans find themselves navigating a complex landscape. Understanding how these benefits can be affected by child support obligations is crucial for those who rely on them. Have you ever wondered how your VA disability benefits might impact your responsibilities as a parent? Let’s dive into this important topic.

Can veteran benefits be taken away to pay child support?

The short answer is yes, veteran benefits can be subject to garnishment for child support. According to various legal resources, including Stateside Legal, child support obligations can lead to a portion of VA benefits being withheld. This is particularly relevant for veterans who may be facing financial difficulties while trying to meet their child support commitments.

However, it’s essential to note that the process is not as straightforward as it might seem. The law protects certain benefits from being garnished, but child support is often an exception. For instance, if a veteran is receiving VA disability compensation, a court may order that a portion of these benefits be allocated to child support payments. This can be a source of stress for many veterans, especially if they are already struggling financially.

If veteran benefits are an individual’s only source of income, does a person still have to pay child support?

This question often arises among veterans who rely solely on their VA benefits for financial support. The answer is nuanced. While the law does allow for child support to be taken from VA benefits, courts typically consider the veteran’s financial situation when determining the amount of support owed. If your VA benefits are your only source of income, it’s crucial to communicate this to the court.

In many cases, courts aim to balance the needs of the child with the financial realities of the parent. If you find yourself in this situation, seeking legal advice can be invaluable. Resources like Disabled Vets provide insights into how these situations are handled and what options may be available to you.

Moreover, if you’re facing challenges with child support payments, it’s worth exploring options for modification. Courts can adjust child support obligations based on changes in income, which can be particularly relevant for veterans whose financial situations may fluctuate.

Ultimately, understanding your rights and responsibilities regarding child support and VA benefits is essential. Engaging with legal professionals who specialize in veterans’ issues can help you navigate these waters more effectively. Remember, you’re not alone in this journey, and there are resources available to support you.

Can veteran benefits be garnished like a regular paycheck to pay child support?

When it comes to child support, many people wonder if veteran benefits can be treated like a regular paycheck. The short answer is that VA disability benefits are generally protected from garnishment for child support. This means that, unlike wages from a job, your VA benefits cannot be directly taken to satisfy child support obligations. This protection is rooted in federal law, which recognizes the importance of these benefits for veterans and their families.

However, this doesn’t mean that child support obligations are ignored. Courts can still consider VA benefits when determining a veteran’s overall financial situation. For instance, if a veteran is receiving substantial VA benefits, a court may take that into account when setting child support amounts. It’s a complex interplay, and understanding your rights and obligations is crucial. If you’re navigating this situation, you might find insights from discussions on platforms like Reddit helpful.

Can veteran benefits be garnished as non-earnings to pay child support after they are deposited into a bank account?

Once VA benefits are deposited into your bank account, the question arises: can they be garnished for child support? The answer is nuanced. While VA benefits themselves are protected from garnishment, once the funds are in your bank account, they may be subject to different rules. Generally, courts can issue orders to garnish funds from bank accounts, but they must follow specific legal procedures.

It’s important to note that the protection of VA benefits does not extend indefinitely once the money is in your account. If a court has ordered child support and you have the means to pay, they may pursue funds from your account. This is where it gets tricky; the classification of funds can come into play. If the court views the funds as part of your overall income, they might be able to access them. For a deeper understanding of how these processes work, you can refer to the VA guidelines.

If benefits cannot be garnished, can the child’s other parent still ask Veterans Affairs to send them some of the benefits?

This is a common concern among parents who are navigating the complexities of child support. While VA benefits are protected from garnishment, the child’s other parent cannot simply request that Veterans Affairs send them a portion of those benefits. However, they can petition the court to consider the veteran’s benefits when determining child support obligations. This means that while the benefits themselves cannot be taken, they can influence the amount of support that the court orders.

In some cases, the court may decide that the veteran’s financial situation, including their VA benefits, warrants a specific child support amount. This is where legal advice becomes invaluable. If you’re in a situation where child support and VA benefits intersect, consulting resources like the Military Divorce Guide can provide clarity and direction.

Ultimately, understanding the nuances of how VA benefits interact with child support can help you navigate these waters more effectively. It’s essential to stay informed and seek guidance tailored to your unique circumstances.

VA Benefits, Garnishment, and Child Support

When it comes to child support, many parents wonder how various forms of income, particularly VA benefits, are treated. Understanding the nuances of child support obligations can be complex, especially for veterans receiving disability benefits. So, can child support be taken from VA disability? The answer is not straightforward, and it often depends on specific circumstances.

VA disability benefits are generally protected from garnishment, which means that creditors cannot take these funds to satisfy debts. However, child support is a different matter. In some cases, child support obligations can be enforced through other means, even if the income source is protected. This leads us to explore how apportionment and garnishment differ in this context.

How is apportionment different from garnishment?

To grasp the implications of child support on VA benefits, it’s essential to understand the difference between apportionment and garnishment. Garnishment is a legal process where a portion of a person’s earnings is withheld to pay a debt, such as child support. This typically involves a court order directing an employer to deduct a specific amount from the employee’s paycheck.

On the other hand, apportionment refers to the division of VA benefits among multiple beneficiaries. For instance, if a veteran has dependents, the VA may apportion a portion of their benefits to support those dependents. This is not the same as garnishment, as it does not involve a court order or a creditor’s claim. Instead, it’s a decision made by the VA based on the veteran’s circumstances and the needs of their dependents.

Understanding this distinction is crucial for veterans who may be facing child support obligations. While garnishment may not apply to VA benefits, apportionment could still be a viable option for ensuring that child support is met.

If veteran benefits cannot be garnished, and are not apportioned, what options does the other parent have if I refuse to pay child support?

It’s a tough situation when one parent refuses to pay child support, especially if they are relying on VA benefits that are protected from garnishment. If you find yourself in this position, it’s important to know that the other parent has several options available to them.

- Modification of Support Orders: The other parent can petition the court for a modification of the child support order. This may involve demonstrating that the current support amount is no longer feasible due to the veteran’s financial situation.

- Contempt of Court: If a parent fails to comply with a child support order, the other parent can file a motion for contempt. This legal action can lead to penalties, including fines or even jail time for the non-compliant parent.

- State Assistance Programs: The other parent may also seek assistance from state programs designed to help custodial parents receive the support they are owed. These programs can sometimes intervene on behalf of the custodial parent.

- Negotiation and Mediation: Open communication can sometimes resolve disputes. The other parent might consider negotiating a payment plan or seeking mediation to reach an agreement that works for both parties.

Ultimately, while VA benefits may be protected from garnishment, there are still avenues available for the other parent to pursue child support. It’s essential to approach these situations with a clear understanding of the legal framework and available options.

For more insights on handling child support duties as a disabled veteran, you can check out this informative article here.

