When navigating the complexities of child support, many parents in Oregon find themselves asking, “How much will I need to pay or receive for my child?” Understanding the nuances of child support calculations can feel overwhelming, but it’s essential for ensuring that your child’s needs are met. Let’s break down the essentials of child support in Oregon, focusing on what you need to know for one child.

A Guide to Child Support in Oregon

Child support in Oregon is determined based on a variety of factors, including the income of both parents, the needs of the child, and the custody arrangement. The state uses a specific formula to calculate the amount, which aims to ensure that children receive adequate financial support from both parents, regardless of their living situation.

To get a clearer picture, you might want to explore the child support calculator provided by the Oregon Department of Justice. This tool can help you estimate the potential support obligations based on your unique circumstances.

What is Child Support?

Child support is a legal obligation for a non-custodial parent to contribute financially to the upbringing of their child. It covers various expenses, including housing, food, education, and healthcare. The goal is to ensure that the child maintains a standard of living similar to what they would have experienced if the parents were together.

In Oregon, the child support guidelines are designed to be fair and equitable. They take into account both parents’ incomes and the amount of time each parent spends with the child. For instance, if one parent has the child for a greater portion of the time, this may influence the amount of support required from the other parent.

For a more detailed understanding of how these calculations work, you can refer to the Oregon Child Support Guidelines. This resource provides insights into the factors considered in determining support amounts, ensuring that both parents are informed about their responsibilities.

It’s also important to note that child support is not a one-size-fits-all solution. Each case is unique, and various elements can affect the final amount. For example, if a parent has other children to support or if there are special needs involved, these factors will be taken into account.

As you navigate this process, remember that communication between parents can significantly impact the outcome. Open discussions about financial responsibilities can lead to more amicable arrangements and better outcomes for the child.

In summary, understanding how child support is calculated in Oregon is crucial for both parents. By utilizing available resources and maintaining open lines of communication, you can ensure that your child’s needs are met while also managing your financial obligations effectively.

How is Oregon Child Support Calculated?

Understanding how child support is calculated in Oregon can feel overwhelming, but it’s essential for ensuring that your child’s needs are met. The state uses a specific formula that considers various factors to determine the amount of support one parent must pay to the other. This calculation is primarily based on the income of both parents, the number of children, and the amount of time each parent spends with the child.

In Oregon, the child support guidelines provide a structured approach to these calculations. For instance, if you’re curious about how much you might owe or receive, you can use the child support calculator available online. This tool can give you a rough estimate based on your specific circumstances.

Additionally, the guidelines take into account other expenses such as health insurance and childcare costs, which can significantly impact the final amount. It’s important to remember that these calculations are designed to ensure that the child’s needs are prioritized, reflecting the lifestyle they would have enjoyed if the parents were together.

Have you ever wondered how these calculations might change if one parent’s income fluctuates? That’s a common concern, and the guidelines allow for adjustments to be made in such cases, ensuring fairness and adaptability.

When Does Child Support End?

Child support is a crucial aspect of parenting after separation, but when does it actually come to an end? In Oregon, child support typically continues until the child turns 18 years old or graduates from high school, whichever comes later. This means that if your child is 17 and still in high school, you may be responsible for support until they graduate, even if they turn 18 before that time.

However, there are exceptions. For instance, if your child becomes emancipated before reaching these milestones, support may end sooner. Emancipation can occur through various means, such as marriage or joining the military. It’s essential to stay informed about these conditions to avoid any surprises.

Have you thought about how changes in your child’s circumstances might affect support obligations? For example, if your child decides to pursue higher education, you might wonder if support continues. In Oregon, there’s no legal requirement for parents to pay for college expenses, but some parents choose to provide support voluntarily. It’s always a good idea to discuss these matters openly to ensure everyone is on the same page.

How Do You Obtain a Child Support Order?

Obtaining a child support order in Oregon is a process that can seem daunting, but it’s a necessary step to ensure your child’s financial needs are met. The first step is to file a petition with the court, which can be done through the Oregon Department of Justice. They provide resources and guidance to help you navigate this process.

Once you file, the court will schedule a hearing where both parents can present their financial information. This is where the calculations we discussed earlier come into play. It’s crucial to have all relevant documents ready, such as income statements and any existing agreements regarding custody and support.

If you’re unsure about how to proceed, consider seeking legal advice. Many families find it helpful to consult with a lawyer who specializes in family law to ensure that their rights are protected. You can also find helpful information on the Oregon Department of Justice website, which offers FAQs and resources related to child support.

Have you thought about how the support order might evolve over time? Life changes, such as job loss or a new job, can impact your ability to pay or the amount needed. It’s important to know that you can request a modification of the support order if your circumstances change significantly.

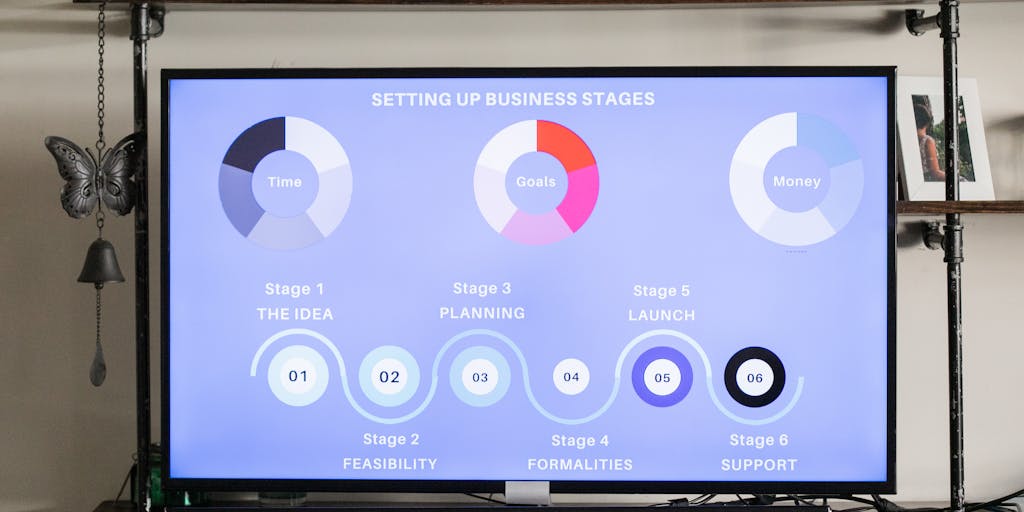

Oregon Child Support Guidelines Calculator

When navigating the complexities of child support in Oregon, understanding how the Oregon Child Support Guidelines Calculator works can be incredibly beneficial. This tool is designed to help parents estimate the amount of child support that may be required based on various factors, including income, the number of children, and the custody arrangement. Have you ever wondered how these calculations are made?