Garnishment: What does it mean?

Garnishment is a legal process that allows a creditor to collect a debt directly from a debtor’s income or assets. This often comes into play in child support cases, where a court may order a portion of a parent’s wages or benefits to be withheld to ensure that child support payments are made. Imagine a situation where a parent is struggling to meet their obligations; garnishment can serve as a safety net for the child, ensuring they receive the financial support they need.

In the context of veterans, garnishment can be particularly nuanced. For instance, if a veteran is receiving VA disability benefits, the question arises: can these benefits be garnished for child support? Understanding the implications of garnishment is crucial for both parents involved in child support cases, especially when one parent is a veteran.

Can a court consider a veteran’s VA compensation benefits as “income” when determining child support obligations?

This is a complex question that often leads to confusion. Generally, VA compensation benefits are not considered “income” in the traditional sense. Courts typically view these benefits as a form of compensation for service-related disabilities rather than a source of income that can be garnished. However, this can vary by jurisdiction and specific case circumstances.

For example, if a veteran is receiving VA compensation benefits, a court may decide that these benefits should not be included in the calculation of child support obligations. This is because the intent of VA benefits is to provide support for the veteran’s disability rather than to serve as a source of income for child support. However, it’s essential to consult with a legal expert to understand how local laws may interpret these benefits.

Can a court consider a veteran’s VA pension benefits as “income” when determining child support obligations?

VA pension benefits, unlike compensation benefits, are often treated differently in the eyes of the law. These benefits are designed to provide financial support to veterans who have limited income and are often considered a form of income. Therefore, a court may include VA pension benefits when calculating child support obligations.

For instance, if a veteran is receiving a VA pension, a court might view this as a regular income stream, which could be subject to garnishment for child support payments. This distinction is crucial for veterans to understand, as it can significantly impact their financial responsibilities and obligations.

Ultimately, navigating the complexities of child support and VA benefits can be challenging. It’s always wise to seek legal advice to ensure that you understand your rights and obligations fully. If you’re interested in learning more about how to manage your finances or explore marketing strategies that could help you increase your income, check out resources like Best YouTube Marketing Agencies or Best Digital Marketing Podcasts.

Can VA compensation or pension benefits be garnished to satisfy a court-ordered child support obligation?

This is a question that many veterans may find themselves grappling with, especially when financial obligations like child support come into play. The short answer is that while VA compensation and pension benefits are generally protected from garnishment, there are exceptions. In most cases, these benefits cannot be seized to satisfy child support obligations. This protection is rooted in federal law, which aims to ensure that veterans receive the financial support they need for their well-being.

However, it’s important to note that if a veteran has other sources of income or assets, those may be subject to garnishment. For instance, wages from a civilian job can be garnished to fulfill child support payments. This distinction can sometimes lead to confusion, as veterans may feel that their VA benefits should cover all financial obligations. Understanding the nuances of these laws can help veterans navigate their responsibilities more effectively.

If garnishment cannot be used to collect the child support ordered, does this mean a veteran does not have to pay the child support?

Just because garnishment isn’t an option doesn’t mean that veterans are off the hook for child support payments. The obligation to pay child support remains, regardless of the source of income. If a veteran is unable to meet their child support obligations due to financial constraints, it’s crucial to communicate with the court or the child support enforcement agency. Ignoring the obligation can lead to serious consequences, including enforcement lawsuits or even loss of custody rights.

In fact, many veterans find themselves in a difficult position where they want to support their children but feel overwhelmed by their financial situation. It’s essential to explore options such as modifying the child support order or seeking assistance from legal resources. Engaging with a family law attorney can provide clarity and help navigate the complexities of child support obligations.

So how does a veteran avoid an enforcement lawsuit if garnishment cannot be used to pay the child support?

Preventing an enforcement lawsuit is all about proactive communication and planning. If you’re a veteran facing challenges in meeting your child support payments, consider the following steps:

- Communicate with the Child Support Agency: Reach out to the agency handling your case. They may offer options for modifying your payment plan based on your current financial situation.

- Document Your Financial Situation: Keep detailed records of your income, expenses, and any changes in your financial circumstances. This documentation can be crucial when discussing modifications.

- Seek Legal Advice: Consulting with a family law attorney can provide you with tailored advice and strategies to manage your obligations without facing legal repercussions.

- Explore Alternative Income Sources: If possible, look for additional sources of income that can help you meet your child support obligations without relying solely on your VA benefits.

By taking these proactive steps, veterans can better manage their child support obligations and avoid the stress of enforcement lawsuits. Remember, the goal is to ensure that your children are supported while also taking care of your own financial health. It’s a delicate balance, but with the right approach, it’s achievable.

If a veteran later receives Social Security retirement benefits, can those be garnished for child support?

This is a question that many veterans and their families ponder, especially when navigating the complexities of child support obligations. The short answer is yes, Social Security retirement benefits can be garnished for child support. However, the process and implications can vary based on individual circumstances.

When a veteran transitions from receiving VA disability benefits to Social Security retirement benefits, the child support obligations remain intact. The law allows for garnishment of these benefits to ensure that children receive the financial support they need. It’s important to note that the amount that can be garnished is typically limited to a certain percentage of the benefits received, which is designed to protect the veteran’s ability to meet their own living expenses.

For instance, if a veteran is receiving $1,500 in Social Security retirement benefits, a court may order that a portion of this amount be allocated for child support. This garnishment is usually handled through the Social Security Administration, which will deduct the specified amount before the veteran receives their payment.

Understanding the nuances of this process can be crucial. If you find yourself in this situation, consulting with a legal expert who specializes in family law and veterans’ benefits can provide clarity and guidance tailored to your specific case.

Child Support and Veterans Benefits – FAQs

Child support and veterans benefits can be a complicated intersection, and many people have questions about how these two areas interact. Here are some frequently asked questions that can help clarify common concerns.

- Can VA disability benefits be garnished for child support? Generally, VA disability benefits are protected from garnishment for child support. However, if a veteran has other income sources, such as Social Security retirement benefits, those can be garnished.

- What happens if a veteran fails to pay child support? If a veteran fails to meet their child support obligations, they may face legal consequences, including wage garnishment or even loss of certain benefits. It’s crucial to stay informed and proactive about these responsibilities.

- Are there any exceptions to garnishment rules? Yes, certain benefits may be exempt from garnishment, and this can vary by state. It’s essential to check local laws or consult with a legal professional to understand your rights and obligations.

- How can veterans ensure they are meeting their child support obligations? Keeping open lines of communication with the other parent and regularly reviewing financial situations can help veterans stay on top of their child support responsibilities.

Frequently Asked Questions About Child Support and Veterans Benefits

As we delve deeper into the relationship between child support and veterans benefits, it’s important to address some of the most pressing questions that arise. Understanding these can help veterans navigate their obligations more effectively.

One common concern is whether veterans can modify their child support payments if their financial situation changes. The answer is yes; veterans can petition the court for a modification based on changes in income, health, or other significant life events. This is particularly relevant for veterans who may experience fluctuations in their benefits or employment status.

Another question often asked is about the impact of child support on a veteran’s ability to receive other benefits. While child support obligations can affect disposable income, they typically do not directly impact eligibility for VA benefits. However, it’s wise to consult with a financial advisor or legal expert to understand how these obligations might influence overall financial health.

In conclusion, navigating child support obligations as a veteran can be challenging, but understanding the rules and seeking appropriate guidance can make a significant difference. If you’re looking for more insights on related topics, you might find articles on Best Pinterest Marketing Agencies, Best Instagram Advertising Agencies, Best Amazon Marketing Agencies, and Best Twitter Marketing Agencies helpful in understanding how to manage your financial responsibilities effectively.

My only income is Veteran’s Benefits – do I have to pay court-ordered child support?

This is a question many veterans face when navigating the complexities of child support obligations. If your only source of income is from Veteran’s Benefits, you might wonder if you are still required to pay child support. The short answer is yes; you are still obligated to pay court-ordered child support, even if your income comes solely from VA benefits. Courts typically view child support as a legal obligation that must be fulfilled, regardless of the source of income.

However, the specifics can vary based on your situation. For instance, if your benefits are your only income and you are struggling to meet your basic needs, you may be able to petition the court for a modification of your child support order. This could involve demonstrating your financial situation and how it impacts your ability to pay. It’s essential to consult with a legal expert who understands family law and veterans’ benefits to explore your options.

Many veterans find themselves in similar situations, and sharing experiences can be incredibly helpful. Have you spoken to others in your community about how they manage their child support obligations? Sometimes, just knowing you’re not alone can provide comfort and clarity.

Will the VA honor a court “Withholding Order” for the collection of child support and allow the child support payments to be taken right out of my Veteran’s Benefits’ check?

This is a crucial question for many veterans who are concerned about how child support payments will be collected. The good news is that the VA does honor court-issued withholding orders for child support. This means that if a court has ordered that a portion of your benefits be withheld for child support, the VA will comply with that order and deduct the specified amount directly from your benefits check.

It’s important to note that the amount withheld will depend on the court’s order and your specific circumstances. The VA typically follows the guidelines set forth by the court, ensuring that the payments are made directly to the custodial parent or the state, depending on the situation. This process can help ensure that child support payments are made consistently, which is beneficial for both the child and the custodial parent.

Have you considered how this might impact your monthly budget? Understanding the implications of these deductions can help you plan better and avoid any surprises.

Even if my benefits cannot be garnished, can my former spouse (or dating partner) ask the VA to send part of my benefits directly to them for child support?

This is a common concern among veterans who rely on their benefits for financial stability. While VA benefits are generally protected from garnishment, your former spouse or dating partner can request that the VA send a portion of your benefits directly to them for child support. This request typically needs to be supported by a court order, which outlines the amount to be sent and the reason for the request.

It’s essential to understand that while the VA may not garnish your benefits in the traditional sense, they can facilitate payments if there is a legal basis for doing so. This means that if a court has determined that a portion of your benefits should be allocated for child support, the VA can comply with that order.

Have you thought about how this might affect your relationship with your former spouse? Open communication can often help ease tensions and clarify expectations regarding financial responsibilities.

What is the process for granting an apportionment? Can I object even if I have been ordered to pay child support?

Understanding the process of apportionment in the context of child support can feel overwhelming, especially when it involves your hard-earned benefits. Apportionment refers to the division of your disability benefits to cover child support obligations. The process typically begins when a court determines that a portion of your VA disability benefits should be allocated for child support. This decision is often based on the needs of the child and the financial situation of both parents.

If you find yourself in a situation where you disagree with the apportionment, it’s important to know that you can object. You might feel that the amount is unfair or that your financial circumstances have changed. In such cases, you can file a motion with the court to contest the apportionment. It’s advisable to gather any relevant documentation that supports your case, such as proof of income or changes in your living situation. Consulting with a legal expert can also provide clarity and guidance on how to navigate this process effectively.

Remember, the court’s primary focus is the welfare of the child, so presenting a strong case that highlights your financial responsibilities and any changes in your circumstances can be crucial.

If my ex does not make a claim for an apportionment, do I still have to worry about paying child support from my Veteran’s Benefits?

This is a common concern among veterans who receive disability benefits. If your ex-partner does not file a claim for apportionment, you may still be obligated to pay child support from your VA benefits. The law generally mandates that child support obligations remain in effect regardless of whether a claim for apportionment has been made.

It’s essential to stay proactive in understanding your responsibilities. If you are unsure about your obligations, consider reaching out to a family law attorney who specializes in veteran affairs. They can help clarify your situation and ensure that you are compliant with any court orders. Additionally, keeping open lines of communication with your ex can sometimes lead to informal agreements that might alleviate some of the financial pressure.

Ultimately, being informed and prepared can help you navigate these waters more smoothly, ensuring that you fulfill your obligations while also protecting your financial interests.

Can the state take my child support out of my bank account where my Veteran’s Benefits’ check is deposited?

This question often arises among veterans who are concerned about the security of their benefits. The short answer is yes; the state can potentially access funds in your bank account to satisfy child support obligations. If you have a court order for child support, the state may have the authority to garnish funds directly from your account, including those where your VA disability benefits are deposited.

However, there are protections in place for veterans. VA disability benefits are generally protected from creditors, but once those funds are deposited into your bank account, they may lose that protection. To safeguard your benefits, consider keeping your VA funds in a separate account and ensuring that you maintain clear records of your income sources. This can help in demonstrating the origin of the funds if any legal issues arise.

It’s also wise to consult with a financial advisor or legal expert who can provide tailored advice based on your specific situation. They can help you understand your rights and the best practices for managing your finances while fulfilling your child support obligations.

My Ex has made a claim for apportionment. What happens now?

Receiving a notice that your ex has filed a claim for apportionment can be unsettling. You might be wondering how this will affect your VA disability benefits and what steps you need to take next. Apportionment is a legal process where a portion of a veteran’s benefits can be allocated to a spouse or child, especially in cases of divorce or separation. Understanding the implications of this claim is crucial for your financial planning and emotional well-being.

First, it’s important to know that the Veterans Administration (VA) has specific guidelines regarding apportionment. They will assess the claim based on various factors, including the financial needs of the claimant and the veteran’s ability to support dependents. If you find yourself in this situation, it’s wise to gather all relevant documentation, such as your disability award letter and any financial records that demonstrate your current situation.

Now, let’s dive deeper into what happens next.