The calculator takes into account both parents’ gross incomes, any additional income sources, and the number of overnights each parent has with the child. For instance, if one parent earns significantly more than the other, the calculator will reflect that disparity in the support amount. You can find the calculator and more detailed information on the Oregon Department of Justice website.

It’s important to remember that while the calculator provides a guideline, the final amount can be influenced by other factors such as special needs of the child or extraordinary expenses. This means that the calculator is a starting point, not a definitive answer. Have you considered how your unique situation might affect the outcome?

Child Support Calculator Information

Understanding the Child Support Calculator is crucial for parents who are either paying or receiving support. The calculator is based on the Oregon Child Support Guidelines, which aim to ensure that children receive adequate financial support from both parents. But what exactly goes into these calculations?

- Income: Both parents’ incomes are assessed, including wages, bonuses, and other sources of income.

- Custody Arrangements: The number of nights the child spends with each parent can significantly impact the support amount.

- Additional Expenses: Costs such as healthcare, childcare, and education can also be factored into the calculations.

For a more personalized estimate, you can use the child support calculator provided by various legal resources. This can help you understand what to expect and prepare for discussions with your co-parent or legal counsel.

Can You Modify Child Support Payments?

Life is full of changes, and sometimes those changes can affect your financial situation. This raises an important question: Can you modify child support payments? The answer is yes, but there are specific conditions that must be met. In Oregon, either parent can request a modification if there has been a significant change in circumstances, such as a job loss, a substantial increase in income, or changes in the child’s needs.

For example, if you lose your job and can no longer afford the current support amount, you can petition the court for a modification. Similarly, if the child develops special needs that require additional financial support, the receiving parent may seek an increase. It’s essential to document any changes and communicate openly with your co-parent about these issues.

To learn more about the process and requirements for modifying child support, you can visit Oregon Law Help. Understanding your rights and responsibilities can empower you to make informed decisions that benefit both you and your child.

Oregon Child Support Guidelines and Calculations

When it comes to child support in Oregon, understanding the guidelines and calculations can feel overwhelming. However, knowing how these figures are determined can empower you to navigate the process more effectively. In Oregon, child support is calculated based on a formula that considers both parents’ incomes, the number of children, and the amount of time each parent spends with the child. This ensures that the financial responsibilities are shared fairly.

For one child, the calculations can vary significantly based on individual circumstances. For instance, if one parent earns significantly more than the other, the support amount will reflect that disparity. Additionally, factors such as healthcare costs, childcare expenses, and any special needs of the child can also influence the final amount. If you’re curious about specific figures, you can explore more detailed information on how much child support is typically awarded in Oregon by visiting this resource.

Things to know about the Child Support Calculator:

One of the most useful tools for parents navigating child support in Oregon is the Child Support Calculator. This online tool can provide a preliminary estimate of what you might expect to pay or receive in child support. Here are a few key points to keep in mind:

- Input Accuracy: The calculator requires accurate input of both parents’ incomes, which includes wages, bonuses, and other sources of income. The more precise your data, the more reliable the estimate.

- Shared Parenting Time: The amount of time each parent spends with the child can significantly affect the support calculation. The calculator takes this into account, so be sure to provide accurate information regarding custody arrangements.

- Additional Expenses: Don’t forget to include any additional costs related to the child, such as medical expenses or educational fees. These can be factored into the support amount.

- Legal Guidance: While the calculator is a great starting point, consulting with a legal professional can provide clarity and ensure that all factors are considered. For more detailed guidance, check out this guide.

Child Support Guidelines

The Oregon Child Support Guidelines are designed to ensure that child support payments are fair and consistent. These guidelines are based on the principle that both parents should contribute to the financial support of their child, regardless of their living arrangements. The state uses a formula that considers both parents’ gross incomes and the number of children involved.

For example, if one parent earns $4,000 a month and the other earns $2,000, the support calculation will reflect their income disparity. The guidelines also account for the child’s needs, ensuring that they receive adequate support for their upbringing. If you want to dive deeper into the specifics of these guidelines, you can refer to the official instructions provided by the Oregon Department of Justice here.

Ultimately, understanding these guidelines can help you make informed decisions about your financial responsibilities as a parent. It’s essential to stay informed and proactive, ensuring that your child’s needs are met while also considering your financial situation. If you have further questions or need assistance, don’t hesitate to reach out to a legal expert who specializes in family law.

Understanding child support can feel overwhelming, especially when you’re navigating the complexities of parenting arrangements. In Oregon, the amount of child support for one child is determined through a specific formula that considers various factors, including income and parenting time. Let’s break this down together.

Calculating Parenting Time Accurately

Have you ever wondered how parenting time affects child support calculations? In Oregon, the amount of time each parent spends with the child is a crucial factor. The more time a parent has with the child, the less financial support they may need to provide. This is because the costs of raising a child are shared based on the time each parent spends with them.

To calculate parenting time accurately, you need to consider:

- The number of overnight stays each parent has with the child.

- Any special arrangements for holidays, vacations, or school breaks.

- Consistency in the schedule, as courts favor stable routines for children.

For example, if one parent has the child for 70% of the time, they may receive less in child support compared to a parent who has the child for only 30%. This balance aims to ensure that both parents contribute to the child’s upbringing fairly.

How to Calculate Child Support

Calculating child support in Oregon involves a formula that takes into account both parents’ incomes and the amount of parenting time. But how do you start? Let’s walk through the process.

First, you’ll need to gather information about both parents’ gross incomes. This includes:

- Salaries and wages

- Bonuses and commissions

- Self-employment income

- Investment income

Once you have this information, you can use the Oregon Child Support Guidelines to determine the basic support obligation. The guidelines provide a table that outlines the expected support amount based on combined parental income and the number of children involved.

For instance, if the combined income of both parents is $5,000 per month, the guideline might suggest a support amount of around $800 for one child. However, this is just a starting point. Adjustments can be made based on specific circumstances, such as medical expenses or childcare costs.

Income

When it comes to income, it’s essential to understand that not all income is treated equally. For example, if one parent is self-employed, their income might be calculated differently than a salaried employee. Courts often look at the net income after necessary business expenses for self-employed individuals.

Additionally, if one parent is intentionally underemployed or unemployed, the court may impute income based on their earning potential. This means they could be required to pay child support based on what they could earn, rather than what they currently do earn.

It’s also worth noting that any changes in income can affect child support obligations. If you lose your job or receive a significant raise, it’s crucial to revisit the child support agreement to ensure it reflects your current financial situation.

In conclusion, understanding how child support is calculated in Oregon for one child involves a careful look at both parents’ incomes and the time spent with the child. By being informed and prepared, you can navigate this process more smoothly. If you’re interested in learning more about related topics, check out our articles on Best YouTube Marketing Agencies or Best Digital Marketing Podcasts for insights that can help you in various aspects of life.

Understanding child support can feel overwhelming, especially when you’re navigating the complexities of family law in Oregon. If you’re a parent trying to figure out how much you might owe or receive in child support for one child, you’re not alone. Let’s break down the key factors that influence child support calculations in Oregon, making it easier for you to grasp what to expect.

Number of children

One of the first things to consider when calculating child support is the number of children involved. In Oregon, the child support guidelines are designed to ensure that the financial needs of each child are met. For instance, if you have one child, the support amount will be different than if you have multiple children. The state uses a formula that takes into account the combined income of both parents and the number of children to determine the support obligation.

For example, if you are the custodial parent of one child, the non-custodial parent may be required to pay a percentage of their income, which typically ranges from 17% to 25% depending on their income level. This percentage is adjusted based on the number of children, so having more children would generally decrease the percentage paid for each child. It’s essential to understand how these calculations work to ensure that both parents contribute fairly to the child’s upbringing.

Their ages and circumstances

The ages and specific circumstances of the children also play a crucial role in determining child support amounts. For instance, younger children may require more financial support for daycare and other early childhood expenses, while older children might have different needs, such as school fees or extracurricular activities. The Oregon Child Support Guidelines take these factors into account, adjusting the support amount based on the child’s age and needs.

Additionally, if a child has special needs or requires medical care, this can significantly impact the support calculation. Courts often consider these unique circumstances to ensure that the child’s best interests are prioritized. It’s important to communicate any specific needs your child may have, as this can lead to a more tailored support arrangement that reflects their actual requirements.

Overnight parenting time

Another significant factor in determining child support in Oregon is the amount of overnight parenting time each parent has with the child. The more time a parent spends with the child, the less financial support they may be required to pay. This is because the parent who has the child overnight is also incurring costs related to housing, food, and other daily expenses.

For example, if you have your child for more than 50% of the time, you may be eligible for a reduction in the child support amount you owe. This is calculated using a formula that considers the number of overnights each parent has with the child. Understanding how overnight parenting time affects your financial obligations can help you plan better and ensure that you are contributing appropriately to your child’s needs.

In conclusion, calculating child support in Oregon for one child involves several factors, including the number of children, their ages and circumstances, and the amount of overnight parenting time. By understanding these elements, you can navigate the child support process more effectively and ensure that your child’s needs are met. If you have further questions or need assistance, consider reaching out to a family law expert who can provide personalized guidance.

When a Different Amount May Be Ordered

Child support in Oregon is typically calculated using a standardized formula, but there are instances when the court may order a different amount. Have you ever wondered what circumstances could lead to such adjustments? Understanding these factors can help you navigate the complexities of child support more effectively.

One primary reason for a deviation from the standard amount is the income of the parents. If one parent has a significantly higher income, the court may decide that they should contribute more to ensure the child’s needs are met. Conversely, if a parent is facing financial hardship, the court might reduce their obligation temporarily.

Another important factor is the needs of the child. For example, if the child has special needs that require additional financial support, the court may increase the child support amount to cover those expenses. This could include costs for therapy, medical care, or educational support that goes beyond what is typically expected.

Additionally, the custodial arrangement can influence the amount of child support ordered. If one parent has the child for a greater percentage of the time, they may receive more support to help cover the costs associated with raising the child. This is often seen in shared custody situations where both parents are actively involved in the child’s life.

Lastly, the medical costs associated with the child can also lead to adjustments in the support amount. Let’s explore this aspect further.

Medical costs

Medical expenses can be a significant factor in determining child support in Oregon. Are you aware of how these costs can impact the overall support amount? When calculating child support, the court considers not only the basic needs of the child but also any additional medical expenses that may arise.

For instance, if the child requires regular medical treatment, such as ongoing therapy or medication, these costs can add up quickly. The court may order that these expenses be shared between both parents, or they may adjust the child support amount to account for these additional financial responsibilities. This ensures that the child’s health needs are prioritized and adequately funded.

Moreover, if one parent has health insurance that covers the child, the court will take this into consideration as well. The cost of premiums and out-of-pocket expenses can influence the final child support determination. It’s essential to keep detailed records of all medical expenses to present to the court if necessary.

Other factors

Beyond income and medical costs, several other factors can influence child support calculations in Oregon. Have you thought about how lifestyle changes or unexpected events might affect your situation? For example, if a parent loses their job or experiences a significant change in income, they may seek a modification of their child support obligation.