A. Starting the process – When will the Veterans Administration NOT allow an apportionment?

The VA will not grant an apportionment claim in certain circumstances. For instance, if the veteran is not receiving compensation or if the claim is deemed to be without merit, the VA may deny the request. Additionally, if the veteran can demonstrate that the apportionment would cause undue hardship, this could also lead to a denial. It’s essential to understand that the VA aims to balance the needs of the veteran with those of the dependents, so they will carefully evaluate the situation.

Moreover, if the veteran is currently in a financial crisis or if the apportionment would significantly impact their ability to meet basic living expenses, the VA may lean towards denying the claim. This is where having a clear picture of your financial situation becomes vital. You might want to consult with a legal expert who specializes in VA benefits to navigate this complex process effectively.

B. If the VA decides that it can grant the claim, what happens next?

If the VA determines that the apportionment claim is valid, they will notify both parties involved. This notification will include details about how much of the veteran’s benefits will be allocated to the claimant. Typically, the VA will take a percentage of the monthly benefits and distribute it accordingly. This can be a challenging moment, as it directly impacts your financial situation.

Once the apportionment is granted, the VA will begin to disburse the funds to the claimant. It’s important to note that this process can take some time, and you may want to stay in close contact with the VA to ensure everything is proceeding smoothly. Additionally, you have the right to appeal the decision if you believe it was made in error or if your financial situation changes.

In conclusion, navigating the complexities of VA disability apportionment can be daunting, but understanding the process can empower you to take the necessary steps. Whether you’re facing a claim or considering your options, remember that you’re not alone. Seeking advice from professionals who specialize in VA benefits can provide clarity and support during this challenging time. If you’re interested in learning more about related topics, check out our articles on Best Snapchat Marketing Agencies or Best Live Chat for Lawyer Websites for additional insights that may help you in your situation.

C. After I fill out the form and give proof of my income, assets and expenses, does the VA need any more information from me?

Once you’ve submitted your form along with the necessary documentation regarding your income, assets, and expenses, you might wonder if the VA will require anything else from you. The short answer is: it depends. The VA often conducts a thorough review of the information provided, and they may reach out for additional details if they find any discrepancies or if they need clarification on certain aspects of your financial situation.

For instance, if you’ve reported a significant change in your income or if there are unusual expenses that could affect your financial stability, the VA might ask for further documentation. This could include bank statements, tax returns, or even letters from employers. It’s essential to be prepared for this possibility, as it can help expedite the process and ensure that your case is handled efficiently.

Additionally, if you’re receiving benefits from other sources, such as Social Security or a pension, the VA may want to verify those amounts as well. Keeping all your financial records organized and accessible can make this part of the process much smoother.

D. What happens next?

After you’ve submitted your information and any additional documents requested by the VA, you might be curious about what happens next. The VA will begin the evaluation process, which can take some time. During this period, they will assess your financial situation in relation to your child support obligations.

It’s important to note that the VA has specific guidelines for determining how disability benefits can be affected by child support. They will look at your overall financial picture, including your ability to meet your child support obligations without compromising your own financial stability. This evaluation is crucial, as it ensures that both your needs and those of your child are taken into account.

While waiting for a decision, it’s a good idea to stay proactive. You can check the status of your claim through the VA’s online portal or by contacting their office directly. This not only keeps you informed but also shows your commitment to resolving the matter efficiently.

E. How will the VA make the Final Decision?

When it comes to the final decision, the VA will consider several factors. They will review all the documentation you provided, including your income, expenses, and any other relevant financial information. The goal is to ensure that the decision is fair and just, taking into account both your financial needs and your responsibilities.

The VA uses a set of guidelines to determine how much of your disability benefits can be allocated towards child support. This process involves a careful analysis of your financial situation, including your monthly expenses and any other obligations you may have. They aim to strike a balance that allows you to support your child while also ensuring that you can maintain your own living standards.

Once the evaluation is complete, you will receive a notification regarding the outcome. If the decision is in your favor, you’ll be informed about the amount that will be deducted for child support. If the decision is not what you expected, you have the right to appeal, and it’s advisable to seek assistance from a legal expert who specializes in VA benefits and family law.

100% VA Disability and Child Support

When it comes to child support, many veterans wonder how their benefits, particularly a 100% VA disability rating, might be affected. The good news is that VA disability benefits are generally considered non-taxable income, which means they are not subject to garnishment for child support. However, this doesn’t mean that they are completely exempt from being considered in child support calculations.

In many states, courts will look at your total income, including VA disability benefits, when determining child support obligations. This means that while the benefits themselves may not be garnished, they can still influence the amount you are required to pay. For instance, if you receive a substantial amount from your VA disability, the court may decide that you have the financial capacity to contribute more towards your child’s needs.

It’s essential to understand that each state has its own laws regarding child support, and the specifics can vary widely. If you’re navigating this complex situation, consulting with a family law attorney who understands both child support and veterans’ benefits can be invaluable. They can help you understand how your VA disability might impact your obligations and rights.

VA Disability in a Divorce

Divorce can be a challenging time, especially for veterans who rely on VA disability benefits. One of the most pressing questions that often arises is how these benefits will be treated during the divorce process. Generally, VA disability benefits are considered separate property and are not subject to division in a divorce. This means that your spouse cannot claim a portion of your VA benefits as part of the marital assets.

However, the situation can become more complicated when it comes to child support and alimony. While your VA disability benefits may not be divided, they can still be factored into the overall financial picture. For example, if you are receiving a 100% disability rating, the court may consider this income when determining how much you should pay in child support or alimony.

It’s also worth noting that if you are receiving VA disability benefits, you may have additional resources available to you, such as healthcare and vocational rehabilitation services, which can help you transition into post-divorce life. Understanding these benefits can empower you to make informed decisions during your divorce.

As you navigate these waters, remember that you are not alone. Many veterans face similar challenges, and there are resources available to help you. Whether it’s connecting with a support group or seeking legal advice, taking proactive steps can make a significant difference in your experience.

F. Can I appeal the Final Decision?

If you find yourself in a situation where a court has made a decision regarding child support or the division of assets that you believe is unfair, you do have the option to appeal. The appeal process can be complex, and it often requires a solid understanding of both family law and the specific circumstances of your case. It’s crucial to gather all relevant documentation and possibly consult with a legal expert who can guide you through the process.

Appealing a decision can be a lengthy process, but if you feel strongly about your case, it may be worth pursuing. Remember, the goal is to ensure that your rights are protected and that you are treated fairly in light of your unique circumstances as a veteran.

When navigating the complexities of divorce and child support, many veterans wonder how their VA disability payments are treated. It’s a topic that can stir up a lot of emotions and questions. Let’s explore the nuances of VA disability payments in the context of child support, ensuring you have a clear understanding of your rights and obligations.

VA DISABILITY PAYMENTS AFTER DIVORCE

After a divorce, the financial landscape can change dramatically. For veterans receiving VA disability benefits, these payments are often a crucial part of their income. But how do these benefits factor into child support obligations? Generally, VA disability payments are considered a form of income, which means they can be included when calculating child support. However, the specifics can vary based on state laws and individual circumstances.

For instance, if you are a veteran receiving a monthly disability payment, this amount may be factored into the total income used to determine your child support obligations. It’s essential to consult with a family law attorney who understands both divorce and military benefits to ensure that your rights are protected. They can help clarify how your VA benefits will be treated in your specific case.

VA Disability and Divorce – Not Marital Property to Divide

One of the most significant aspects of VA disability payments is that they are not considered marital property. This means that during a divorce, your VA disability benefits cannot be divided between you and your spouse. This distinction is crucial because it protects your benefits from being subject to division in the divorce settlement.

However, while the benefits themselves are safe from division, they can still be considered when determining child support. This can lead to some confusion, as veterans may feel that their disability payments are being unfairly targeted. It’s important to remember that while the payments are not marital property, they are still a source of income that can be used to support your children.

Division of VA Disability Payments After Deposit Into Account?

Another common question revolves around what happens to VA disability payments once they are deposited into a joint account or used for shared expenses. If your VA disability payments are deposited into a joint account, they may become part of the marital assets, complicating matters further. However, the core benefit itself remains protected from division.

For example, if you receive a monthly VA disability payment and deposit it into a joint account, your spouse may argue that they have a right to a portion of those funds for child support. This is where the legal nuances come into play. Courts typically look at the intent and purpose of the funds. If the payments are clearly designated for your personal support and not for shared expenses, they may still be treated as separate income for child support calculations.

Ultimately, the best course of action is to maintain clear records of your VA disability payments and consult with a legal expert who can guide you through the intricacies of your situation. Understanding how these payments interact with child support can help you make informed decisions and protect your financial future.

When navigating the complexities of child support and disability benefits, many veterans find themselves asking a crucial question: Can child support be taken from VA disability payments? This topic is not only significant for veterans but also for their families, as it intertwines financial stability with legal obligations. Let’s explore the relationship between VA disability benefits and child support, shedding light on the legal framework and practical implications.

VA Disability and Child Support and Alimony

Understanding how VA disability benefits interact with child support and alimony is essential for veterans and their families. VA disability benefits are designed to provide financial support to veterans who have incurred disabilities as a result of their service. However, these benefits can also be subject to garnishment for child support and alimony obligations.

Many veterans may feel overwhelmed by the idea of their disability payments being reduced to meet these obligations. It’s important to recognize that while VA disability benefits are protected from certain types of garnishments, they are not entirely exempt from child support and alimony claims. This means that if a veteran is required to pay child support or alimony, a portion of their VA disability benefits may be garnished to fulfill these obligations.

For instance, if a veteran is receiving a monthly VA disability payment and has a court order for child support, the court can legally require a portion of that payment to be directed towards child support. This can create a challenging situation for veterans who rely on these benefits for their livelihood.

U.S. SUPREME COURT DECISION ON VA DISABILITY

The legal landscape surrounding VA disability and child support was significantly shaped by a U.S. Supreme Court decision. In 2017, the Court ruled that VA disability benefits could be garnished for child support and alimony, clarifying the legal standing of these benefits in relation to family law obligations. This ruling emphasized that while VA benefits are intended to support veterans, they can also be utilized to ensure that children receive the financial support they need.

This decision has profound implications for veterans. It underscores the importance of understanding one’s legal responsibilities and the potential impact of these obligations on financial stability. If you’re a veteran facing child support or alimony issues, it’s crucial to consult with a legal expert who can provide guidance tailored to your situation.

VA DISABILITY MAY BE GARNISHED FOR CHILD SUPPORT & ALIMONY

So, what does this mean for veterans? Essentially, it means that if you are a veteran receiving VA disability benefits and you have a child support or alimony obligation, a portion of your benefits may be subject to garnishment. This garnishment is typically handled through the state’s child support enforcement agency, which can directly deduct the required amount from your VA payments.

It’s worth noting that the amount that can be garnished is often determined by state law, which varies across the country. Some states have specific guidelines on how much can be taken from disability payments, while others may have more flexible rules. Understanding your state’s regulations is crucial in managing your finances effectively.

Moreover, if you find yourself in a situation where your VA disability benefits are being garnished, it’s essential to stay informed about your rights. You may have options to contest the garnishment or seek a modification of your child support order based on changes in your financial situation. Engaging with a knowledgeable attorney can help you navigate these waters and advocate for your best interests.

In conclusion, while VA disability benefits are a vital source of income for many veterans, they are not immune to garnishment for child support and alimony. By understanding the legal framework and seeking appropriate guidance, veterans can better manage their financial obligations while ensuring they meet their responsibilities to their families.

VA DISABILITY AND CHILD SUPPORT IN COLORADO

When navigating the complexities of family law, especially in the context of divorce and child support, understanding how various income sources are treated is crucial. In Colorado, as in many states, the question often arises: can child support be taken from VA disability payments? This is particularly relevant for veterans who rely on these benefits for their livelihood. The short answer is yes, but let’s delve deeper into the nuances.

VA disability benefits are designed to support veterans who have incurred injuries or illnesses related to their service. These benefits are typically not considered taxable income, which can complicate how they are viewed in child support calculations. In Colorado, the courts have the discretion to consider VA disability payments as income when determining child support obligations. This means that if you are a veteran receiving these benefits, they could potentially be factored into your child support payments.

However, it’s essential to recognize that the court will also consider your overall financial situation, including other sources of income and your ability to pay. This holistic approach aims to ensure that child support obligations are fair and reasonable, taking into account the best interests of the child.

VA Disability and Divorce FAQ

Divorce can be a challenging process, especially when it involves children and financial obligations. Many veterans have questions about how their VA disability benefits will be treated during divorce proceedings. Here are some common inquiries:

- Will my VA disability benefits be divided in a divorce? Generally, VA disability benefits are not subject to division as marital property. However, they can be considered when calculating child support and spousal support.

- Can my ex-spouse claim a portion of my VA benefits? No, your ex-spouse cannot claim your VA disability benefits directly. However, they may be factored into the overall financial picture during support calculations.

- What if my VA disability benefits change? If your benefits increase or decrease, you can request a modification of your child support order to reflect these changes.

CAN CHILD SUPPORT BE TAKEN FROM VA DISABILITY PAYMENTS?

As we explore the specifics of child support and VA disability payments, it’s important to understand the legal framework surrounding these issues. In Colorado, child support is calculated based on a formula that considers both parents’ incomes, including VA disability payments. This means that if you are a veteran receiving these benefits, they can indeed be included in the calculation of your child support obligations.