Additionally, the age of the child can play a role. As children grow, their needs change, and so do the associated costs. For instance, teenagers often have higher expenses related to activities, clothing, and education. The court may adjust the support amount to reflect these changing needs.

Furthermore, the parenting time arrangement can also impact the support amount. If one parent takes on more responsibility for day-to-day care, the court may recognize this by adjusting the financial support accordingly. It’s crucial to communicate openly with your co-parent about any changes in circumstances that could affect child support.

In conclusion, while Oregon has a standard formula for calculating child support, various factors can lead to different amounts being ordered. Understanding these nuances can empower you to advocate for your child’s best interests while navigating the complexities of child support. If you’re looking for more insights on related topics, consider checking out articles on Best Instagram Advertising Agencies or Best Amazon Marketing Agencies for additional resources that may help you in your journey.

Understanding child support can feel overwhelming, especially when you’re navigating the complexities of family law in Oregon. If you’re a parent trying to figure out how much you might owe or receive for one child, you’re not alone. Let’s break it down together.

If Both of You Agree on an Amount

One of the most straightforward ways to determine child support is through mutual agreement. If both parents can come to a consensus on the amount, it can save time, money, and emotional stress. This agreement can be formalized in a legal document, which is often more efficient than going through the court system.

When parents agree on an amount, it’s essential to consider various factors, such as:

- The income of both parents

- The needs of the child, including education, healthcare, and extracurricular activities

- Any special circumstances, like medical needs or childcare costs

By discussing these factors openly, you can arrive at a figure that feels fair to both parties. Remember, it’s always a good idea to consult with a legal professional to ensure that your agreement is in line with Oregon’s child support guidelines.

Paying and Receiving Support

Once child support is established, understanding the payment process is crucial. In Oregon, child support payments are typically made through the Oregon Child Support Program, which helps ensure that payments are tracked and delivered efficiently. This system can provide peace of mind for both the paying and receiving parent.

For the paying parent, it’s important to keep track of payments and maintain records. This can help avoid disputes later on. If you find yourself struggling to make payments, it’s vital to communicate with the other parent and possibly seek a modification through the court. Life changes, and so can financial situations.

If you receive Oregon TANF (public assistance)

If you’re receiving Temporary Assistance for Needy Families (TANF) in Oregon, the child support process can be a bit different. TANF is designed to assist families in need, and part of that assistance involves child support. In this case, the state may require that you assign your child support rights to them, which means that any payments made will go directly to the state to reimburse them for the assistance you’re receiving.

This can feel a bit disheartening, but it’s important to remember that the goal is to support your child’s needs. If you’re in this situation, it’s wise to stay informed about your rights and responsibilities. You can always reach out to local resources or legal aid for guidance on how to navigate this process effectively.

In conclusion, understanding child support in Oregon, especially for one child, involves knowing your options and rights. Whether you’re negotiating an amount with the other parent or navigating the complexities of public assistance, being informed is your best tool. If you’re looking for more insights on related topics, check out our articles on Best Pinterest Marketing Agencies or Best Twitter Marketing Agencies for additional resources that might help you in your journey.

If you don’t receive public assistance

Understanding child support in Oregon can feel overwhelming, especially if you’re navigating it without the safety net of public assistance. In Oregon, child support calculations are primarily based on the income of both parents and the needs of the child. If you’re not receiving public assistance, the state uses a formula that considers your income, the other parent’s income, and the number of children involved. This means that the amount you pay or receive can vary significantly based on your financial situation.

For one child, the basic support obligation can range widely. For instance, if you earn a monthly income of $3,000, you might expect to pay around $500 to $600 in child support, depending on the other parent’s income and custody arrangements. It’s essential to keep in mind that these figures are just estimates; actual amounts can differ based on specific circumstances.

Moreover, if you’re not receiving public assistance, you might have more flexibility in negotiating the terms of your support agreement. This can be beneficial if you’re looking to create a more tailored arrangement that reflects your unique situation. Always consider consulting with a legal expert to ensure that your rights and responsibilities are clearly understood.

Changing a Support Order

Life is full of changes, and sometimes those changes necessitate a reevaluation of child support orders. Whether it’s a job loss, a significant raise, or a change in custody arrangements, you might find yourself needing to adjust your child support payments. In Oregon, modifying a support order isn’t as daunting as it may seem, but it does require following specific legal procedures.

To initiate a change, you’ll need to file a motion with the court that issued the original support order. This motion should clearly outline the reasons for the requested change. For example, if you’ve lost your job and can no longer afford the current payments, you’ll need to provide documentation of your financial situation. The court will then review your case and determine whether a modification is warranted.

It’s important to note that simply not paying child support because you feel you can’t afford it is not advisable. This can lead to legal repercussions, including wage garnishment or even jail time. Instead, proactively seeking a modification can help you avoid these issues and ensure that your child’s needs are still met.

If You’re Struggling to Pay

Finding yourself in a position where you’re struggling to make child support payments can be incredibly stressful. You’re not alone in this; many parents face financial hardships that make it difficult to meet their obligations. The key is to address the situation head-on rather than letting it fester. If you’re having trouble making payments, the first step is to communicate with the other parent. Open dialogue can sometimes lead to temporary arrangements that work for both parties.

Additionally, consider reaching out to a legal professional who can provide guidance tailored to your situation. They can help you understand your options, including the possibility of modifying your support order. Remember, the court’s primary concern is the well-being of the child, so demonstrating your commitment to fulfilling your responsibilities, even if it means adjusting the amount, can go a long way.

Lastly, if you’re looking for resources to help manage your finances during tough times, there are many organizations and programs available that can offer support. Whether it’s financial counseling or assistance programs, seeking help can provide you with the tools you need to navigate this challenging period.

Information for Parents Asked to Pay Child Support

When it comes to child support, many parents find themselves navigating a complex and often emotional landscape. If you’re in Oregon and facing questions about how much you might owe for one child, you’re not alone. Understanding the ins and outs of child support can feel overwhelming, but it’s crucial for ensuring that your child’s needs are met. So, what exactly does child support entail, and how is it determined in Oregon?

What is child support?