One of the key factors to consider is the nature of VA disability benefits. Since they are intended to compensate for service-related injuries, the courts may take a compassionate approach when determining how much of these benefits should be allocated to child support. For instance, if your disability significantly impacts your ability to earn additional income, the court may adjust your support obligations accordingly.

It’s also worth noting that if you are facing financial hardship due to your disability, you may have grounds to request a modification of your child support order. Courts are generally sympathetic to the challenges faced by veterans, and they aim to ensure that support obligations do not place undue strain on your financial situation.

In conclusion, while VA disability payments can be considered in child support calculations in Colorado, the courts will take a comprehensive view of your financial circumstances. If you find yourself in this situation, it may be beneficial to consult with a family law attorney who understands the intricacies of both family law and veterans’ benefits. They can provide guidance tailored to your specific situation, ensuring that your rights and responsibilities are clearly understood.

IS VA DISABILITY CONSIDERED INCOME FOR CHILD SUPPORT?

When navigating the complexities of child support, one of the most pressing questions for veterans is whether their VA disability benefits are classified as income. The answer can significantly impact your financial obligations and overall well-being. Generally, VA disability benefits are not considered income in the traditional sense. This means they typically cannot be garnished for child support payments.

However, laws can vary by state, and some jurisdictions may interpret these benefits differently. For instance, in some cases, courts may consider the totality of a veteran’s financial situation, including VA benefits, when determining child support obligations. It’s essential to consult with a family law attorney who understands your state’s regulations to get tailored advice.

Moreover, understanding how your benefits are viewed can help you plan better. If you’re receiving VA disability, it’s crucial to keep detailed records of your income and expenses, as this documentation can be invaluable in court proceedings.

IS VA DISABILITY CONSIDERED INCOME FOR ALIMONY?

Similar to child support, the question of whether VA disability benefits count as income for alimony is a nuanced one. Alimony, or spousal support, is designed to provide financial assistance to a lower-earning spouse after a divorce. In many cases, VA disability benefits are not classified as income for alimony calculations. This is because these benefits are intended to compensate for service-related disabilities rather than serve as a source of income.

However, just like with child support, the specifics can vary based on state laws. Some courts may take a broader view of income, considering all sources of financial support when determining alimony. If you find yourself in this situation, it’s wise to seek legal counsel to understand how your VA benefits might be treated in your particular case.

Additionally, it’s worth noting that the emotional and financial implications of alimony can be significant. If you’re facing a divorce, consider how your VA benefits fit into your overall financial picture and what that means for your future.

DOES MY VA DISABILITY CHANGE IF I GET DIVORCED?

Divorce can be a tumultuous time, and many veterans wonder how it might affect their VA disability benefits. The good news is that your VA disability compensation is generally protected from division during divorce proceedings. This means that your benefits should remain intact, regardless of the outcome of your divorce.

However, there are some important considerations to keep in mind. If you are ordered to pay child support or alimony, the court may look at your overall financial situation, including your VA benefits, to determine your ability to pay. This doesn’t mean your benefits will be reduced, but it could influence how much you are required to pay.

Moreover, if you are receiving a disability rating that is based on your service-connected conditions, it’s crucial to maintain communication with the VA. Changes in your marital status can sometimes affect your eligibility for certain benefits, such as health care or additional compensation for dependents. Always stay informed and proactive about your benefits, especially during significant life changes like divorce.

DOES A 100% VA DISABILITY RATING AFFECT CHILD SUPPORT?

When it comes to child support, many veterans wonder how their benefits, particularly a 100% VA disability rating, might influence their obligations. The short answer is yes, a 100% VA disability rating can affect child support calculations, but the specifics can vary significantly based on individual circumstances and state laws.

In general, child support is calculated based on the income of the non-custodial parent. For veterans receiving VA disability benefits, these payments are often considered income. However, the way they are treated can differ. Some states may exclude VA disability payments from the income calculation, while others may include them. This means that if you are receiving a 100% disability rating, it could potentially increase your child support obligations, depending on where you live.

It’s essential to consult with a family law attorney who understands both child support and veterans’ benefits in your state. They can provide guidance tailored to your situation, ensuring that you are meeting your obligations without compromising your financial stability.

Handling Your Child Support Duties as a Disabled Veteran in Texas

As a disabled veteran in Texas, navigating child support can feel overwhelming, especially when balancing your health and financial responsibilities. Texas law has specific guidelines regarding how disability payments are treated in child support cases. Understanding these can help you manage your obligations more effectively.

In Texas, child support is typically calculated based on a percentage of the non-custodial parent’s income. If you are receiving VA disability benefits, these payments are generally included in the income calculation. However, Texas also recognizes the unique challenges faced by disabled veterans. For instance, if your disability significantly impacts your ability to earn income, you may be able to request a modification of your child support order.

It’s crucial to keep communication open with your ex-spouse and the court. If your financial situation changes due to your disability, you should document these changes and seek a review of your child support obligations. This proactive approach can help ensure that your child support payments remain fair and manageable.

VA Disability Child Support Texas: Where Commitment Meets Complexity

In Texas, the intersection of VA disability benefits and child support can be complex. Many veterans find themselves in a situation where they are committed to supporting their children while also managing the financial implications of their disability. This dual commitment can lead to confusion and stress.

One of the key complexities arises from the fact that while VA disability benefits are designed to provide financial support for veterans, they can also be seen as a source of income for child support calculations. This means that if you are receiving a 100% disability rating, your benefits could be factored into how much you owe in child support. However, the law also recognizes that these benefits are meant to support your well-being, which can lead to potential adjustments in your obligations.

For example, if your disability prevents you from working or limits your earning capacity, you may be eligible for a reduction in your child support payments. It’s essential to document your situation thoroughly and work with a legal professional who understands both family law and veterans’ benefits. They can help you navigate the complexities and advocate for a fair resolution that considers your unique circumstances.

Ultimately, being a disabled veteran does not exempt you from child support obligations, but it does provide avenues for adjustments based on your situation. By staying informed and seeking the right support, you can fulfill your responsibilities while also taking care of your health and well-being.

Wrangling Texas Child Support: A Guide for Veterans and Parents

When it comes to child support in Texas, veterans receiving VA disability benefits often find themselves in a unique situation. You might be wondering, can your disability payments be affected by child support obligations? The answer is nuanced and requires a closer look at both Texas law and federal regulations.

In Texas, child support is calculated based on the non-custodial parent’s income, which can include VA disability benefits. However, the law also recognizes that these benefits are intended to support the veteran’s well-being and should not be entirely consumed by child support payments. This means that while your VA disability can be considered in the calculation, there are protections in place to ensure you are not left without necessary resources.

Understanding how child support is determined can feel overwhelming, but it’s essential to know your rights. For instance, Texas law stipulates that a portion of your VA benefits may be exempt from child support calculations, allowing you to maintain a standard of living that supports both you and your child. If you’re navigating this complex landscape, consulting with a family law attorney who specializes in veteran issues can provide clarity and guidance tailored to your situation.