Child support is a legal obligation that one parent pays to the other to help cover the costs of raising their child. This support is designed to ensure that the child’s basic needs—such as food, shelter, clothing, education, and healthcare—are met, even if the parents are no longer together. In Oregon, child support is calculated based on a formula that considers both parents’ incomes, the number of children, and the amount of time each parent spends with the child.

For instance, if you’re the non-custodial parent, you might be required to pay a percentage of your income towards child support. This percentage can vary, but for one child, it typically hovers around 25% of your gross income. However, this is just a guideline; the actual amount can be influenced by various factors, including any additional expenses like medical costs or childcare.

Can I be forced to pay child support?

Yes, if a court has determined that you are the non-custodial parent, you can be legally obligated to pay child support. This obligation is enforced to ensure that children receive the financial support they need, regardless of the parents’ relationship status. If you fail to pay, there can be serious consequences, including wage garnishment, tax refund interception, or even legal penalties.

It’s important to note that child support is not just a suggestion; it’s a legal requirement. If you believe that your financial situation has changed significantly, you can petition the court for a modification of your child support order. This might be necessary if you’ve lost your job or experienced a significant decrease in income. Always remember, communication with the other parent and the court is key to navigating these changes effectively.

In conclusion, understanding child support in Oregon is essential for both parents. It’s not just about the money; it’s about ensuring that your child has the resources they need to thrive. If you’re looking for more information on related topics, you might find insights in articles like Best Snapchat Marketing Agencies or Best Live Chat for Lawyer Websites. These resources can provide additional context on how to navigate the complexities of family law and support systems.

Understanding child support can feel overwhelming, especially when you’re navigating the complexities of family law in Oregon. If you’re a parent facing this situation, you might be wondering, “How much support will I have to pay?” Let’s break it down together.

How much support will I have to pay?

The amount of child support you may be required to pay in Oregon is determined by a formula that considers several factors, including your income, the other parent’s income, and the needs of the child. Generally, the state uses a guideline that suggests a percentage of your income based on the number of children you are supporting. For one child, the typical guideline suggests that the non-custodial parent should pay around 25% of their gross income.

For example, if your gross monthly income is $4,000, you might expect to pay about $1,000 in child support. However, this is just a guideline; actual payments can vary based on specific circumstances, such as additional expenses for healthcare, education, or childcare. It’s essential to consider these factors when calculating your potential obligations.

Additionally, Oregon has a child support calculator available online, which can help you estimate your payments based on your unique situation. This tool can be a great starting point to understand what you might be looking at financially.

How long does child support last?

Another common question is, “How long will I be paying child support?” In Oregon, child support typically lasts until the child turns 18 years old or graduates from high school, whichever comes later. This means if your child is 17 and still in high school, you may continue to pay support until they graduate, even if they turn 18 before that time.

However, there are exceptions. If your child has special needs or if there are other circumstances that warrant extended support, the court may order payments to continue beyond the typical age limit. It’s crucial to stay informed about your obligations and any changes that might occur as your child grows.

Can I disagree with the papers asking me to pay support?

If you receive child support papers and believe the amount is unfair or incorrect, you absolutely have the right to disagree. In Oregon, you can file a motion to contest the child support order. This process allows you to present your case to the court, where you can argue for a modification based on your financial situation or other relevant factors.

It’s important to gather evidence to support your claims, such as pay stubs, tax returns, or documentation of any changes in your circumstances. Engaging with a legal professional can also be beneficial, as they can guide you through the process and help ensure that your voice is heard.

Remember, child support is designed to ensure that children receive the financial support they need, but it should also be fair to both parents. If you feel that the current arrangement isn’t just, don’t hesitate to take action.

How do I disagree with divorce or custody papers that say I have to pay child support?

Disagreeing with divorce or custody papers, especially regarding child support, can feel overwhelming. You might be wondering, “What are my options?” First, it’s essential to understand that you have the right to contest any terms you believe are unfair or incorrect. Start by carefully reviewing the documents you received. Look for specific details about the child support amount and the rationale behind it.

If you believe the amount is too high or based on incorrect information, gather evidence to support your case. This could include your income statements, expenses, and any changes in your financial situation. Once you have your documentation, you can file a motion with the court to request a modification of the child support order. It’s often beneficial to consult with a family law attorney who can guide you through the process and help you present your case effectively.

Remember, the court’s primary concern is the well-being of the child, so be prepared to demonstrate how your proposed changes serve their best interests.

How do I disagree with Oregon Child Support Program (CSP) or District Attorney (DA) papers?

If you receive papers from the Oregon Child Support Program (CSP) or the District Attorney (DA) regarding child support, and you disagree with them, it’s crucial to act promptly. Start by reviewing the documents thoroughly to understand the basis of the support order. Are there discrepancies in the income reported? Did you miss any important details that could affect the amount?

To formally disagree, you can file a request for a hearing. This process allows you to present your case before a judge. Be sure to include any evidence that supports your position, such as pay stubs, tax returns, or proof of expenses. It’s also wise to seek legal advice, as navigating the child support system can be complex. An attorney can help you understand your rights and the best strategies for your situation.

Additionally, consider reaching out to the CSP directly. They may have resources or mediation options available that could help resolve the issue without going to court.

Will the other parent know if I question the support order?

One common concern when questioning a child support order is whether the other parent will be informed of your actions. Generally, yes, the other parent will be notified if you file a motion to contest or modify the support order. This is part of the legal process to ensure transparency and fairness.

However, this doesn’t mean you should shy away from addressing your concerns. Open communication can sometimes lead to a mutual agreement without the need for court intervention. If you feel comfortable, consider discussing your concerns with the other parent directly. You might find that they are open to negotiation, which could save both of you time and stress.

Ultimately, while the other parent will be aware of your actions, approaching the situation thoughtfully and respectfully can lead to a more amicable resolution. Remember, the goal is to ensure the best outcome for your child while also addressing your financial realities.

What will happen at a child support hearing with the Child Support Program?