VA Disability Child Support Texas: Navigating the Legal Landscape and Legal Process for Determining Child Support

Determining child support when VA disability benefits are involved can be a complicated process. In Texas, the legal framework is designed to ensure that both the needs of the child and the financial realities of the parent are taken into account. You might be asking yourself, how does the legal process work?

First, it’s important to gather all relevant financial documents, including your VA disability award letter. This document will help establish your income level. The Texas Child Support Guidelines provide a formula that considers your income, the number of children, and the needs of the child. However, VA disability payments are treated differently than regular income. They are often viewed as a source of income that is not subject to garnishment in the same way as wages.

Moreover, if you find yourself in a situation where child support is being calculated, you may want to consider filing a motion to modify the support order if your financial situation changes. For example, if your disability rating increases or decreases, this could impact your ability to pay. Engaging with a legal professional can help you navigate these changes effectively, ensuring that your rights are protected while also fulfilling your obligations as a parent.

Child Custody and Visitation: Balancing Support and Access

Child custody and visitation rights are often intertwined with child support obligations, creating a delicate balance that can be challenging to navigate. As a veteran receiving VA disability benefits, you may be concerned about how your financial responsibilities affect your relationship with your child. Have you ever felt that financial obligations overshadow your ability to spend quality time with your child?

In Texas, the courts prioritize the best interests of the child when determining custody arrangements. This means that while child support is a critical factor, it should not impede your ability to maintain a meaningful relationship with your child. If you are struggling to meet your child support obligations due to your disability income, it’s crucial to communicate this with the court. They may consider your circumstances and adjust the support order accordingly.

Additionally, establishing a solid visitation schedule can help reinforce your role as an active parent, regardless of financial challenges. Courts often look favorably on parents who are engaged and present in their children’s lives. If you’re facing difficulties, consider reaching out to local support groups or legal resources that can provide assistance and guidance tailored to your unique situation.

When it comes to child support, many parents wonder how their financial obligations might be affected by their income sources, especially if they are receiving VA disability benefits. This topic can be complex, but understanding the nuances can help you navigate your responsibilities and rights more effectively.

Child Support Modification Process: Seeking Financial Fairness

Have you ever felt that your financial situation has changed significantly, making it difficult to meet your child support obligations? If you’re receiving VA disability benefits, you might be eligible for a modification of your child support order. The process typically begins with filing a motion in court, where you can present evidence of your current financial status.

It’s essential to gather documentation that reflects your income, including your VA disability benefits. Courts generally consider the best interests of the child, but they also recognize that a parent’s ability to pay can change due to various circumstances. For instance, if your disability has limited your earning potential, this could be a valid reason for seeking a modification.

In many states, the law allows for adjustments to child support based on changes in income, which can include a decrease in your VA benefits or other financial hardships. Consulting with a family law attorney can provide you with tailored advice and help you navigate the legal landscape effectively.

Available Resources and Support for Disabled Veterans

As a disabled veteran, you have access to various resources that can assist you in managing your financial obligations. Organizations like the U.S. Department of Veterans Affairs offer programs designed to support veterans in need. These programs can provide financial counseling, legal assistance, and even help with navigating child support issues.

Additionally, local veteran service organizations often have resources that can help you understand your rights and responsibilities regarding child support. They can connect you with legal aid services that specialize in family law, ensuring you have the support you need to advocate for yourself and your children.

Don’t hesitate to reach out to these organizations; they exist to help you navigate the complexities of your situation. Remember, you’re not alone in this journey, and there are people and resources ready to support you.

Parental Rights and Responsibilities: Beyond Financial Obligations

Child support is just one aspect of being a parent, and it’s crucial to remember that your responsibilities extend beyond financial contributions. As a parent, you have the right to be involved in your child’s life, regardless of your financial situation. This involvement can include making decisions about their education, healthcare, and overall well-being.

It’s important to maintain open communication with your co-parent about your situation. If you’re facing challenges due to your disability, discussing these openly can foster understanding and cooperation. Many parents find that working together, even in difficult circumstances, can lead to better outcomes for their children.

Moreover, being proactive about your parental rights can help you stay engaged in your child’s life. Whether it’s attending school events or participating in extracurricular activities, your presence is invaluable. Remember, your children benefit from your love and support just as much as they do from financial stability.

In conclusion, while child support obligations can feel overwhelming, especially when navigating the complexities of VA disability benefits, understanding your rights and available resources can empower you to make informed decisions. If you’re looking for more information on related topics, consider checking out articles like Best Facebook Advertising Agencies or Best Google Adwords Advertising Agencies for insights that might help you in other areas of your life.

When it comes to child support, many parents wonder about the implications of their income sources, especially when it involves VA disability benefits. This topic can be quite complex, as laws vary significantly from state to state. So, can child support be taken from VA disability? Let’s dive into the details and explore how this works.

State-Specific Child Support Laws: Navigating Variations

Child support laws are not one-size-fits-all; they differ from state to state. This means that the way VA disability benefits are treated in relation to child support can vary widely depending on where you live. For instance, some states may consider VA disability payments as income when calculating child support obligations, while others may not.

Understanding your state’s specific laws is crucial. For example, in some jurisdictions, VA disability benefits are exempt from being counted as income for child support calculations. This can provide significant relief for veterans who are already managing the challenges of disability. On the other hand, states that do include these benefits in their calculations may lead to higher child support payments, which can be a source of stress for many.

If you’re unsure about your state’s laws, it might be beneficial to consult with a family law attorney who specializes in child support issues. They can provide clarity and help you navigate the complexities of your situation.

Wrangling VA Disability Child Support: Ride Off into the Sunset

So, how do you handle child support if you’re receiving VA disability benefits? It’s essential to approach this with a clear understanding of your rights and obligations. If you find yourself in a situation where child support is being calculated based on your VA benefits, it’s important to gather all relevant documentation. This includes your VA disability award letter and any other financial statements that can help clarify your income.

In some cases, you may need to go to court to contest the inclusion of your VA benefits in child support calculations. This can feel daunting, but remember, you’re not alone in this journey. Many veterans have successfully navigated similar challenges. It’s about advocating for yourself and ensuring that your financial obligations are fair and manageable.

Embracing the Spirit of Texas in Navigating Child Support

Let’s take a closer look at how Texas handles child support in relation to VA disability benefits. In Texas, the law generally treats VA disability payments as income, which means they can be considered when calculating child support obligations. However, there are nuances to this rule. For instance, if the disability benefits are specifically designated for the veteran’s medical expenses, they may not be included in the income calculation.