Attending a child support hearing can feel daunting, but understanding the process can help ease your anxiety. When you arrive, you’ll be greeted by a hearing officer or judge who will oversee the proceedings. The primary goal of this hearing is to determine the appropriate amount of child support based on various factors, including your income, the needs of the child, and any existing financial obligations.

Before the hearing, it’s crucial to gather all necessary documentation. This includes proof of income, tax returns, and any expenses related to the child’s care, such as medical bills or educational costs. Having this information at your fingertips not only demonstrates your commitment to supporting your child but also helps the court make an informed decision.

During the hearing, both parents will have the opportunity to present their case. You might be asked questions about your financial situation and your child’s needs. It’s important to be honest and clear in your responses. The hearing officer will consider all evidence presented and may use Oregon’s child support guidelines to calculate the support amount. Remember, the focus is on what is in the best interest of the child.

After the hearing, you will receive a written order detailing the child support amount and payment schedule. If you disagree with the decision, you have the right to appeal, but it’s wise to consult with a legal expert to understand your options fully.

If I leave Oregon after child support is ordered, do I still have to pay?

Leaving Oregon after a child support order has been established doesn’t exempt you from your financial responsibilities. In fact, the obligation to pay child support remains in effect regardless of your location. This means that if you move to another state, you are still legally required to adhere to the terms of the child support order issued in Oregon.

However, the process can become a bit more complex. The receiving parent can seek enforcement of the child support order in your new state through the Uniform Interstate Family Support Act (UIFSA). This law allows for the enforcement of child support orders across state lines, ensuring that children receive the support they need, no matter where the paying parent resides.

It’s also important to note that if your financial situation changes significantly after moving, you can request a modification of the child support order. This typically involves filing a petition in the state where the order was originally issued or in your new state, depending on the circumstances. Always keep communication open with the other parent and consider seeking legal advice to navigate these changes effectively.

Can Oregon make me pay a child support order from another state?

Yes, Oregon can enforce a child support order issued by another state. This is made possible through the same UIFSA mentioned earlier, which facilitates the recognition and enforcement of child support orders across state lines. If you have a child support obligation from another state and you move to Oregon, the state can take action to ensure that payments are made.

When a child support order from another state is registered in Oregon, the local child support agency can assist in enforcing the order. This means they can help with wage garnishment, intercepting tax refunds, and other methods to ensure compliance. It’s a system designed to protect the rights of children and ensure they receive the financial support they need, regardless of where the parents live.

If you find yourself in this situation, it’s wise to consult with a legal professional who understands both Oregon law and the laws of the state that issued the original order. They can provide guidance on your rights and responsibilities, helping you navigate the complexities of interstate child support obligations.

Child Support FAQs

When it comes to understanding child support in Oregon, many parents have questions. How is the amount determined? What factors influence the calculations? Let’s dive into some of the most frequently asked questions to clarify these important aspects.

Income

One of the primary factors in determining child support is the income of both parents. This can include wages, bonuses, and other forms of income. Understanding how income is calculated can help you anticipate what your obligations might be.

I don’t know the other parent’s income. What should I use?

This is a common concern for many parents navigating child support. If you find yourself in a situation where you are unsure of the other parent’s income, there are a few steps you can take. First, consider using the Oregon Child Support Guidelines, which provide a formula based on the income of both parents. If you don’t have access to the other parent’s financial information, you can estimate their income based on their employment history or similar jobs in the area.

Additionally, you might want to look into obtaining a court order for the other parent to disclose their income. This can be a straightforward process, and it ensures that both parties are on the same page regarding financial responsibilities. Remember, the goal is to ensure that the child’s needs are met, and having accurate information is crucial for fair support calculations.

In some cases, if the other parent is self-employed or has irregular income, it may be necessary to consult with a financial expert or attorney who specializes in family law. They can provide insights into how to approach the situation and ensure that you are advocating for your child’s best interests.

Ultimately, navigating child support can feel overwhelming, but you’re not alone. Many resources are available to help you understand your rights and responsibilities. If you’re looking for more information on related topics, check out our articles on Best Facebook Advertising Agencies or Mutesix Reviews for insights that might help you in your journey.

What if a parent chooses not to work or is underemployed?

It’s a tough situation when a parent decides not to work or finds themselves underemployed. You might wonder how this impacts child support obligations in Oregon. The state has guidelines that aim to ensure that children receive adequate financial support, regardless of a parent’s employment status. If a parent is voluntarily unemployed or underemployed, the court may impute income based on their earning potential rather than their actual income. This means that the court will consider what the parent could reasonably earn if they were working full-time in a job that matches their skills and experience.

For instance, if a parent has a degree in engineering but is working part-time at a retail store, the court might determine that they should be earning a salary reflective of their qualifications. This approach helps prevent parents from manipulating their income to reduce their child support payments. However, it’s essential to provide evidence of your job search efforts or any legitimate reasons for your employment situation to avoid potential penalties.

Have you ever faced a similar dilemma? It can be frustrating, but understanding how the system works can empower you to make informed decisions.

Can I use my gross income from last year’s taxes?

When calculating child support in Oregon, many parents wonder if they can rely on their gross income from the previous year’s tax returns. The answer is a bit nuanced. While last year’s income can serve as a starting point, the courts typically prefer to use your current income to ensure that the child support amount reflects your present financial situation. This is particularly important if your income has significantly changed since last year.

For example, if you received a promotion or a raise, it would be more accurate to base your child support obligation on your current earnings rather than last year’s figures. Conversely, if you’ve experienced a decrease in income, you may want to present that information to the court to adjust your support obligations accordingly. It’s always a good idea to keep your financial documentation up to date and be prepared to discuss any changes in your income during child support hearings.

Have you thought about how your financial situation might change in the future? Staying proactive can help you navigate these waters more smoothly.

Does a spouse’s income count?

When determining child support in Oregon, you might be curious about whether your spouse’s income is factored into the equation. Generally, the answer is no; child support calculations primarily focus on the income of the parent who is obligated to pay support. However, there are exceptions. If the parent receiving child support is living with a new partner, the court may consider that partner’s income in certain situations, especially if it affects the financial needs of the child.