This distinction is crucial for Texas veterans. If you’re receiving VA benefits, it’s wise to keep detailed records of how those funds are used. This can help in discussions about child support and ensure that you’re not overburdened by payments that don’t take your unique situation into account.

Ultimately, navigating child support while receiving VA disability benefits requires a blend of knowledge, preparation, and sometimes, legal assistance. If you’re looking for more information on how disability impacts child support, you might find it helpful to read this article, which delves deeper into the topic.

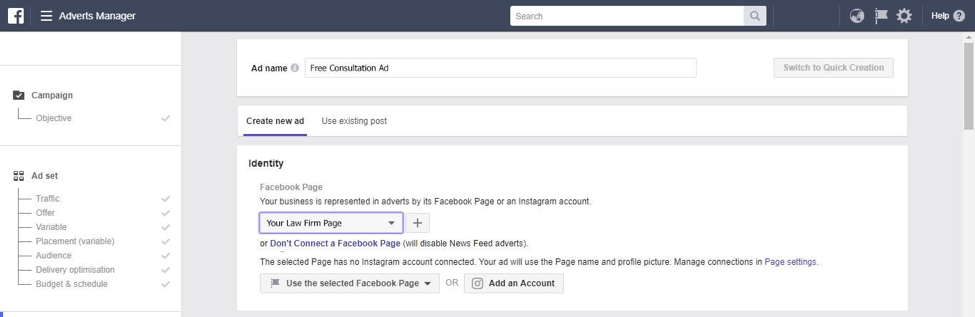

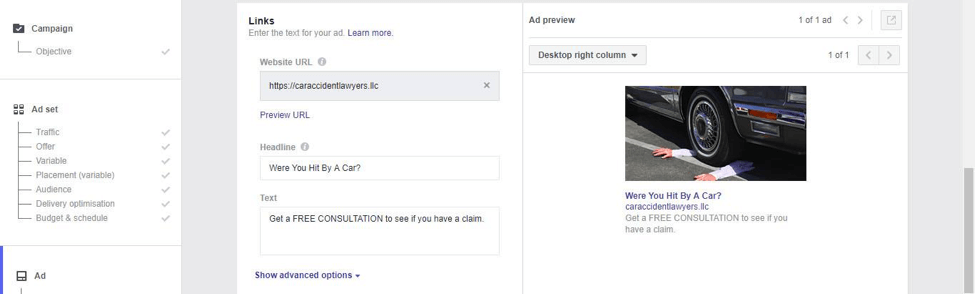

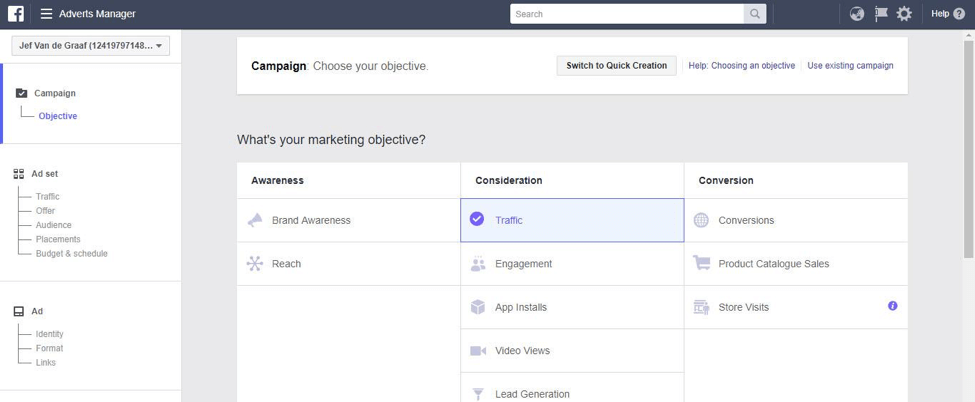

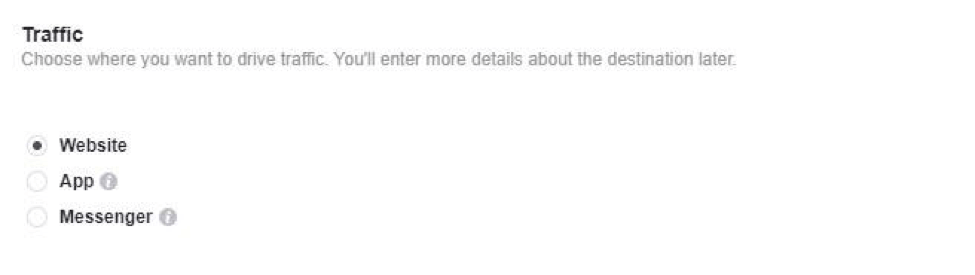

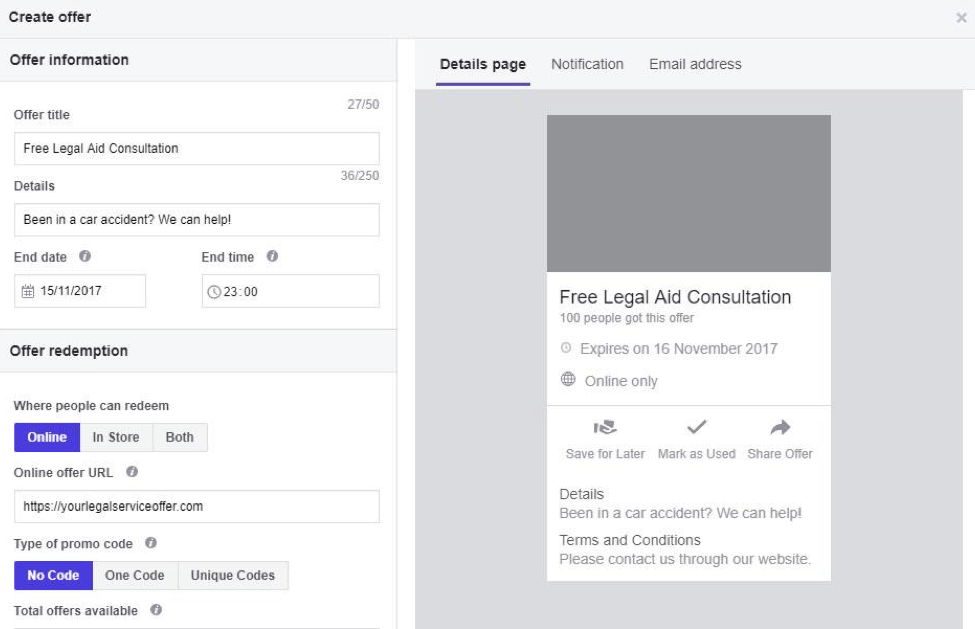

The benefit of setting up a Facebook Ad with an offer is that people who see this ad can save it and receive notifications about it.

The benefit of setting up a Facebook Ad with an offer is that people who see this ad can save it and receive notifications about it.