For instance, if the custodial parent’s partner contributes significantly to household expenses, the court might take that into account when assessing the child’s needs. This can sometimes lead to a reduction in the amount of child support required from the non-custodial parent. It’s essential to understand how these dynamics can play out in your specific situation, as they can significantly impact your financial obligations.

Have you had discussions about finances with your spouse or partner? Open communication can help clarify expectations and responsibilities.

Health Insurance and Cash Medical Support

When it comes to child support in Oregon, understanding the nuances of health insurance and cash medical support is crucial. You might be wondering, how does health insurance factor into the overall child support calculation? Let’s break it down.

How much does a parent have to pay for their children’s health insurance?

In Oregon, the cost of health insurance for children is typically included in the child support calculations. The state uses a formula that considers both parents’ incomes and the number of children involved. Generally, the parent who is responsible for providing health insurance will have that cost factored into their child support obligations. This means that if you’re the parent providing health insurance, you may receive a credit against your child support payments.

For example, if you pay $200 a month for your child’s health insurance, this amount can be deducted from your total child support obligation. This ensures that both parents contribute fairly to the child’s healthcare needs. It’s important to keep records of these payments, as they can significantly impact your financial responsibilities.

What if a parent currently provides insurance, but the cost is more than four percent of both parents’ combined incomes?

Now, let’s consider a scenario where the cost of health insurance exceeds four percent of both parents’ combined incomes. This situation can complicate things a bit. If the health insurance premium is deemed excessive, the court may adjust the child support order to ensure that the burden of these costs is shared more equitably.

In such cases, the parent who is paying for the insurance might not be required to cover the entire cost alone. Instead, the court may order the other parent to contribute to the excess amount. This is designed to prevent one parent from being overwhelmed by high healthcare costs while still ensuring that the child has access to necessary medical care.

It’s always a good idea to communicate openly with your co-parent about these expenses. If you find yourself in this situation, consider discussing it with a legal expert who can provide guidance tailored to your specific circumstances. Remember, the goal is to prioritize the well-being of your child while also being fair to both parents.

Both parents have coverage available for the child. Who decides which coverage to provide? Do both parents have to provide?

When it comes to child support in Oregon, one of the critical aspects to consider is health insurance coverage for the child. You might wonder, if both parents have coverage available, who gets to decide which plan to use? This can be a bit of a gray area, but generally, the parent who has the child more often may be the one to choose the coverage. However, it’s essential for both parents to communicate openly about their options.

In many cases, the court may require both parents to contribute to the child’s health insurance costs, especially if both have access to affordable plans. This means that even if one parent is the primary provider of health insurance, the other parent may still be responsible for a portion of the costs. It’s a collaborative effort aimed at ensuring the child has the best possible care.

Ultimately, the decision should be made in the child’s best interest, taking into account factors like coverage quality, costs, and accessibility. If you find yourself in a situation where you and your co-parent disagree on which coverage to provide, it might be helpful to consult with a family law attorney to navigate the complexities of your specific situation.

Parenting Time Credit

Understanding parenting time credit is crucial when calculating child support in Oregon. Parenting time credit refers to the amount of time a parent spends with their child, which can influence the child support obligations. The more time you spend with your child, the less you may be required to pay in child support, as the court recognizes that you are directly contributing to the child’s care during that time.

For instance, if you have your child for 125 overnights a year, you might think that this would significantly reduce your child support payments. However, the calculation can be more nuanced than it appears. The state of Oregon uses specific formulas to determine the percentage of parenting time credit, which can sometimes lead to confusion.

I have 125 overnights, which is 34.24 percent of the parenting time. Why is my parenting time credit percentage only 23.65 percent?

This is a common question among parents navigating the child support system. You might feel frustrated if your calculations don’t seem to match the official percentage. The discrepancy often arises from how the state calculates parenting time. Oregon uses a formula that considers not just the number of overnights but also the total number of days in a year and the time spent with the child during those days.

For example, if you have your child for 125 overnights, that’s a significant amount of time. However, if the other parent has the child for the remaining days, the total parenting time is calculated based on a full year, which can lead to a lower percentage than you expect. The formula may also take into account other factors, such as shared holidays or vacations, which can further complicate the calculations.

To get a clearer picture, it might be beneficial to consult with a family law expert who can help you understand how these calculations work and ensure that your parenting time is accurately represented. Remember, the goal is to ensure that both parents contribute fairly to the child’s upbringing while also recognizing the time spent together.

Why does the calculator say I have to pay when I am the custodial parent with 200 overnights or 54.79 percent of the parenting time?

It can be quite perplexing to see a child support calculator indicate that you owe payments, especially when you are the custodial parent and have your child for a significant portion of the year. You might be wondering, “How can this be?” The answer lies in the way child support is calculated in Oregon, which considers various factors beyond just the number of overnights.

In Oregon, child support calculations are based on a formula that takes into account both parents’ incomes, the number of children, and the amount of parenting time each parent has. Even if you have your child for 200 overnights, the calculator also weighs your income against the other parent’s income. If your income is significantly higher, you may still be required to pay child support to help balance the financial responsibilities of raising your child.

Additionally, the formula considers the costs associated with raising a child, including healthcare, education, and other expenses. This means that even as the custodial parent, if your financial situation is more favorable, the calculator may determine that you should contribute to the child’s expenses in a way that supports their well-being.

It’s essential to understand that the goal of child support is to ensure that both parents contribute fairly to the child’s upbringing, regardless of the custody arrangement. If you’re feeling uncertain about your specific situation, consulting with a family law attorney can provide clarity and help you navigate the complexities of child support calculations.

Do I get parenting time credit for a Child Attending School that lives with me?

When it comes to parenting time and child support, many parents wonder how school arrangements impact their situation. If your child lives with you and attends school, you might be asking, “Do I get credit for that time?” The answer is generally yes, but it can depend on the specifics of your custody agreement and the child support calculations in Oregon.

In Oregon, parenting time is typically calculated based on the number of overnights a child spends with each parent. If your child lives with you during the school year, those days count towards your parenting time. However, the nuances of your custody arrangement can affect how this time is viewed in terms of child support obligations.

For instance, if your child is primarily living with you and you are responsible for their day-to-day needs, this can positively influence your child support calculations. It’s important to document your parenting time accurately and communicate with the other parent to ensure that both parties are on the same page regarding the child’s living arrangements and schooling.

Ultimately, understanding how parenting time credits work can help you navigate your responsibilities and rights as a parent. If you have questions about your specific situation, it may be beneficial to seek advice from a family law professional who can provide tailored guidance.

FREE CHILD SUPPORT CALCULATOR

Are you curious about how much child support you might owe or receive? A free child support calculator can be an invaluable tool in understanding your financial obligations. These calculators take into account various factors, including income, number of children, and parenting time, to provide an estimate of what you might expect to pay or receive.

Using a child support calculator can help you prepare for discussions with your co-parent or legal counsel. It allows you to see how different scenarios—like changes in income or parenting time—can impact your child support obligations. This proactive approach can lead to more informed decisions and smoother negotiations.

While these calculators provide a good starting point, remember that they are just estimates. Each family’s situation is unique, and the final determination of child support will depend on the specifics of your case and any agreements made between you and your co-parent. If you want to dive deeper into child support calculations, consider exploring resources that explain the process in detail, such as How Much Is Child Support In Az For 1 Kid or Voy Media Reviews for insights on related topics.

BASIC MONTHLY CHILD SUPPORT OBLIGATION SCHEDULE

When it comes to understanding child support in Oregon, many parents find themselves asking, “How much will I need to pay or receive?” The answer isn’t always straightforward, as it depends on various factors, including income, the number of children, and specific needs of the child. However, Oregon has established a basic monthly child support obligation schedule that serves as a guideline for determining the amount owed.

In Oregon, the child support calculation is primarily based on the income of both parents. The state uses a formula that considers the gross income of both parents, the number of children, and any additional expenses related to the child, such as healthcare and childcare costs. This formula aims to ensure that the child’s needs are met while also being fair to both parents.

For one child, the basic support obligation can vary significantly based on the combined income of both parents. For instance, if the combined monthly income of both parents is around $3,000, the basic child support obligation might be approximately $600 per month. However, if the combined income increases to $6,000, the obligation could rise to about $1,200. This tiered approach helps to adjust the support amount according to the financial capabilities of the parents.

It’s important to note that these figures are just examples and can change based on specific circumstances. For instance, if one parent has additional children from another relationship, this may affect the support calculation. Additionally, if there are extraordinary expenses, such as medical bills or educational costs, these can also be factored into the support obligation.

Understanding the nuances of child support can be overwhelming, but resources are available to help navigate this process. For more detailed information on child support calculations in other states, you might find it helpful to check out articles like How Much Is Child Support In Kansas For 1 Kid or How Much Is Child Support In SC For 1 Kid.

Ultimately, the goal of child support is to ensure that children receive the financial support they need to thrive. If you’re navigating this process, consider consulting with a family law attorney who can provide personalized guidance based on your situation. Remember, every family is unique, and understanding your rights and obligations is key to making informed decisions.

I have to disagree with the idea that child support is just a simple percentage of income. While the 25% guideline is a starting point, it doesn’t take into account the real costs of raising a child, like school supplies, sports fees, or unexpected medical bills. Every family’s situation is different, and those extra expenses can really add up. It’s important to look at the whole picture, not just the basic formula.

I totally see your point about the extra costs of raising a child! Things like school supplies and sports fees can really add up, and they aren’t always included in the basic child support calculations. For example, if a kid wants to join a soccer team, that can mean registration fees, uniforms, and travel costs, which can be a lot more than just the percentage of income. It definitely makes sense to consider all those extra expenses!

This article does a great job explaining how important child support is for making sure kids have what they need, even when parents aren’t together. I remember when my friend’s parents went through a divorce, and child support helped make sure he could still participate in sports and go on school trips. It’s really cool to see how these payments can help kids have a stable life and keep enjoying their activities! If you ever have questions about it, talking to someone who knows the laws can really help.

I’m really curious about this whole child support thing, but I have to admit, I’m not totally convinced. If parents can just agree on an amount, how do we know it’s fair? What if one parent is making a lot more money than the other? It seems like there should be some kind of standard or formula to make sure everyone is treated equally. Can anyone explain how that works?

You bring up a great point about fairness! In many places, there are actually guidelines or formulas that help determine child support based on each parent’s income and the needs of the child. For example, if one parent makes a lot more money, the formula can help ensure that the child gets the support they need, no matter who has custody. It’s definitely a complicated issue, but those standards are meant to help keep things fair!

It’s really important for us to take care of our planet and make choices that help nature thrive. Just like how we need to support children in different ways, we also need to support our environment by reducing waste and using resources wisely. Every little action, like recycling or planting trees, can make a big difference for our Earth. Let’s work together to create a healthier, more sustainable world for everyone!

I totally agree that every little action counts! For example, when we choose to walk or bike instead of driving, we not only reduce pollution but also get some exercise. It’s amazing how small changes in our daily lives can help both our health and the planet!

I totally get what you mean! Last summer, I started biking to school instead of asking my parents for a ride. Not only did I feel more energized, but I also noticed how much nicer the air smelled when I was outside. It really made me think about how even small choices can make a big difference!

Hey there! It’s great to see you diving into the topic of child support—understanding it can really help families. Here’s a quick tip: always keep track of your income and any extra expenses related to your child. This way, when you’re calculating support, you’ll have all the info you need to make sure it’s fair for everyone involved. Remember, asking questions and seeking help is a sign of strength, so don’t hesitate to reach out for guidance! You’ve got this!

I really like how this article explains child support in Oregon! It’s super important for parents to understand how it works so they can make sure their kids have what they need. I remember when my friend’s parents went through a similar situation, and they used a calculator to figure out the support amount. It helped them have a clear plan and made things a lot easier for everyone involved. Communication really does make a difference!